Victoria’s Secret. You know the brand, but do you know its strategy today?

The fashion shows made headlines, but the real story is in the data—in the pricing, the platform placements, and the shifting sales channels.

We pulled apart their product listings, financials, and retail footprint to see what’s really happening. This is a clear-eyed Victoria’s Secret market analysis for anyone interested in how a legacy brand adapts.

What did we find? A brand carefully balancing its luxury image with accessible entry points, aggressively shifting online, and using data to decide where to compete. Let’s break it down, starting with where they’re showing up—and how they’re selling—on two of the biggest retail platforms in the world.

Data Sources:

- The e-commerce data was gathered using Amazon Search Results Scraper and Walmart Search Results Scraper.

- POI data from ScrapeHero Data Store

- Victoriassecretandco.com

With ScrapeHero Cloud, you can download data in just two clicks!Don’t want to code? ScrapeHero Cloud is exactly what you need.

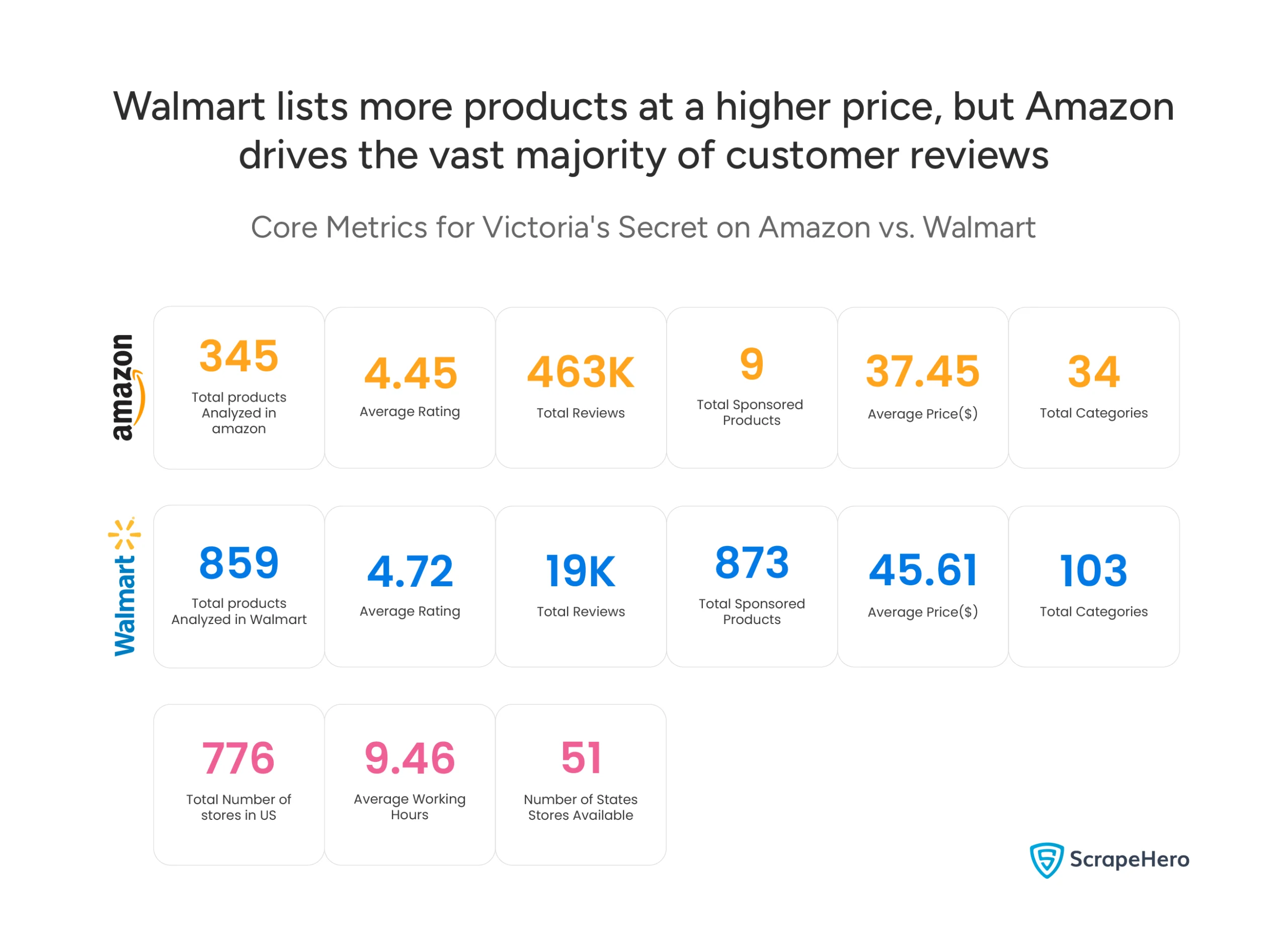

Victoria’s Secret’s Digital Shelf Analysis – Amazon vs. Walmart

The numbers tell a clear story of dual strategies.

Victoria’s Secret lists 859 products on Walmart with an average price of $45.61. On Amazon, they list fewer products—345—at a lower average price of $37.45.

But look at customer engagement. Amazon dominates with 463,000 total reviews, building massive social proof. Walmart has just 19,000 reviews.

The biggest difference? Advertising. Victoria’s Secret sponsors a huge 873 products on Walmart. On Amazon, they only sponsor 9 products.

What does this mean for Victoria’s Secret brand analytics?

- Amazon is the volume and trust engine. The strategy is to convert browsers with reviews and ratings.

- Walmart is about premium visibility. The brand lists more, charges more, and pays for placement to win the digital aisle.

This platform-specific approach directly shapes their product mix and pricing tiers. So, what exactly are they selling at these different price points?

Victoria’s Secret Product Trends: Portfolio & Price Positioning on Amazon

To understand a brand’s strategy, you need to look at what it sells and for how much. Here, we break down the Victoria’s Secret product analysis on Amazon into two clear tiers: the high-margin luxuries and the accessible volume drivers.

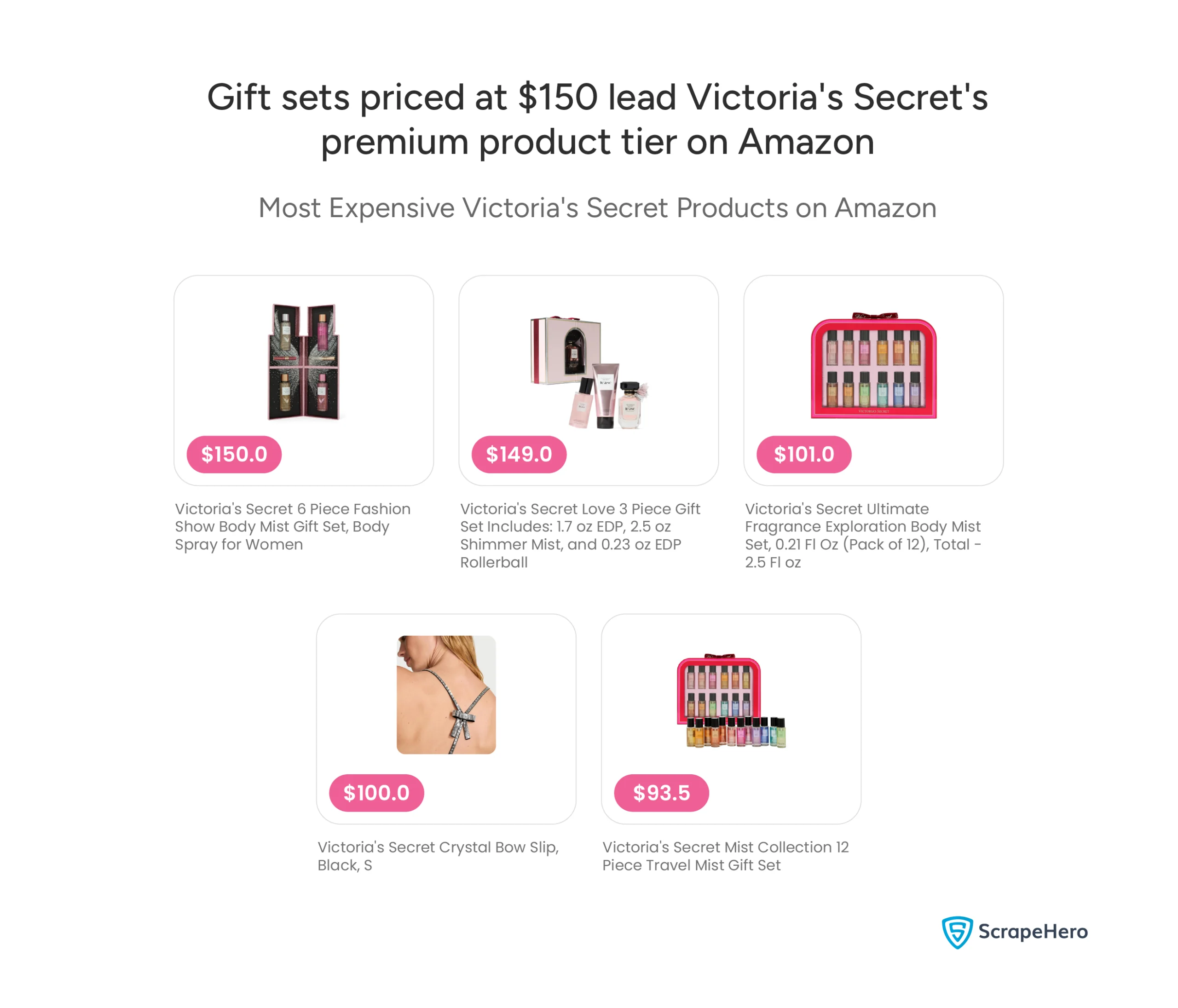

The Premium Tier of Victoria’s Secret

Victoria’s Secret’s luxury strategy on Amazon is unmistakable when you look at the price tags. Gift sets dominate the top of the list, clearly positioned as high-value flagship items.

- The Victoria’s Secret 6 Piece Fashion Show Body Mist Gift Set leads at $150.

- The Love 3 Piece Gift Set follows closely at $149.

- Multiple fragrance and sleepwear items, like the Crystal Bow Slip and various Eau de Parfums, anchor the $80 to $100 range.

This pricing structure reveals a focused Victoria’s Secret product trend. The brand uses elaborate gift sets and signature perfumes to command premium prices.

These items are not everyday purchases. They cater to gifting, self-indulgence, and special occasions.

The Accessible Entry Point of Victoria’s Secret

Their most affordable items on Amazon are all about removing barriers to entry.

You can get started with Victoria’s Secret for less than the cost of a lunch.

- Victoria’s Secret Women’s No Show Cheeky Underwear costs just $7.50.

- Mix-and-Match Brazilian Bikini Bottoms start at $8.20.

- Their Color Balm Tinted Lip Conditioner is a clean $10.00.

Even multi-pack cotton underwear and small accessories like the PINK Card Case Wallet don’t break the $13 mark.

Why does this matter? It’s a classic funnel strategy. The affordable underwear, swimwear, and lip care aren’t the big profit drivers on their own. They’re the gateway. They get a first-time buyer to experience the brand, trust the fit, and enjoy the feeling. That $7.50 purchase builds the relationship that might later justify an $80 perfume or a $100 pajama set.

This is how you see Victoria’s Secret product trends in action: use low-friction items to build a massive customer base, then leverage that relationship to sell the high-margin luxuries.

Marketing Spend & Category Focus of Victoria’s Secret on Amazon

So, where is Victoria’s Secret putting its money to make sure you see these products? Their advertising spend tells us what they really want to sell right now.

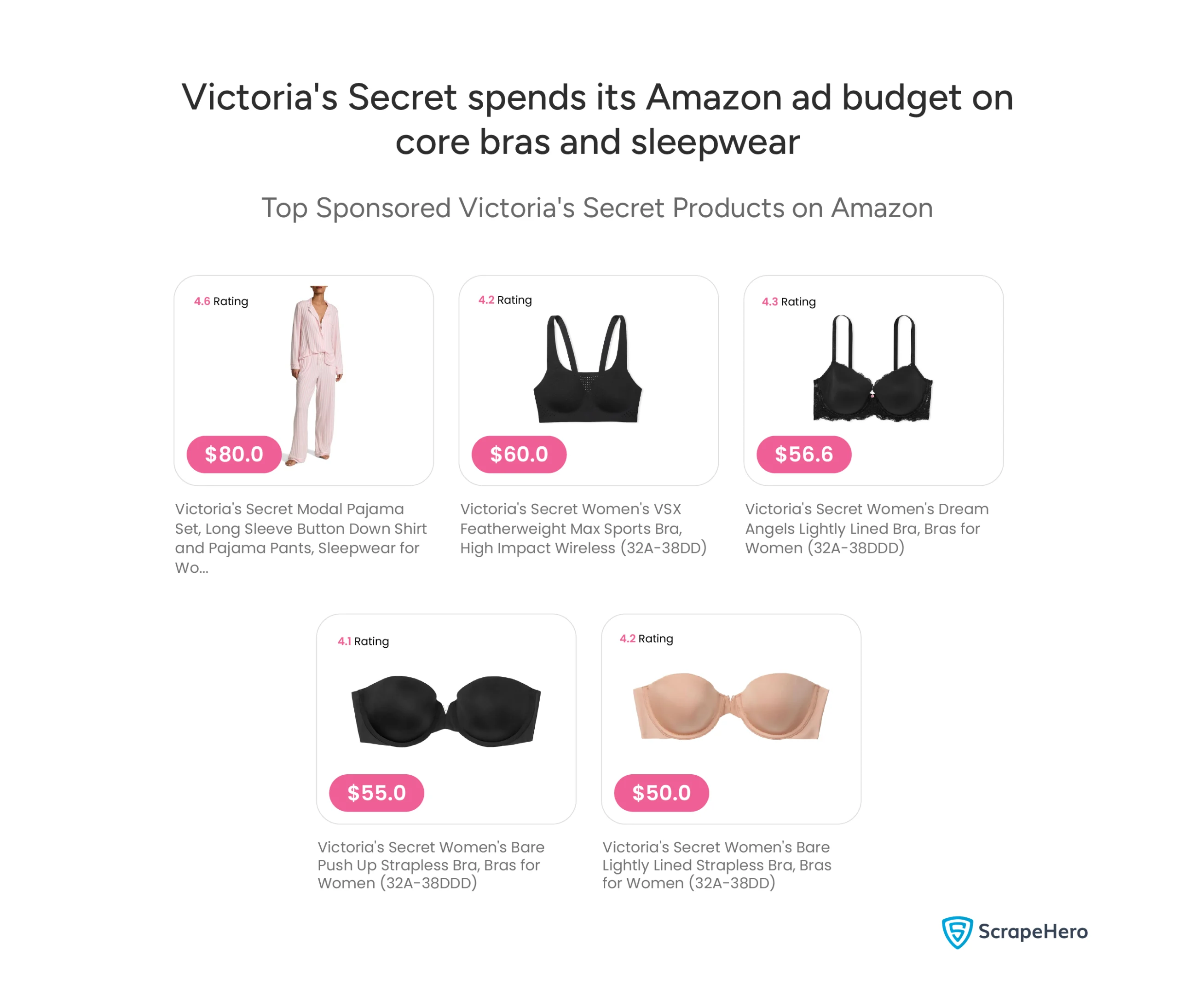

Sponsored listings are paid ads. They guarantee top placement in search results. For Victoria’s Secret on Amazon, their ad budget goes almost entirely into two categories: bras and pajama sets.

Look at the data. Eight of their nine sponsored products are bras, with average prices between $48 and $60.

The ninth is a modal pajama set rated 4.6 stars and priced at $80. They are not promoting the $150 gift sets or the $7.50 underwear here. They are pushing the reliable, mid-price workhorses.

- The Body by Victoria T-Shirt Bra (4.5 stars, $48)

- The Featherweight Max Sports Bra (4.2 stars, $60)

- The Modal Pajama Set (4.6 stars, $80)

This focus is a powerful piece of Victoria’s Secret brand analytics. It shows where they feel competitive pressure and where they see the strongest return on ad spend. They are doubling down on their core category—lingerie—while also aggressively promoting sleepwear as a key growth area. They are using paid promotion to defend their territory and conquer a new one.

This focus is a powerful piece of Victoria’s Secret brand analytics. It shows where they feel competitive pressure and where they see the strongest return on ad spend. They are doubling down on their core category—lingerie—while also aggressively promoting sleepwear as a key growth area. They are using paid promotion to defend their territory and conquer a new one.

The Logic Behind the Ad Spend 💡 Why promote a $48 bra and not a $150 gift set? Volume and conversion. The mid-range bra is a frequent, considered purchase for a wider audience. An ad here directly intercepts a high-intent search for “wireless bra” or “t-shirt bra.” The goal is to win the crucial, everyday sale that builds customer loyalty.

Physical Retail Strategic Role

Victoria’s Secret operates 776 stores across 51 states, but their placement is highly strategic.

Look where they are. They cluster stores in states with the highest spending power.

- California has a massive 107 stores.

- New York follows with 42.

- Even smaller, affluent states like Washington (18) and Massachusetts (17) have significant presence.

This is a deliberate Victoria’s Secret market strategy in action. They aren’t blanketing the country. They are planting flags where the money is.

A store in a high-GDP state isn’t just a sales point; it’s a brand temple. It’s where customers go for fittings, experience the luxury ambiance, and build a tangible connection with the brand.

The takeaway? Victoria’s Secret retail strategy is now about quality of location, not quantity. They maintain a physical network that services their most valuable customers and reinforces their premium identity.

The Store as a Marketing Tool 💡 In an era of digital sales, why keep so many stores? For a brand built on fit and feel, the fitting room is irreplaceable. A store visit often secures a customer’s size profile, boosting confidence for future online purchases. The physical space also serves as a 3D billboard, maintaining top-of-mind awareness and brand prestige in affluent communities.

Financial Health & The Digital Shift of Victoria’s Secret

Here’s where all the strategies we’ve seen, the platform plays, the product tiers, the ad spend, show up on the bottom line. The financials reveal the truth.

The headline is stability. Total revenue has held steady around $6.2 to $6.3 billion over the past three years. But look closer. That steady line is hiding a major transformation happening beneath the surface.

Retail sales are down. They’ve dropped from about $3.9 billion in 2023 to roughly $3.4 billion in 2025. That’s a clear, consistent decline in their traditional brick-and-mortar business.

Online sales are up. In the same period, direct online sales grew from around $1.84 billion to over $2.04 billion.

Think about what this means.

The brand is successfully moving its customers online. The focus on sponsored bras and accessible underwear on digital platforms isn’t a side project. It’s the main event, and the financials prove it’s working.

This is the most critical piece of Victoria’s Secret product performance data. It confirms the strategic pivot is real, it’s data-driven, and it’s already reshaping the company’s revenue model.

Conclusion: Victoria’s Secret in the New Retail Era

So, what did our Victoria’s Secret market analysis really show us?

Victoria’s Secret is no longer just a mall retailer. It’s a digitally-led omnichannel brand with a sharp focus on where and how to compete.

Let’s recap the key takeaways:

- Dual Digital Playbooks: They master two platforms—building trust and volume on Amazon, while chasing premium visibility on Walmart.

- Strategic Product Tiers: They balance high-margin luxury (think $150 gift sets) with accessible gateway products (like $7.50 underwear) to both elevate the brand and drive customer acquisition.

- Focused Investment: Their advertising dollars zero in on core, high-consideration categories like bras and sleepwear, defending their turf and conquering new ground.

- Targeted Physical Presence: Their 776 stores aren’t everywhere; they’re in affluent markets where they act as brand temples and fitting hubs for a loyal customer base.

- The Financial Proof: Most importantly, the numbers confirm the shift. Steady total revenue hides a crucial transformation: retail sales are down, online sales are up. The digital channel is now the growth engine.

The bottom line? Victoria’s Secret has moved beyond its iconic runway. Its future is being written on digital shelves, in targeted ad spends, and in a financial statement that rewards this strategic shift. They are leveraging their legacy while fiercely adapting to where the modern customer shops.

This Victoria’s Secret product analysis reveals a brand that understands its evolution. By using data to guide every decision—from pricing to placement—they are carefully navigating their way into retail’s next chapter.

Found this data-driven breakdown insightful? Share this Victoria’s Secret market analysis to spark a conversation about brand strategy in the digital age.

Are You Wondering How to Do a Similar Analysis?

How did we uncover all these insights for this Victoria’s Secret market analysis? We didn’t do it manually.

Think about what it would take. You’d have to:

- Click through hundreds of product pages on Amazon and Walmart, copying prices and reviews one by one.

- Manually count sponsored listings and calculate average ratings.

- Scour store locators in all 51 states to map out 776 physical locations.

- Comb through annual reports to track sales trends over years.

That’s not strategy. That’s tedious, error-prone data entry. It could take a team weeks.

The Smarter Way to Get Market Data

A deep dive like this requires data at scale. You need accurate, structured information on:

- Digital Shelf Health: Real-time product counts, pricing, ratings, and review volumes across multiple e-commerce sites.

- Physical Footprint: Precise store locations (POI data) and market saturation analytics.

- Competitive Intelligence: Advertising spend visibility (like sponsored product counts) and category-level performance.

This is where specialized data collection services come in. Instead of building and maintaining your own web scraping infrastructure, you can get clean, analysis-ready data delivered.

The value is clear: you skip the months of development and constant maintenance. You avoid the headaches of blocked requests and changing website structures. You get to focus on what you do best—turning raw data into a winning strategy.

Focus on Insights, Not Infrastructure

Your competitive edge doesn’t come from building a data pipeline. It comes from the insights you extract from it. Outsourcing the complex task of large-scale data collection frees up your time and resources. You can invest them in higher-value work: interpreting trends, identifying opportunities, and making faster, smarter decisions.

When you need reliable, scalable data for a comprehensive Victoria’s Secret brand analytics project or any other competitive analysis, outsourcing to a web scraping service specialist is the smarter choice.

Report by ScrapeHero using publicly available data. This analysis is independent and not affiliated with Victoria’s Secret.