The product counts listed in this article include the number of products available on Walmart Grocery and Amazon Prime Now online stores for purchase by public. The data does not include product inventory in physical stores run by respective companies.

For the last couple of years, global economy has been carefully watching the tightening war between “Amazon Prime now” and “Walmart grocery”. America’s retail giant Walmart WMT 98.4 +0.8 +0.8% with $480 billion in revenue, competing with America’s largest online retailer Amazon with $90 billion revenue could mean plenty of advances on both sides. Walmart seems to be trying to cover more ground, significantly expanding their distribution to over 1800 locations around the country. Amazon has been working harder on brand positioning.

Nevertheless, the options available to an average American shopper has increased exponentially.

Walmart started curbside pickup in 2014, and by the end of 2019 it is expected to be available at 3,000 store locations. Buyers could order online, pull up at a designated parking spot at the specified time window and wait for their groceries to be loaded. Just like that, you are good to go in less than 2 minutes. Amazon went from one or two hour delivery to 30 minutes express service this year, while also focusing on Go stores.

Let us look at few more aspects of their growth in the recent months.

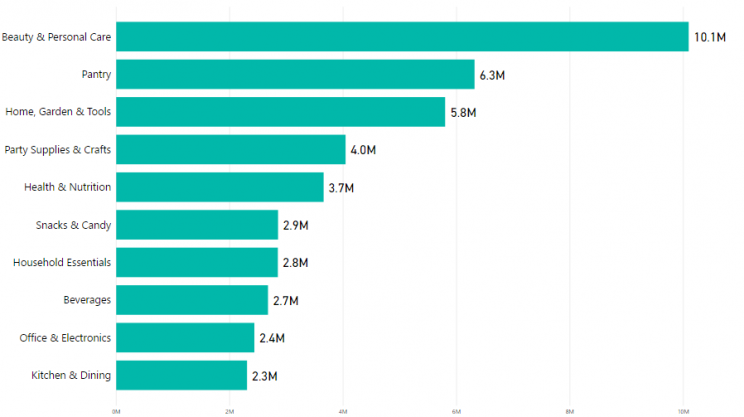

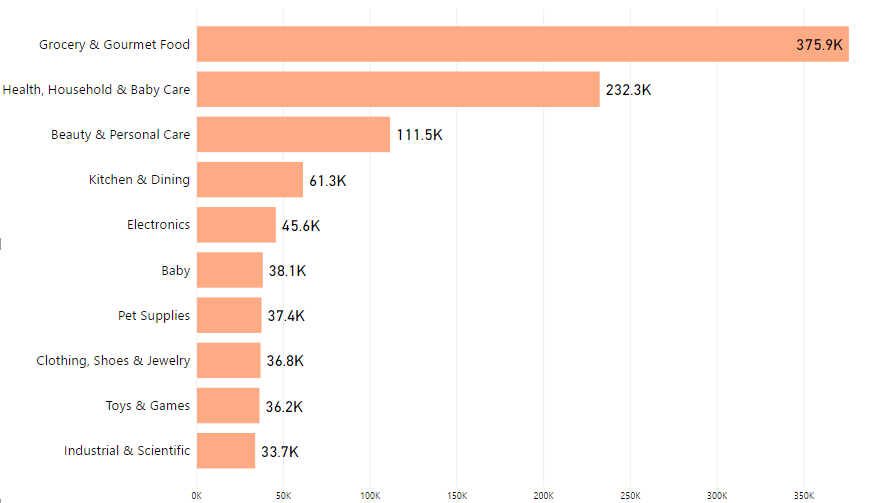

Top Categories on Amazon Prime Now and Walmart Grocery

Compared to July 2018, the top categories have barely changed across both players. Beauty & Personal Care stays on top for Walmart, while the number of products on this category spiked up from 9.3M to 10.1M. Pantry, standing second has also experienced an increase of around 1 million products according to the graph below.

The case is quite similar with Amazon, with all top categories staying the same. Amazon continues to be America’s first choice for Grocery and Gourmet food delivery. The number of products went from 304.8K in July to 376K in October. Amazon also spiked up number of products in second and third categories, Health, Household & Baby Care and Beauty and Personal Care by 50K and 10.5 K respectively.

Correlating buying behavior

While top categories on both players speaks a lot about where people like to buy specific products from, this cannot tell us a country-wide buying pattern. This is mainly because of the difference in number of products being sold through Amazon Prime Now and Walmart Grocery.

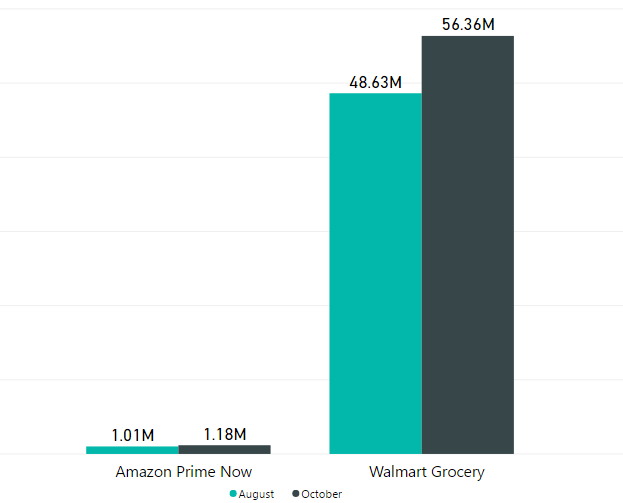

When Amazon hit 1 million products in last August, Walmart Grocery was already at 49 million products. As of October 2018, Amazon Prime Now is at 1.18 million products, while Walmart Grocery is at a heaping 56 million. Category scores and who sells what better would only begin to make sense when both players eventually level out on their product numbers. This seems like a long way to go for Amazon Prime Now.

Store expansion scales of Prime Now and Walmart Grocery

Though Amazon managed to top Wall Street’s earning forecast for the third quarter this year with 30% surge in sales, Amazon Prime Now local and physical stores were hit with a quarter to quarter decline. Amazon seems to have channeled most of its efforts into online grocery delivery. With Whole Foods joining the league, Amazon has store locations in 63 cities now.

Around August this year, Amazon Prime Now did a 10-city launch in Charlotte and Raleigh, North Carolina, Las Vegas, Memphis and Nashville, New Orleans, Oklahoma City, Phoenix, Seattle, and Tucson, Arizona.

Despite the low numbers, Amazon’s brand value seems to really pay off among its high end customers. Amazon Prime Now’s curbside pickup which started in August this year is already getting better points than Walmart Grocery which has been operating similar services since 2014. Walmart Grocery has a minimum cost, while Prime Now allows any total with $1.99 fee for a one-hour pick up window. Walmart also has fixed slots, which are hours apart, making it harder for working population to accommodate the service.

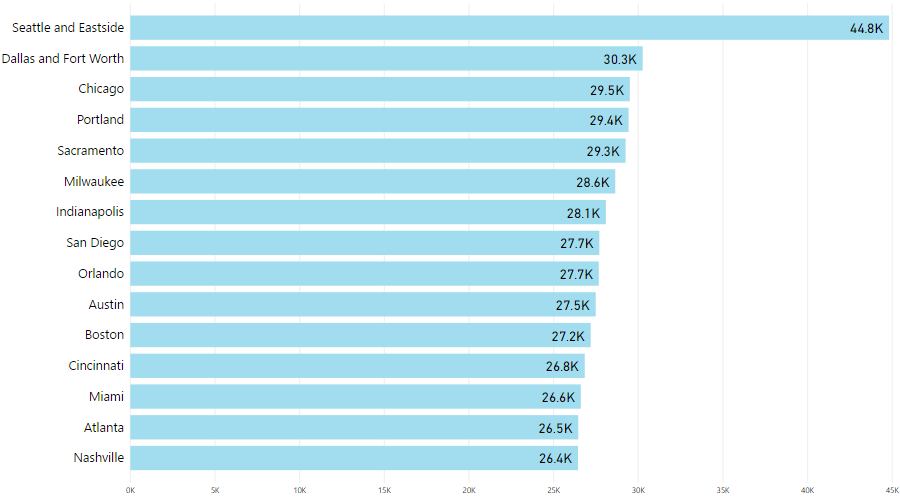

Let’s take a look at the number of products available in top locations of Amazon Prime Now.

Walmart however, has made great progress with its expansion plans. Walmart Grocery was available in 50 markets since August this year and store pick up is available at 1,800 Walmart locations around the country. Walmart owns over 4,800 stores located within 10 miles of 90% of the US population, an advantage they are capitalizing while going on a war with Amazon Prime Now. Walmart experienced a 40% jump in online sales, with market share in the online retail segment going form 2.9 in 2012 to 4.3% in 2017. Amazon was already at 46% in 2017, though Prime Now grocery delivery has made little impact so far.

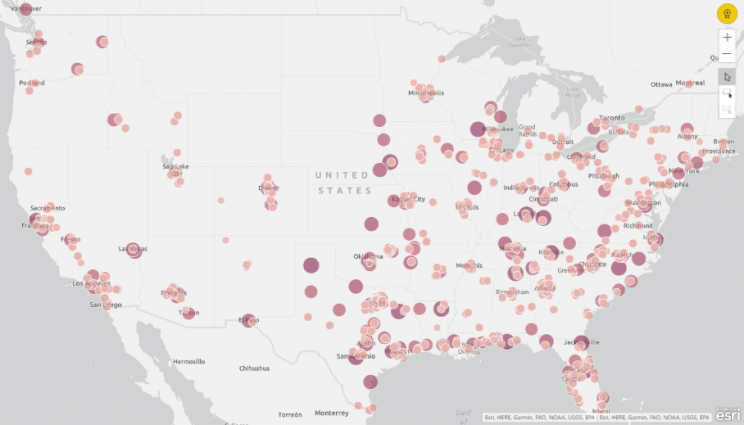

The map below shows number of Walmart store locations in each city across the country. San Antonio tops the list, with 11 store locations in total.

Read More:

Partnerships – The road ahead for online retail

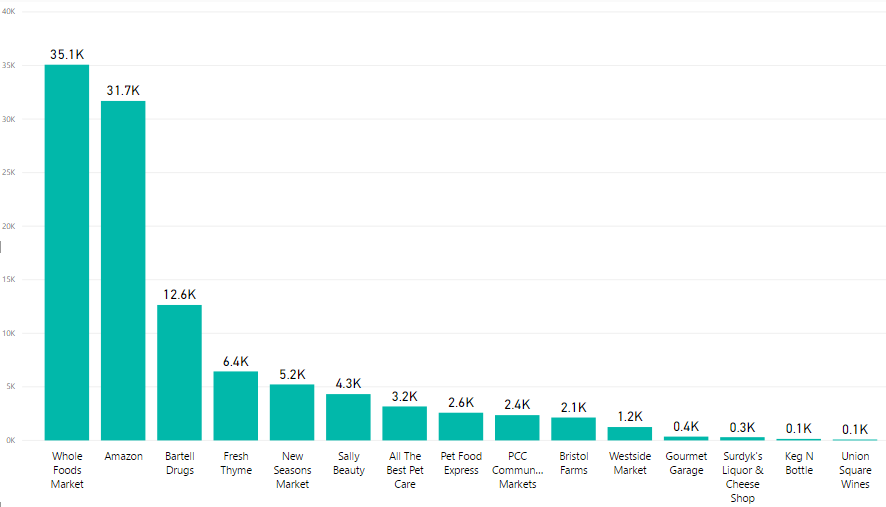

For Amazon Prime Now, its delivery capacity has definitely strengthened post the acquisition of Whole Foods, its largest partner store that delivers mostly to the ‘Gourmet and Grocery’ Category. Whole Foods contributes 35.1K products to the Prime Now shelf. Amazon stores are next with 31.7K products.

Bartell Drugs, which is third on the list was the first drug store producer to Offer Amazon Prime Now service in November 2017, and is gaining a lot of sales through the Prime Now. The graph below shows top 14 stores that are currently selling through Amazon Prime Now.

For Walmart however, the future looks quite adventurous. Apart from trying a fleet of independent delivery options similar to Amazon’s Flex to boost its online grocery delivery, the retail giant is testing new waters as well.

Walmart has begun pushing eBooks, at a price ($9.99/month) which undercuts Amazon Audible ($14.95). Walmart recently made a record purchase of $16 billion, acquiring Flipkart, an emerging e-commerce player in India.

In 2017, it purchased Moosejaw, ShoeBuy, Jet.com, Hayneedle, ModCloth and Bonobos, a lineup of online brands that would start stores on Walmart. The retail giant has already announced a strategic partnership to create an automotive specialty store on its website with Advanced Autoparts Inc. AAP 51.6 +2.6 +5.3%

Though quite exciting, these expansions are putting significant weight on Walmart’s spending balance. Despite being America’s favorite grocery shop, they are still far behind Amazon when it comes to online potential and capabilities. Compared to Amazon’s 122 fulfilment centres across the country, Walmart runs less than 10 dedicated e-commerce facilities. This just means that we have quite a lot to analyze, watch and witness in the coming years as Walmart and Amazon create history’s first e-commerce war.

For the full data on Amazon Vs Walmart competition or for other valuable data to be gathered from a variety of websites, contact us on the form below.

We can help with your data or automation needs

Turn the Internet into meaningful, structured and usable data