In an era where healthcare accessibility is a prime concern, retail health clinic in the US offer an increasingly vital alternative. These clinics, often situated within shopping centers or pharmacies, serve as walk-in clinics for basic medical care. But how many retail health clinics are there in the US? How are they geographically distributed across the nation? Who owns the lion’s share of retail health clinic locations in the US?

This article dives deep into a comprehensive location analysis of retail health clinics in the US. Backed by credible data and thorough research, this analysis aims to provide insights for healthcare providers, consumers, and healthcare entrepreneurs. Understanding the landscape of retail health clinic in the US could empower more informed healthcare choices.

An Overview of the Retail Health Clinic Locations in the US

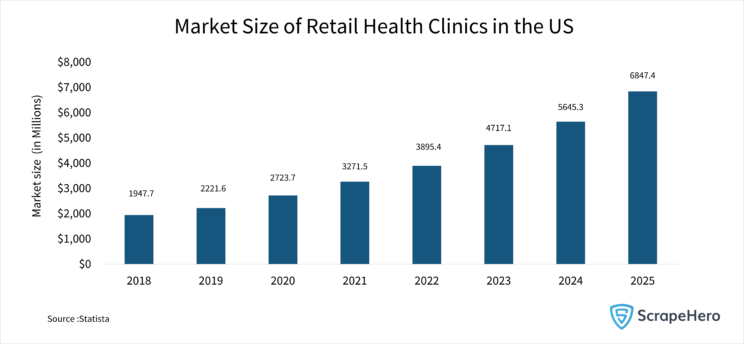

The landscape of retail health clinic locations in the US is expanding at an unprecedented rate. The market size of these walk-in clinics has been exponentially increasing since 2018. It is expected to reach 6847 million USD by 2025. This uptick fuels questions on how to open retail health clinics and who the major retail health clinic location providers are.

Regional Disparities in Retail Health Clinics in the US

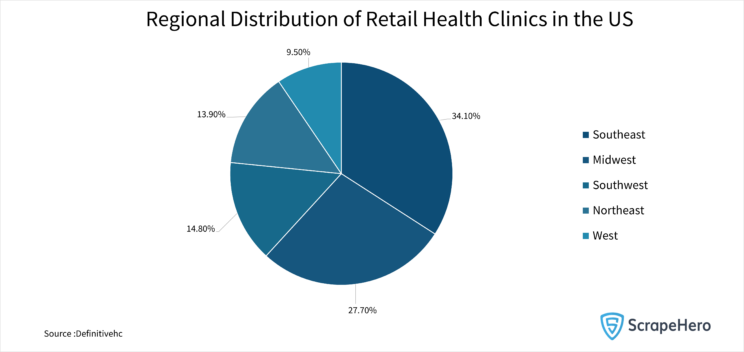

The distribution of retail health clinic in the US reveals noteworthy regional disparities. For instance, data from 2023 suggests that the Southeast region accounts for a significant 34.10% of retail health clinics, far outpacing other regions. The West lags considerably, comprising just 9.50% of retail health clinic locations.

Why does the Southeast dominate in terms of retail health clinic locations? A host of factors, including population density, healthcare access, and local regulations, might contribute to this regional discrepancy. These elements are vital for entrepreneurs researching how to open retail health clinics. The concentration in the Southeast suggests a market that is both mature and receptive, making it a lucrative option for new retail health clinic location providers.

These regional variances in retail health clinic locations in the US indicate a broader healthcare narrative. While the Southeast appears to be a stronghold for retail health clinics, the West represents an area ripe for expansion. Understanding these nuances is crucial for retail health clinic location providers and healthcare entrepreneurs.

Patient Traffic to the Retail Health Clinics in the US

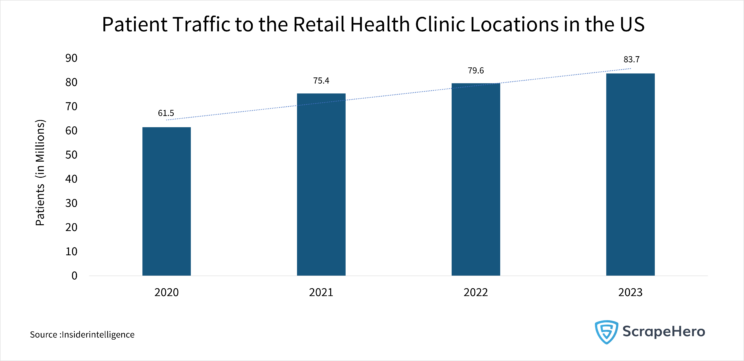

The surge in patient visits to retail health clinic in the US underscores the evolving dynamics of healthcare consumption. According to recent data, the number of patients visiting these clinics has substantially increased from 2020 to 2023. Patient visits accounted for 61.5 million in 2020 and are projected to reach 83.7 million by 2023.

This upward trajectory holds implications for various stakeholders. For those contemplating how to open retail health clinics, this data could serve as an encouraging market signal. With more patients turning to these clinics, retail health clinic location providers may experience an increased demand for their services.

So, how many retail health clinics in the US are effectively meeting this rising consumer need? While the number of clinics continues to grow, this increased patient traffic suggests that the market can sustain additional retail health clinic locations. For entrepreneurs, the surge in patient visits could inform where new clinics are most needed, especially in regions that are currently underserved.

Geographic Concentration of Retail Health Clinic Locations Across States

As the demand for retail health clinic locations in the US intensifies, understanding the geographic distribution of these clinics becomes crucial. Data indicates that certain states and cities have become hotspots for retail health clinic locations, offering valuable insights for healthcare entrepreneurs and retail health clinic location providers.

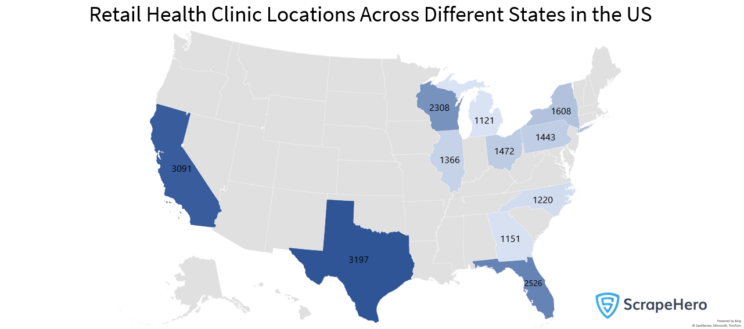

When 16 major clinics were considered, Texas, California, Florida, Wisconsin, and New York emerged as states with the most retail health clinic locations in the US. Texas has a whopping 3197 retail health clinic locations of the clinics in consideration as of August 2023, the highest among all the states in the US. Given this concentration, individuals interested in how to open retail health clinics should consider these states as potential markets ripe for either entry or expansion.

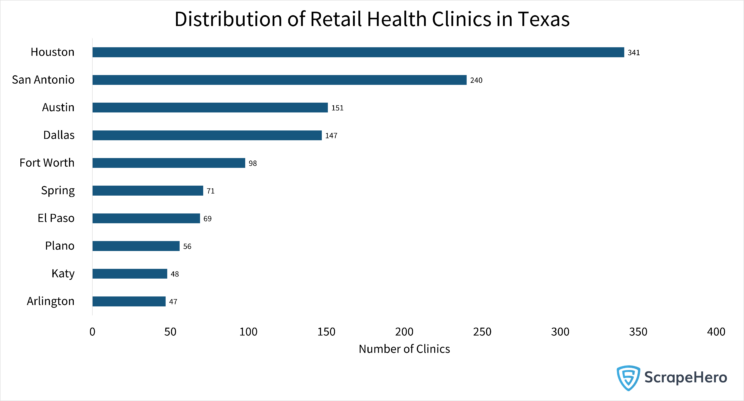

Among the states, Texas stands out for its robust network of retail health clinic locations. Cities like Houston, San Antonio, and Austin are hubs, each contributing a significant number of clinics to the state’s total. For entrepreneurs in the US, focusing on cities like these in Texas provides a microcosm of the larger national trend.

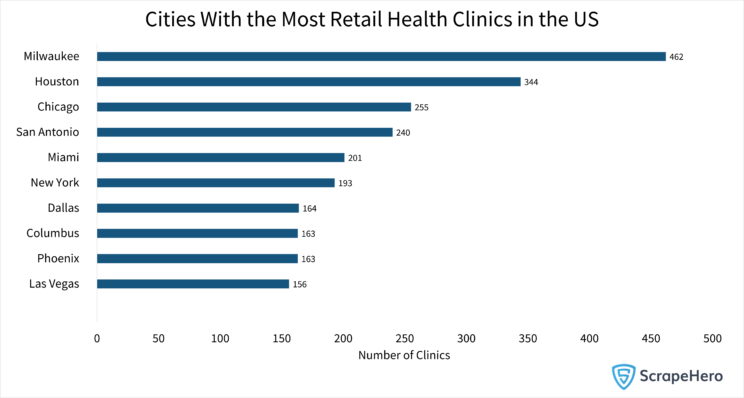

As of August 2023, Milwaukee is the city with the most retail health clinic locations in the US (462), followed by Houston and Chicago.

Top Retail Health Clinics in the US

In assessing retail health clinic in the US, a few key providers dominate the landscape.

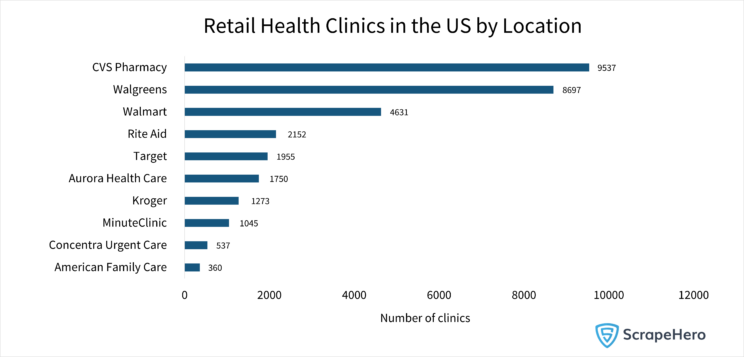

The graph delineates the leading retail health clinic location providers in the US. Walgreens and CVS Pharmacy emerge as the undisputed leaders, followed by other brands like Walmart and Rite Aid. CVS Pharmacy surpasses with approximately 9537 locations, while Walgreens is a close second with around 8697 locations as of August 2023.

Download store locations to gain a better understanding.

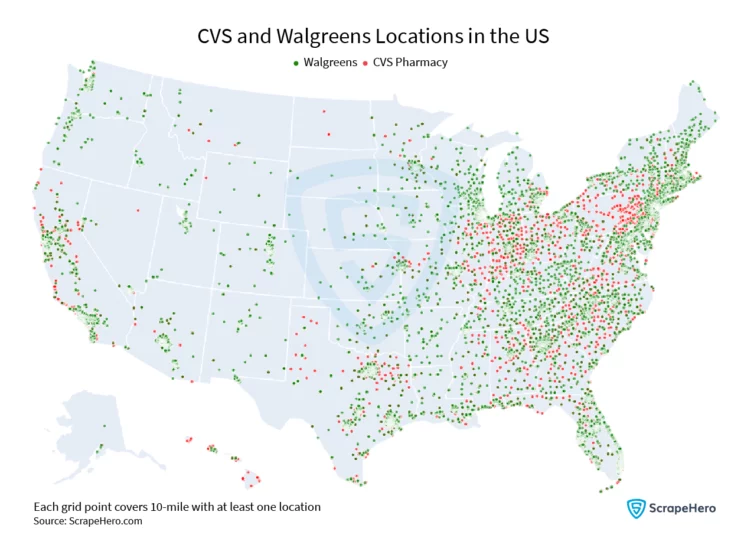

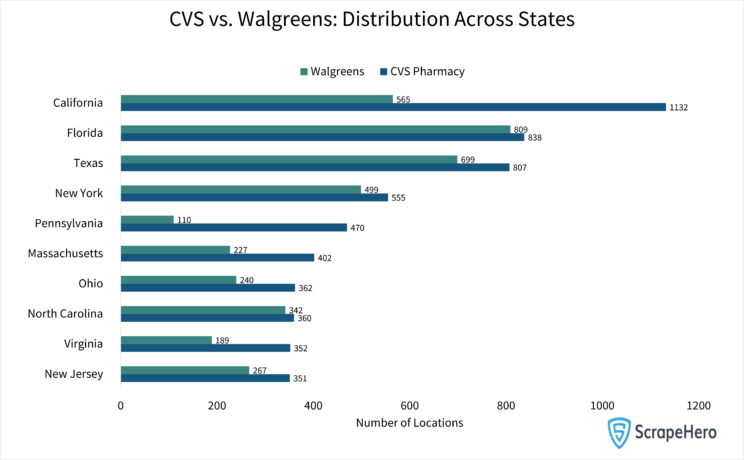

The landscape of retail health clinics in the U.S. would be incomplete without discussing CVS and Walgreens. A close look at state distributions reveals that both chains have strategically located their stores. For instance, CVS has 1132 locations in California alone, while Walgreens maintains only 565 stores in the same location. The widespread distribution of CVS and Walgreens makes them integral retail health clinic providers in the US, especially for basic care and prescription needs.

Conclusion

Understanding the landscape of retail health clinic in the US is imperative for anyone involved in the healthcare sector, be it a consumer, a current provider, or an aspiring entrepreneur. By dissecting regional disparities, assessing patient traffic, and analyzing dominant retail health clinic location providers, stakeholders can make data-driven decisions to better serve American healthcare needs.

Understand the landscape of retail health clinic locations in the US with ScrapeHero’s datasets.

Frequently Asked Questions

- How big is the retail clinic market in the US?

The market for retail health clinic locations in the US has shown remarkable growth in recent years. As to projections, the market size for retail health clinics is expected to reach approximately 6847 million USD by 2025. This expansion has fueled interest among entrepreneurs in how to open retail health clinics in different regions. - What are the top retail health companies?

In terms of retail health clinic location providers, Walgreens and CVS Pharmacy are the leading players in the United States. According to available data, CVS Pharmacy leads with around 9,537 retail health clinic locations, closely followed by Walgreens, which has approximately 8,697 locations as of 2023. - What is an example of retail healthcare?

Retail healthcare refers to walk-in clinics often located within larger retail stores or shopping centers. These retail health clinic locations offer basic medical care, including vaccinations, minor injury treatment, and routine health check-ups. They serve as an increasingly vital alternative to traditional healthcare settings and contribute to the number of retail health clinic locations in the US. CVS Pharmacy, Walmart, and Walgreens are some of the leading retail healthcare clinics in the US.