Web scraping is an easy way around for any business that utilizes data from the internet; venture capitalist firms are no different. Venture capitalists are now increasingly using web scraping for investment research to extract vast amounts of online data and identify promising startups.

Utilizing web scraping for venture capitalists would mean gathering the vast data available online and deriving insights that might otherwise remain hidden. By shedding light on the benefits of web scraping for venture capitalists, this blog will help you understand how web scraping can turn traditional investment research into a more data-driven process.

What Does Web Scraping for Investment Research Mean?

Web scraping for investment research in the context of a venture capitalist firm refers to the process of using automated tools to extract large amounts of data relevant to market research from websites and online platforms. This is to gather relevant information such as trends in technology, market flux, consumer preferences, competitive landscapes, and potential investment opportunities.

This method allows Venture Capitalists to efficiently collect data on a scale that would be impractical manually. It can include scraping news sites, forums, social media, company websites, regulatory filings, and more to identify promising startups, assess industry trends, and evaluate the performance and potential of existing investments.

So, how do venture capitalist companies use web scraping, and what benefits does a venture capitalist firm derive from it?

What are the Benefits of Web Scraping for Venture Capitalists?

Venture Capitalist firms often invest in startups and emerging industries with high growth potential, so access to the most current data is crucial. Web scraping for Venture Capitalist firms goes beyond simply collecting data from the web. It’s about obtaining vast amounts of data to gain a deeper understanding of a startup’s potential.

Here’s how venture capitalist companies utilize web scraping to make data-driven decisions:

1. Identify Emerging Trends

By scraping data from industry publications, research reports, and social media platforms, Venture Capitalists can spot and stay ahead of emerging trends. This allows them to identify promising sectors ripe for investment before the competition catches on.

For example, a Venture Capitalist firm could scrape data from social media platforms to analyze consumer sentiment towards a new type of food delivery service, giving them a head start in evaluating potential startups in this space.

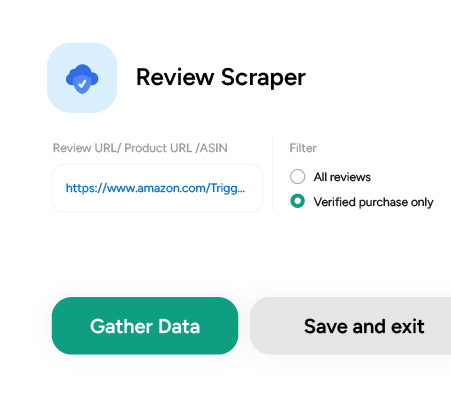

Don’t want to code? ScrapeHero Cloud is exactly what you need.

With ScrapeHero Cloud, you can download data in just two clicks!

2. Evaluate Startups Efficiently

Web scraping allows Venture Capitalists to gather information on a large pool of startups quickly. This includes scraping financial data like funding rounds, competitor analysis, and user base growth. Doing this research manually would involve extracting websites and compiling data from various sources. Web scraping automates this process, saving time and resources.

- Funding Rounds: This refers to the amount of money a startup has raised from investors in different investment stages (Seed round, Series A, B, etc.). By scraping data on funding rounds, Venture Capitalists can understand a startup’s financial backing, valuation, and potential for future growth.

- Competitor Analysis: Web scraping can be used to gather information about a startup’s competitors. This might include data on competitor products, pricing strategies, market share, and customer reviews. By analyzing this data, Venture Capitalists can assess the landscape of the startup’s industry and its potential for success.

- User Base Growth: Venture Capitalists can scrape data on metrics like user signups, app downloads, or social media followers to understand a startup’s user base growth trajectory. This data helps measure the startup’s market traction and potential for scalability.

3. Make Informed Investment Decisions

Financial data extraction helps build a complete picture of a startup’s financial health and market position. This allows Venture Capitalists to make well-informed investment decisions with greater confidence.

By scraping financial data like revenue figures, burn rate, and customer acquisition costs, Venture Capitalists can assess a startup’s financial sustainability and potential for growth. This data, combined with other scraped information like news articles and social media sentiment, allows Venture Capitalists to gain a holistic understanding of the startup’s overall success rate.

Why it is Best to Outsource Web Scraping for Investment Research

Swift decisions are important in venture capitalism. Venture capitalists need vast amounts of data to have a comprehensive picture of the market, which is why relying on web scraping for investment research is advantageous.

Venture capitalist firms often utilize web crawlers to scrape financial data from various online sources. These web scraping tools enable them to extract valuable information such as market trends, competitor analysis, and financial performance metrics from different websites. However, managing and optimizing these web crawlers for venture capital firms requires specialized expertise.

Hiring a dedicated data scraping expert ensures that the process of web scraping financial data is done efficiently. A skilled professional can navigate the complexities of web scraping, ensuring the accurate and up-to-date extraction of relevant information. This saves time and ensures the quality and reliability of the investment research.

The benefits of web scraping for venture capitalists are undeniable. Venture capitalist firms can access advanced scraping technologies and ensure best practices by utilizing the expertise of an external specialist like ScrapeHero. By employing a data partner like ScrapeHero, venture capitalist firms can streamline their investment research process and gain an edge in the market.

Why is ScrapeHero the Better Choice for Venture Capitalists in Web Scraping

There are multiple web scraping service providers available in the market. But ScrapeHero is the preferred choice for many. The following are the reasons why it is best for venture capitalists to outsource their data needs to us.

- Customized Solutions: ScrapeHero provides tailored scraping solutions specifically designed to meet the unique business requirements of our clients.

- Data Integrity: ScrapeHero delivers clean, structured, and immediately usable data, eliminating the need for further processing and saving significant time and resources.

- Comprehensive Support: Beyond data delivery, ScrapeHero offers continuous support, thus helping businesses maximize the value of the data collected.

- Cost-Effectiveness: ScrapeHero offers high-quality services at comparatively lower prices. This makes web scraping accessible to companies of all sizes.

- Legal Compliance: ScrapeHero adheres strictly to legal and ethical scraping standards, guaranteeing that our data collection methods do not infringe on website terms of service or legal regulations.

- Hassle-Free: ScrapeHero takes care of the entire data collection and processing process, freeing our customers to focus on running their business. We handle everything from web scraping and data extraction to quality checks and delivery, saving valuable time and resources.

- No Long-Term Contracts: We understand that business needs may evolve, so we offer flexible pricing plans with no long-term contracts. This allows businesses to choose the solution that best suits their immediate needs, with the flexibility to adjust as the business grows.

Closing Thoughts on the Benefits of Using Web Scraping for Venture Capitalists

It can thus be concluded that in a market that is highly competitive, web scraping gives venture capitalists the ability to make data-driven decisions. Venture capitalists (VCs) can discover trends, streamline research, and ultimately make more informed investments with web scraping.

If you’re a Venture Capitalist firm in search of a reliable web scraping service provider, ScrapeHero is a trusted name. Our team of experts can help you design a customized web scraping solution to meet your specific investment research needs.