Some sectors exhibit more volatility than others, and the financial sector is one of them.

Access to up-to-date financial data is thus necessary for everything from selecting the right stocks to buy or sell to deciding on your next investment plan.

Web scraping financial data is one way to access accurate and up-to-date financial information.

But what is financial data scraping, why scrape financial data, and where is the best place to scrape financial data?

What is Financial Data Scraping?

Financial data scraping is the automated extraction of financial information from websites.

The process involves systematically collecting specific data points such as stock prices, economic indicators, or company financial news.

This process differs from simply browsing through financial websites, as scraping automates the data collection. This is significantly faster and more efficient than manually doing it.

The extracted financial data can then be compiled and analyzed for various purposes in the financial sector:

- Assess the Current Market Landscape: Conduct an analysis of the prevailing conditions within the financial market.

- Identify Market Trends: Focus on understanding market shifts and trends.

- Monitor Impactful News: Continuously monitor news events that have the potential to influence national and global stock markets and economic activity.

- Evaluate Consumer Behavior: Integrate an evaluation of consumer behavior and sentiment into the analysis for valuable insights.

Don’t want to code? ScrapeHero Cloud is exactly what you need.

With ScrapeHero Cloud, you can download data in just two clicks!

Where is the Best Place to Scrape Financial Data?

Some well-known sources for scraping financial data are as follows:

Stock Exchange

- Major stock exchanges, such as the NASDAQ Stock Market and the London Stock Exchange (LSE), function as central hubs for publicly traded companies.

Learn how to scrape NASDAQ and extract stock market information using Python and LXML with our guide. - These exchanges provide financial data sets, including quarterly results, balance sheets, and shareholding patterns.

- By scraping this data, you can gain valuable insights into the financial health and performance of listed companies.

Financial News Providers

- Financial news providers like Bloomberg, Yahoo Finance, Google Finance, and MorningStar are sources for scraping financial data.

Use our guide to learn step-by-step how to scrape Yahoo Finance using Python and LXML. - These platforms make an ideal target for financial data extraction because they contain financial news and market updates.

- The scraped data can include real-time stock prices, breaking news impacting markets, and expert financial analysis.

Trading Platforms

- The rise of FinTech (financial technology) companies has led to the emergence of numerous online trading platforms.

- Potential data points for scraping include real-time stock prices, quarterly and yearly performance reports, historical price charts, and market analysis tools.

Credit Rating Agencies

- Credit rating agencies conduct in-depth research and analysis to assess the creditworthiness of companies and governments.

- Moody’s, Standard & Poor’s (S&P), and Fitch Ratings are established credit rating agencies.

- The resulting credit ratings offer insights into the financial stability and risk associated with bonds, debt instruments, and overall financial health.

- By scraping credit rating data, you can better understand the risk profile of various investment opportunities.

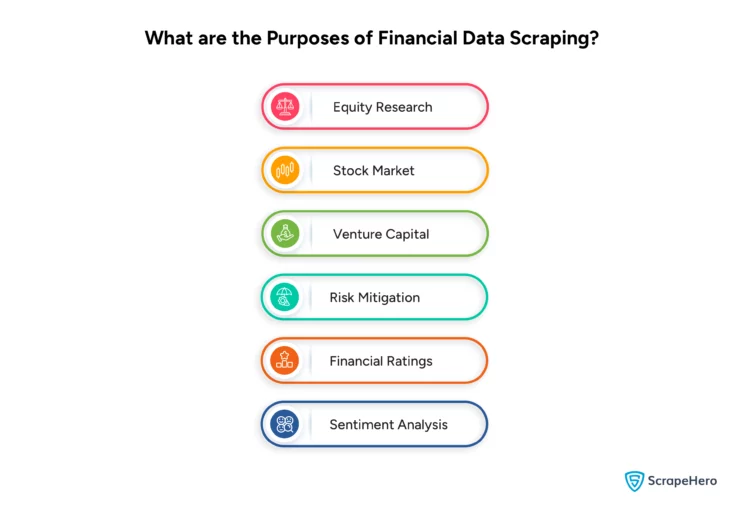

What are the Purposes of Financial Data Scraping

Financial data scraping and analysis have many benefits. Here is a breakdown of the benefits in different areas.

Equity Research

Making sound investment decisions requires thoroughly understanding a company’s financial health.

This involves analyzing data from their financial statements (profit and loss, balance sheet, cash flow) over several years. It is also possible to analyze the data from stock exchanges (quarterly results, balance sheets) and financial news providers (expert analysis, market trends).

This comprehensive analysis allows for formulating well-informed investment recommendations for stocks and equities.

Stock Market

Investment firms rely on sophisticated algorithms for stock trading, including tasks like price prediction, sentiment analysis, and equity research. These algorithms require a vast amount of accurate data.

Financial data scraping can help collect real-time stock data from the web. This data can provide the foundation for building algorithms and machine-learning models that can identify correlations between various financial metrics and stock prices.

For investors, web scraping financial data from multiple sources, including trading platforms and financial news providers, gives them a holistic understanding of the stock market.

By analyzing this data, they can identify emerging trends, assess market sentiment, and make informed investment decisions based on real-time market movements and historical patterns.

Venture Capital

Venture capital firms need to carefully evaluate potential investments before committing funds. They can analyze scraped financial data to identify promising startups and assess their investment potential.

Data from credit rating agencies and trading platforms can help understand a startup’s financial stability and growth trajectory.

Additionally, scraping news articles and social media sentiment can give an idea about the market reception and potential demand for the startup’s product or service.

Risk Mitigation

The financial industry is subject to strict regulations, with non-compliance potentially leading to substantial penalties.

Financial data scraping can help improve compliance and risk management by automating the monitoring of relevant sources like government regulations, court records, and sanction lists.

Also, by scraping data from credit rating agencies and financial news providers, financial institutions can assess the risk profile of potential borrowers and investments. This enables institutions to make informed decisions and safeguard themselves from financial losses.

Financial Ratings

Financial rating agencies can benefit from financial data scraping to collect information from various websites and public sources.

Real-time data from these sources can be used to conduct research and analysis to provide insights to wealth managers, banks, and institutional investors who rely on this information for making investment decisions.

Sentiment Analysis

Financial data scraping can extend beyond traditional financial data and incorporate social media sentiment analysis.

Investors can understand market sentiment and potential future market movements by scraping social media platforms and analyzing public opinion toward specific companies, industries, or economic trends.

This additional layer of data can provide a more detailed understanding of the market and potentially lead to more profitable investment decisions.

Beyond the traditional numbers, alternative data like social media sentiment can provide a richer context for financial data.

Want to gather alternative data alongside traditional financial data?

Challenges in Scraping Financial Data

Scraping financial data can be a bit of a challenge if web scraping is not your area of expertise.

-

Technical Expertise

Building and maintaining scrapers requires programming skills and knowledge of web scraping techniques.

-

Scalability

Financial data can be vast, and scraping large volumes requires robust infrastructure to handle the traffic and data processing. Scaling your in-house setup to meet growing needs can be expensive.

-

Legality and Ethics

Respecting robots.txt files and terms of service is crucial. It’s important to navigate the legal and ethical boundaries of data collection.

Get acquainted with the laws and norms governing the legality of web scraping with our guide. -

Data Quality and Consistency

Websites can change their structure frequently, potentially breaking your scraper and leading to inconsistent data. Verifying and cleaning the scraped data to ensure accuracy can be a time-consuming task.

-

Resource Allocation

Building and maintaining an in-house scraping team requires dedicated staff and resources. This can take away from core business activities.

Considering the difficulties mentioned above, it is best to get the help of an experienced web scraping service provider like ScrapeHero.

Web Scraping Financial Data With ScrapeHero

ScrapeHero is an enterprise-grade web scraping service provider with over a decade of experience. With 11200+ customers, we are a trusted name.

Other points that make us stand out as a reliable web scraping partner are:

- We are a full-service data provider, meaning you wouldn’t need any software, hardware, proxies, scraping tools, or skills. We do it all for you.

- We can build custom AI-based solutions (AI, ML, NLP) to analyze the data we gather for you.

- Our customers range from the largest global companies to midsize businesses and startups.

- We value customer privacy and refrain from revealing your identity.

- Our customers are happy with us, and we have a 98% retention rate.

- Our automated data quality checks utilize AI and ML to identify data quality issues.

- Our platform is built to scale and can crawl at thousands of pages per second.

Thus, rather than taking a chance by scraping financial data on your own, let ScrapeHero scrape the financial data for you while you focus on your core business.