Let’s look beyond the brand stories.

This report provides a quantitative analysis of Sephora vs Ulta Beauty, benchmarking their performance where it matters most—from their physical footprint and social media influence to their e-commerce strength.

Using relevant data, we will do a definitive market comparison across key business metrics.

This analysis of Sephora vs Ulta Beauty covers:

- Physical Footprint: Who has more stores in America’s wealthiest zip codes?

- Digital Clout: Which brand commands a larger online follower base and more engagement?

- E-Commerce Scale: Who is winning on Amazon and Walmart’s virtual shelves?

- Price & Perception: How do their pricing strategies and customer ratings compare online?

NB: The POI data for this analysis was downloaded from the ScrapeHero Data Store.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

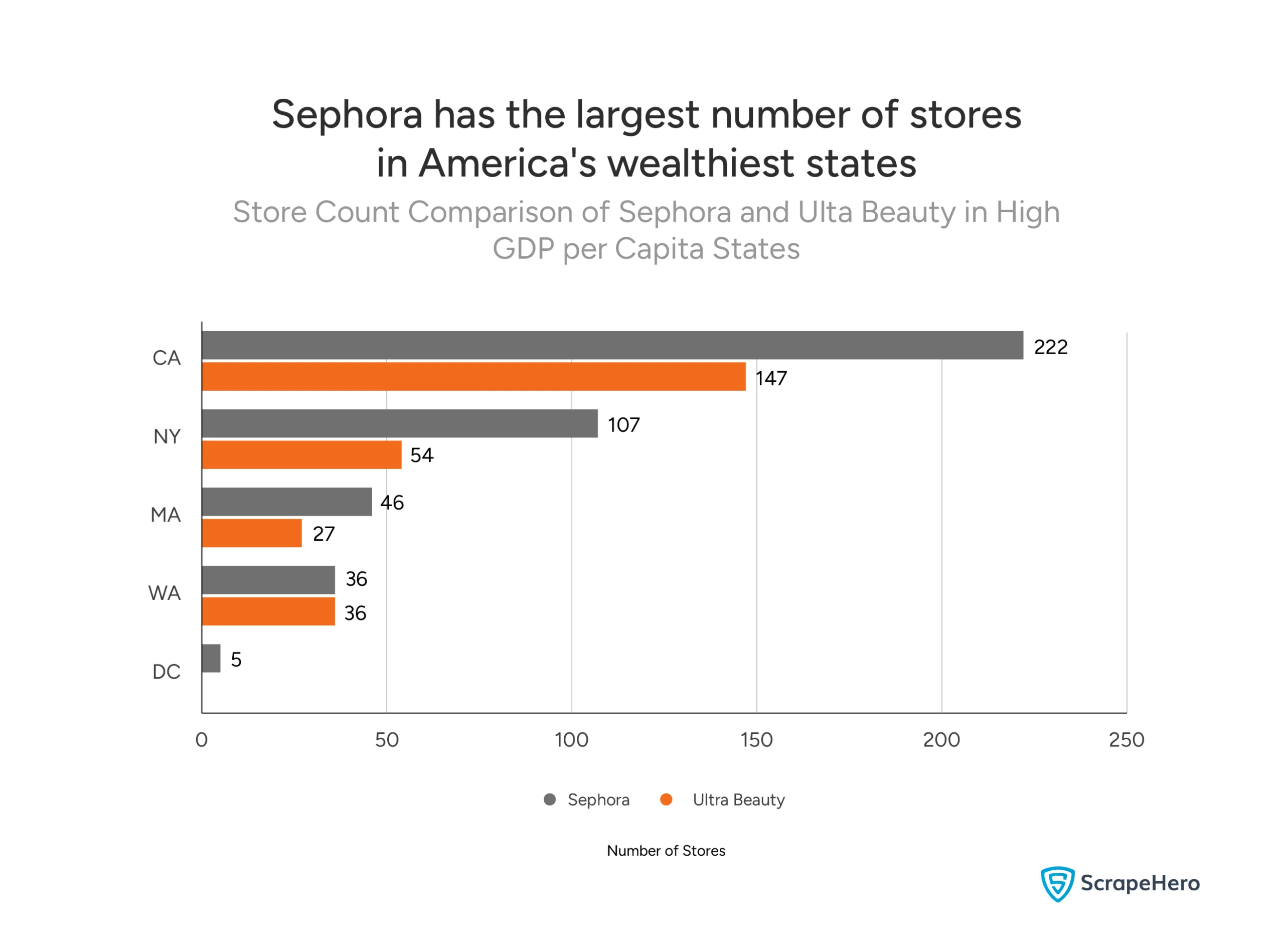

Sephora vs Ulta Beauty in America’s High-Value Markets

Sephora SA is a French multinational retailer of personal care and beauty products, offering nearly 340 brands alongside its own private label, Sephora Collection.

Ulta Beauty, Inc. is an American chain of cosmetic stores headquartered in Bolingbrook, Illinois.

A Sephora vs Ulta Beauty market comparison reveals a clear and deliberate expansion strategy.

Sephora is strategically targeting the most valuable markets. Our analysis of their physical locations in the five states (and D.C.) with the highest GDP per capita shows a decisive push for affluent customers.

The data clearly shows:

- Sephora significantly outpaces Ulta Beauty in three of the five wealthiest markets: California, New York, and Massachusetts.

- Washington D.C., presents a notable gap, with Sephora operating 36 stores and Ulta Beauty having no presence at all.

- Washington state is the only market in this group where both brands are virtually tied.

Digital Dominance: Online Scale and Social Engagement

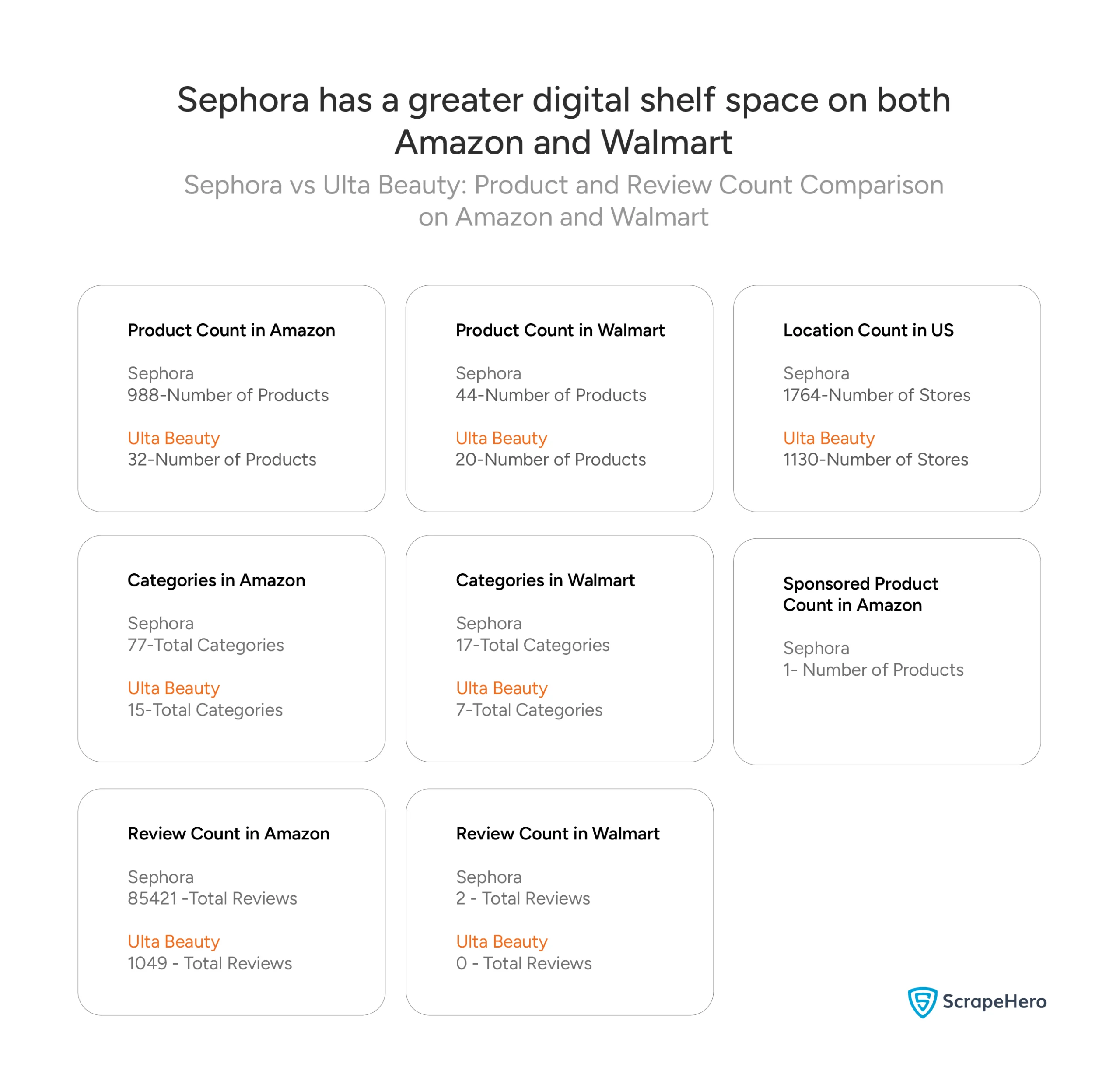

Online Reach: Measuring Market Share on Amazon and Walmart

When it comes to online retail, the Sephora vs Ulta Beauty performance gap is substantial. A look at their presence on Amazon and Walmart reveals that Sephora is dominating the digital shelf.

The data from the table highlights a stark contrast in online scale:

- On Amazon, Sephora offers over 30 times more products than Ulta Beauty (988 vs. 32).

- This massive product selection translates into a huge engagement gap. Sephora has gathered 85,421 reviews, dwarfing Ulta Beauty’s 1,049. This suggests a far higher sales volume and customer interaction.

- The pattern continues on Walmart, where Sephora lists more than double the number of products.

- Notably, Ulta Beauty products on Walmart have yet to receive a single review, indicating a very low level of consumer activity on that platform.

Sephora’s Commanding Social Presence

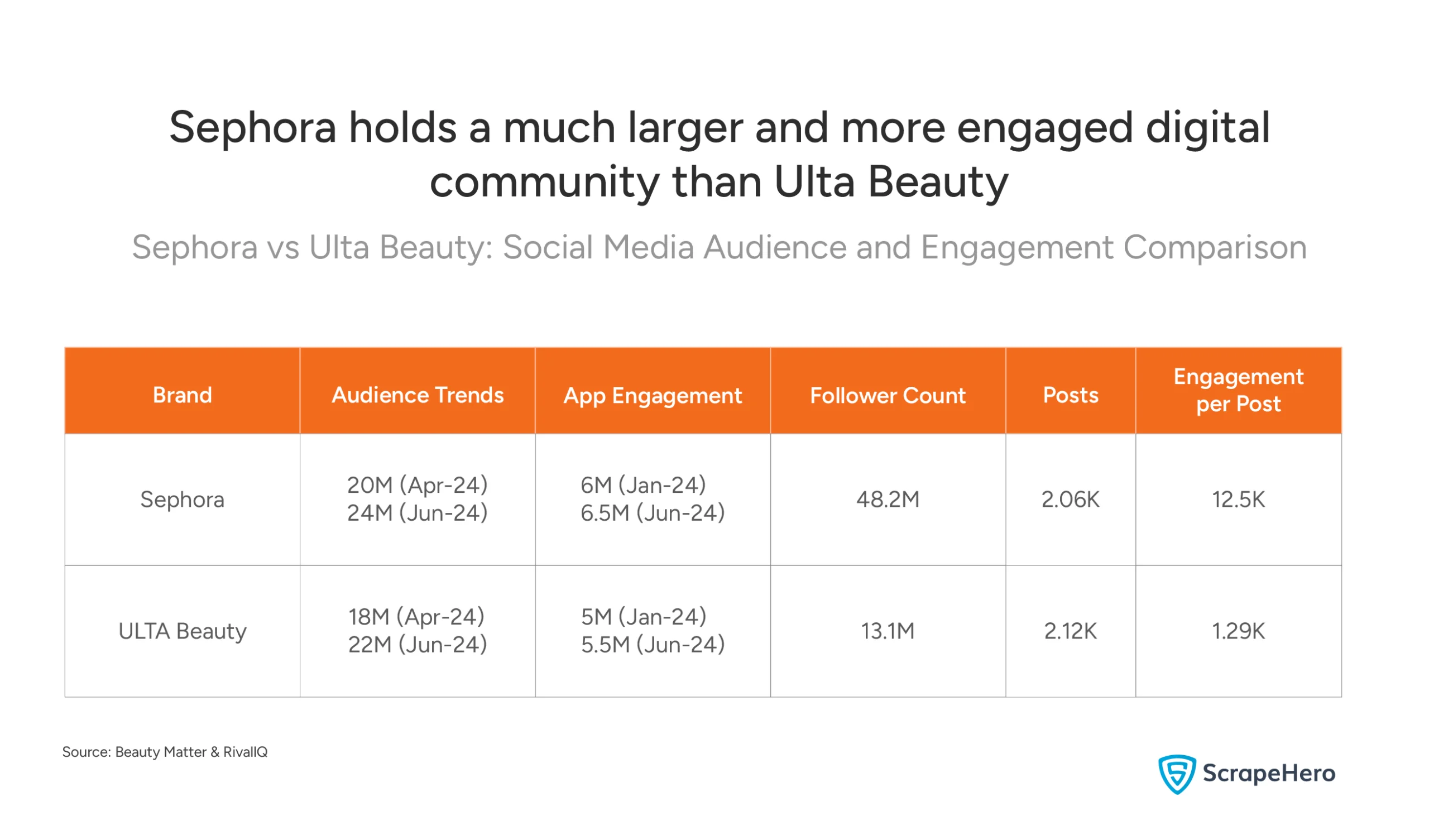

While both brands are growing their online audiences, a deeper look at social media reveals the true strength of Sephora’s brand connection. The data shows that Sephora commands a far more active and responsive community.

This Sephora vs Ulta market comparison on social platforms highlights key differences:

- Follower Gap: Sephora’s follower count of 48.2 million is nearly four times larger than Ulta Beauty’s 13.1 million. This gives Sephora an immense built-in advantage for organic reach and brand visibility.

- Engagement Quality: Despite Ulta Beauty posting slightly more often, Sephora’s content resonates far more powerfully. Sephora generates over 12,500 engagements per post, compared to Ulta’s ~1,300.

- This means Sephora’s audience is not just larger, but significantly more active and involved, a key indicator of brand loyalty.

Brand Positioning of Sephora vs Ulta Beauty on Amazon and Walmart

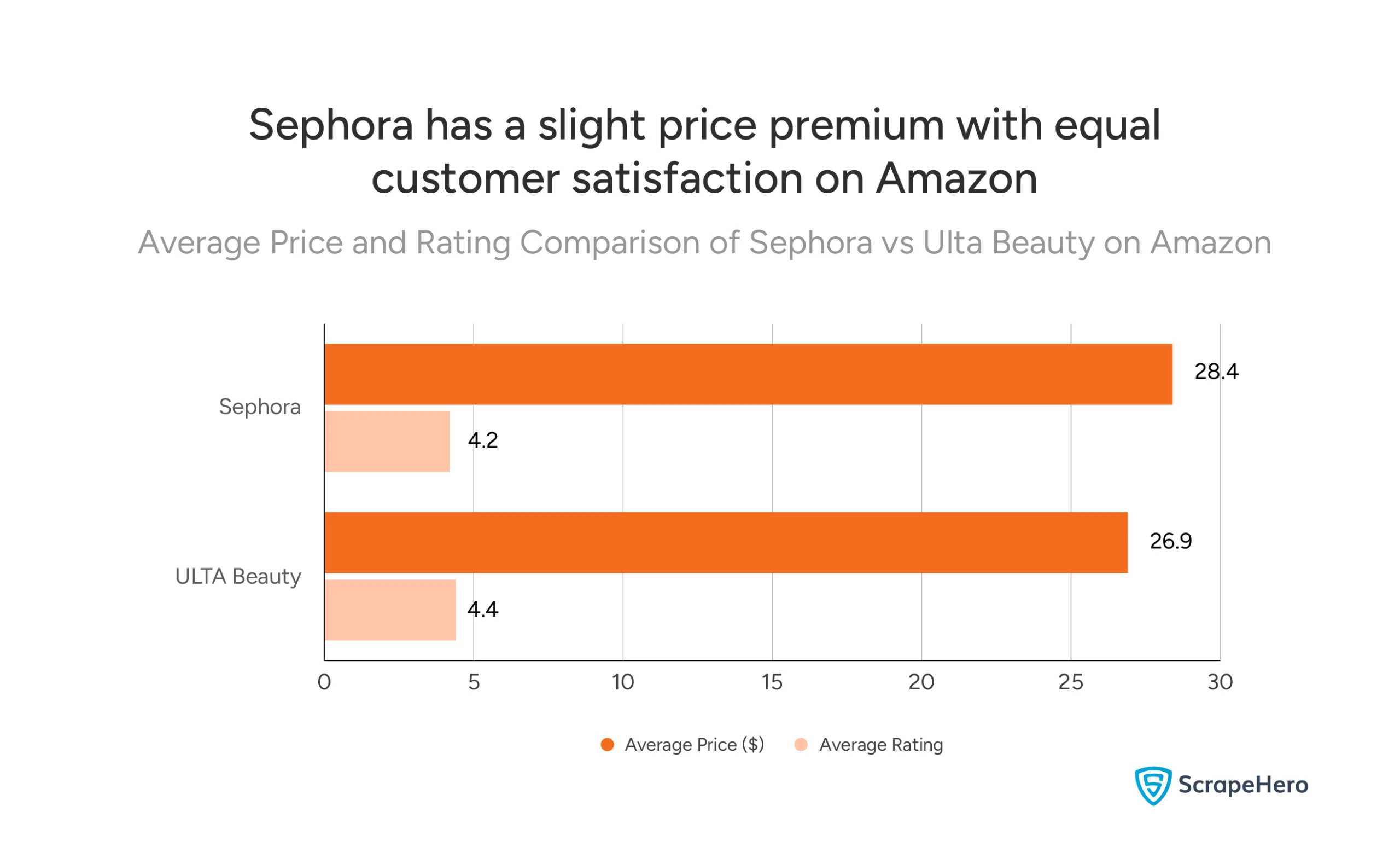

Sephora and Ulta Beauty on Amazon

On Amazon, Sephora charges slightly more, but customers are just as satisfied.

The data reveals a clear and consistent pattern:

- Sephora’s products carry a slight price premium, averaging $28.40 compared to Ulta Beauty’s $26.90.

- Despite this higher price point, both brands maintain a similar average rating of 4.2 and 4.4 stars.

This is a key finding in our Ulta Beauty vs Sephora analysis.

This shows that Sephora’s brand name allows it to charge more, and customers agree it’s worth the price. On Amazon, Sephora’s premium strategy is a proven success.

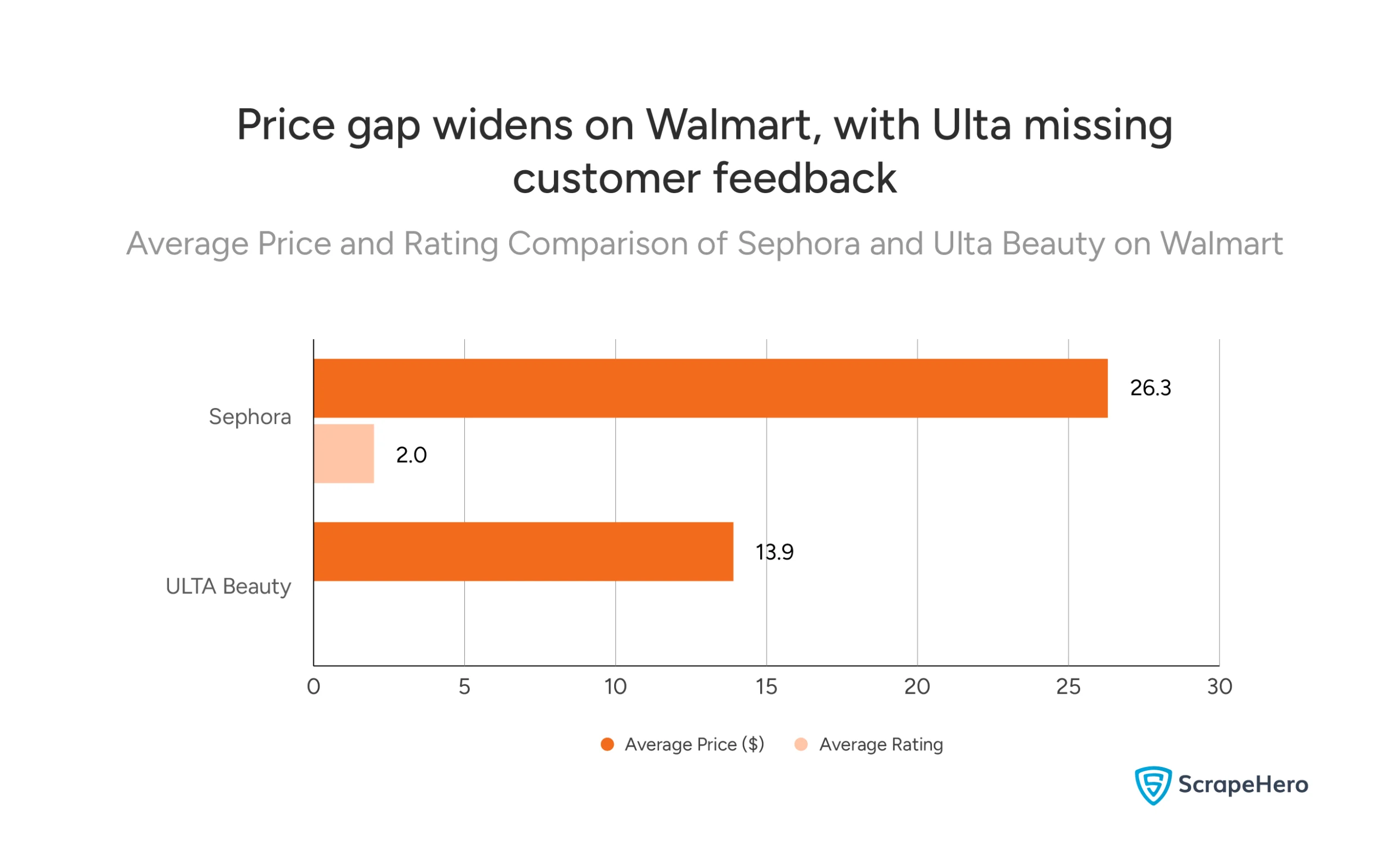

Sephora and Ulta Beauty on Walmart

The Sephora vs Ulta Beauty performance on Walmart reveals unexpected challenges for both brands, with neither achieving a strong foothold.

The data presents a mixed picture:

- Ulta Beauty holds a significant price advantage, with an average cost of $13.90—nearly half of Sephora’s average price of $26.30.

- However, Ulta’s products on Walmart have no available customer ratings, indicating a severe lack of customer engagement or sales volume.

- Conversely, while Sephora has a visible presence, it is struggling with customer satisfaction, holding a very low average rating of just 2.0 stars.

This part of our Ulta Beauty vs Sephora analysis highlights a key weakness. For Ulta, the low price point fails to attract measurable feedback.

For Sephora, this Sephora vs Ulta market comparison suggests its brand reputation for quality is not translating to the Walmart marketplace, resulting in poor customer reviews.

Walmart appears to be a challenging channel for both brands’ current strategies.

Our Conclusion About Sephora vs Ulta Beauty

The data presents a clear and consistent verdict in the Sephora vs Ulta Beauty rivalry.

This is not a story of a close race, but one of two distinct strategies yielding different levels of market dominance.

Sephora has built an undeniable lead in scale and prestige. Our analysis confirms it dominates across nearly every key metric:

- Physically, by targeting affluent consumers in high-GDP states.

- Digitally, by commanding a massive and highly engaged social community.

- On Amazon, by leveraging its brand equity to command a price premium without sacrificing customer satisfaction.

Ulta Beauty, while a powerful competitor, plays a different game. Its strategy of accessibility and breadth is reflected in its more moderate physical presence in luxury markets and its significantly smaller digital footprint.

The most telling finding is on Walmart, where both brands struggle: Ulta’s low prices might have failed to generate any measurable customer feedback, while Sephora’s presence was met with poor ratings, revealing Walmart as a challenging frontier for both.

Want to Do a Similar Analysis?

This Sephora vs Ulta Beauty analysis has quantified their strategies across physical retail, e-commerce scale, social media, and brand positioning.

Manually compiling this data, from thousands of store locations and product listings to millions of social media metrics and reviews, is a monumental task that can take weeks of effort.

The reality of modern market intelligence is that it requires data at scale. To truly understand competitor performance and your performance, you need accurate, up-to-the-minute data on:

- Store counts and expansion strategies in key markets.

- Product assortment and pricing across platforms like Amazon and Walmart.

- Social media engagement and audience growth.

- Customer sentiment through review volumes and ratings.

This is where a specialized data service becomes essential. Instead of manually tracking hundreds of data points, you can access ready-to-analyze data that delivers clear, actionable insights.

For businesses that need similar competitive intelligence, ScrapeHero web scraping service handles the complexity of large-scale data collection. We navigate thousands of web pages, extract accurate information, and deliver it in a structured format, saving you the time and resources required for in-house data gathering.

The alternative, building and maintaining your own data collection infrastructure, means diverting focus from your core goal: strategic analysis and decision-making.

When you need data effortlessly, outsourcing to a specialized web scraping service is simply the smarter choice. You get the insights without the infrastructure.

Report by ScrapeHero using publicly available data. This report is independent and not affiliated with Sephora or Ulta Beauty.