For most Americans, healthcare is a top personal and financial priority. Yet drug costs in the US are among the highest in the world. Prescription discount services such as GoodRx and Blink Health may offer relief as these are digital platforms that help users obtain lower rates on medications.

In this article, we looked into the locations of one of the biggest prescription discount services – GoodRx and Blink Health. Several other factors such as population, associated retail chains, and available services were considered.

Insights in Brief You can download all GoodRx and Blink Health locations data from our data store

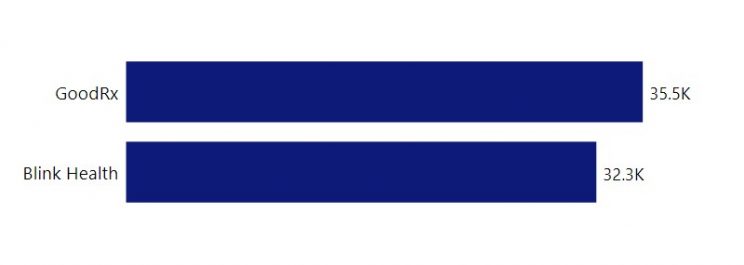

Number of Stores – GoodRx and Blink Health

We analyzed over 67,000 stores that have GoodRx and Blink Health services available. GoodRx has a slightly larger footprint with the service available in 35.5K stores compared to Blink Health, which is present in 32.2K stores.

These prescription services are available in a wide variety of stores such as supermarkets, grocery stores, health clinics, and more.

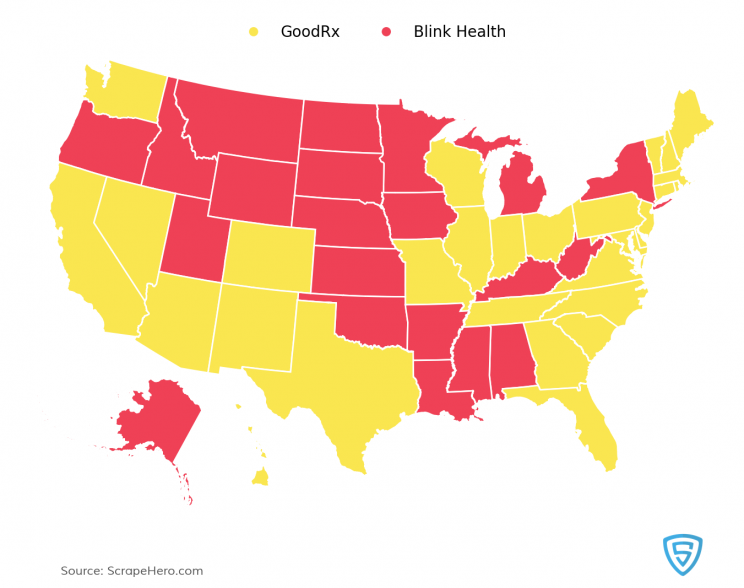

GoodRx and Blink Health: Most Stores per State

The map above shows the reigning prescription service in each state. GoodRx dominates in 29 states. Most of which are along the east coast and southwest regions trailing from California to Texas. Blink Health outnumbers in 21 states, of which more than half the states are in the central regions.

Which counties have the most stores per capita?

More than 45% of stores under GoodRx are located in counties where the per capita income ranges from $20K to $30K. While over 40% of stores that have Blink Health services are located in regions where the per capita income ranges between $25K to $35K. A few counties that had a high per capita income (above $60K) and a fairly high number of stores were – New York County in New York (480) and Montgomery County in Maryland (852).

The charts below show the per capita income (county) by the number of stores with both discount services respectively.

GoodRx has more stores in highly populated counties and tends to be concentrated in several urban cities. A store with GoodRx available caters to around 20K-30K people. On the other hand, an individual store with Blink Health is available to 25-35K people and its locations are more ubiquitous.

Top Retail Chains Associated with GoodRx and Blink Health

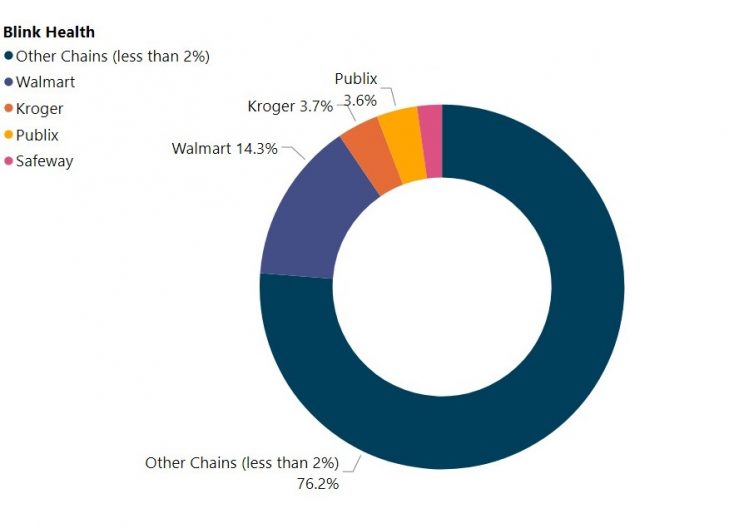

Retail Chains under Blink Health

Blink Health is available in 32,216 stores nationwide. These stores are clinics, pharmacies, supermarkets, urgent cares, and small-scale businesses. We found over 10,000 individual chains that were available under Blink Health.

The chart below shows the percentage of major retail chains that make up Blink Health.

The largest retail chains that provide the prescription discount service are Walmart – (14.3%), Kroger (3.7%), Publix (3.6%), and Safeway (2.2%). These chains together make up more than 23% of total stores.

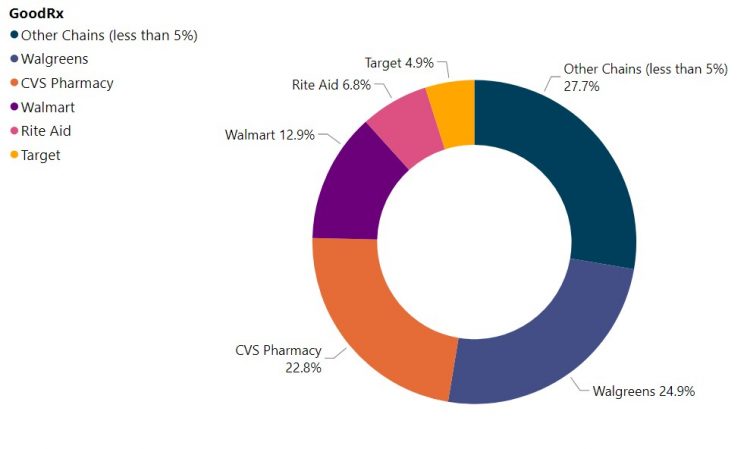

Retail Chains under GoodRx

GoodRx has a slightly larger store count than Blink Health with 35,505 stores. The discount provider is in a total of 78 retail chains.

The chart below shows the percentage of major retail chains that make up Blink Health.

More than 70% of stores come from major chains such as Walgreens (24.9%), CVS Pharmacy (22.8%), Walmart (12.9%), Rite Aid (6.8%), and Target stores (4.9%).

Other main retail stores and regional grocery chains which have GoodRx available at more than 90% of their locations are – RiteAid, Meijer, Safeway, Costco, Sams Club, Hy-Vee, and Albertsons.

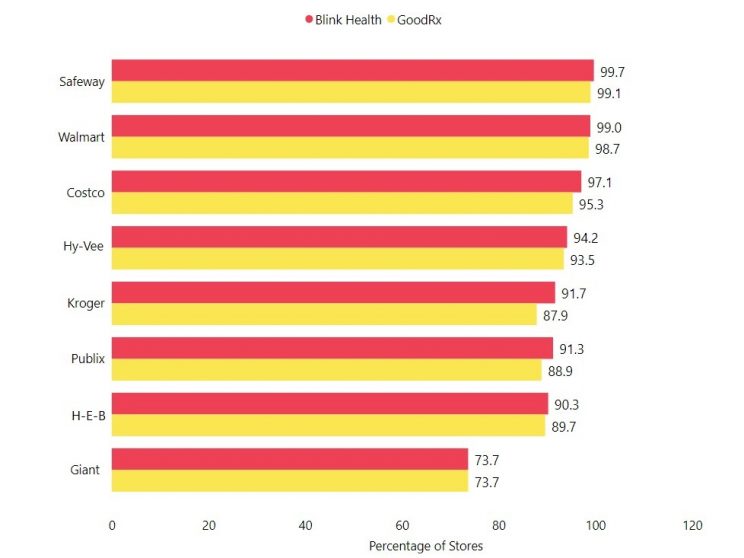

Common Retail Chains under GoodRx and Blink Health

The chart below shows the percentage of top chains that are available under both the prescription services.

With most major chains there isn’t a significant partiality between the two services, there is only a difference of 1-4%.

The dashboard below shows where GoodRx and Blink Health discount services are available along with associated retail chains.

Benefits of Prescription Discount Services

Discount prescription services and cards are an impactful part of a complex and nuanced healthcare landscape. These services are doing well in the healthcare market during the Covid-19 pandemic because it caters to those who are not insured and looking to care for themselves at home.

But they may face competition and politics from other players as well. The eCommerce giant Amazon has started its own online pharmacy and has plans to open pharmacies at Whole Food Market stores. Other major pharmacy retailers like CVS and Walgreens might see an effect on its market share.

The ScrapeHero Data Store tracks store closures and openings, that focuses on supermarket stores, discount stores, department stores, hospitality, and more. You can subscribe to our store data plans and get datasets with data points such as store openings, store closures, parking availability, services, subsidiaries, and much more.

We can help with your data or automation needs

Turn the Internet into meaningful, structured and usable data