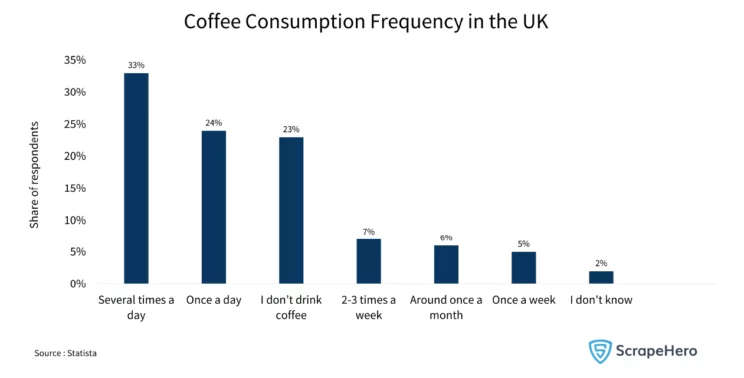

Previously considered to be a traditional tea-drinking country, the UK has emerged in recent years as one of Europe’s top coffee-drinking nations. Understanding the market positioning and locations of the leading coffee shop chains in the UK can offer valuable insights for various stakeholders, especially since the UK is the largest branded coffee shop market in Europe.

This report aims to dissect the geographical footprint and customer preferences surrounding three major players: Costa Coffee, Greggs, and Starbucks. We’ll focus on a comprehensive location analysis that encompasses the entire United Kingdom, including England, Wales, and Scotland. Within these regions, we will also drill down to specific cities.

Armed with rigorous data and keen analysis, this report will serve as an authoritative guide to the dynamics shaping the coffee chains in the UK, providing actionable insights for businesses.

Leading Coffee Shop Chains in the UK

In the following section, we delve into a comprehensive examination of the leading coffee shop chains in the UK, focusing on their overall geographical spread and market penetration. This section is designed to give an overarching view of how Costa Coffee, Greggs, and Starbucks have distributed their locations across the UK.

Subsections will break down this analysis further, spotlighting the distribution of these coffee chains in England, Wales, and Scotland individually. Additionally, we will highlight cities where these brands have concentrated their presence most heavily.

Distribution of the Leading Coffee Shop Chains in the UK

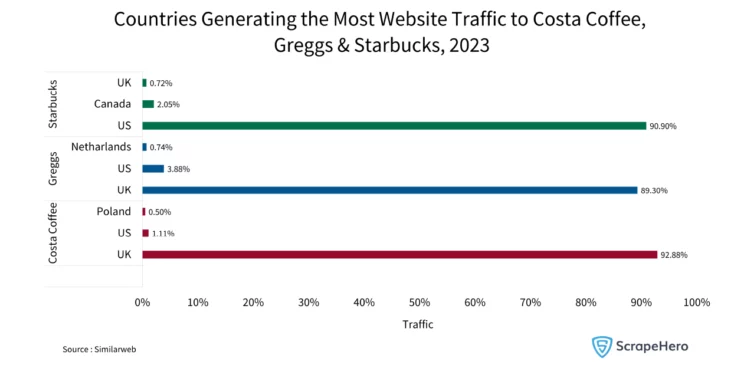

As we move to uncover the intricacies of the coffee shop landscape in the UK, one of the most illuminating metrics is the distribution of store locations. The accompanying map visually lays out the breadth and density of outlets for Costa Coffee, Greggs, and Starbucks.

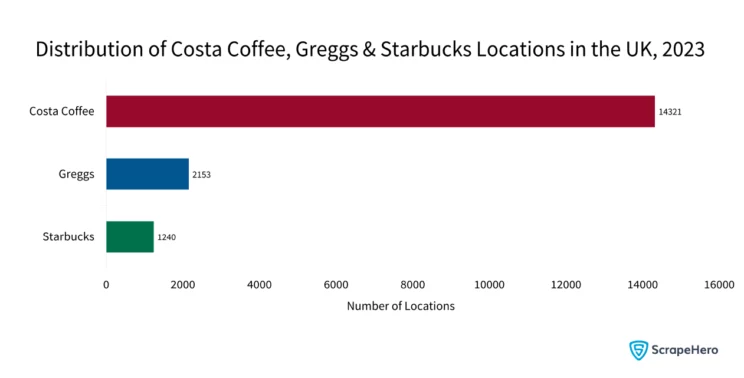

When comparing these three brands in the UK, it’s evident that Costa Coffee leads the pack with a staggering 14,321 outlets. This is a significant figure that sets it apart as the dominant force among coffee chains in the UK. In second place, we find Greggs with 2,153 outlets, followed by Starbucks, which has established 1,240 locations.

This data reveals a clear hierarchy among these coffee giants, and it offers a snapshot of consumer preferences as well as market strategies. By grasping the distribution patterns of these leading coffee shops in the UK, stakeholders can better understand market saturation, consumer choice, and regional dynamics, thus enabling more informed business decisions.

Costa Coffee, Greggs & Starbucks Across the UK

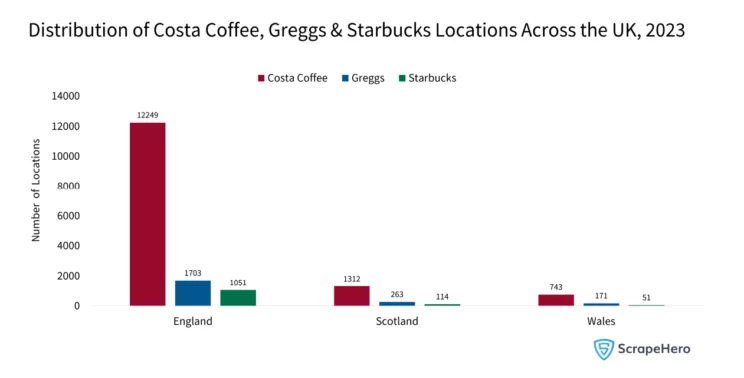

To fully grasp the scale and influence of the leading coffee shop chains in the UK, one must look at their geographical spread across individual nations within the UK: England, Scotland, and Wales. The following map illustrates this distribution, providing a visual account of each brand’s stronghold in these regions.

Costa Coffee emerges as the leader in all three nations—England, Scotland, and Wales. This not only cements its position as the predominant force among coffee chains in the UK but also suggests a well-executed, cohesive strategy that caters to diverse markets within the United Kingdom. Greggs occupies second place across these nations, demonstrating a solid footprint that extends beyond just coffee chains in England. Starbucks trails in third place, maintaining a consistent, albeit smaller, presence across these regions.

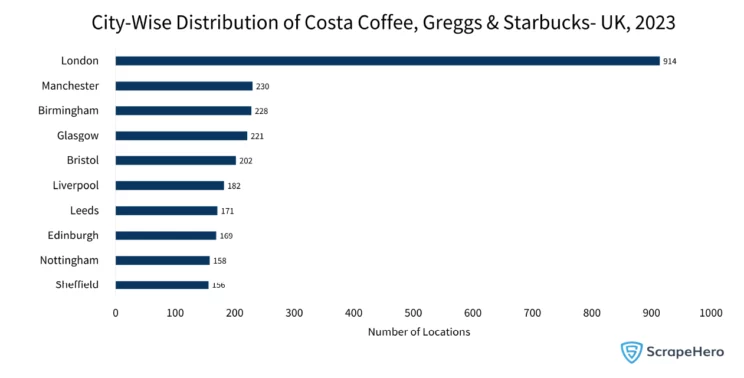

City-Wise Distribution of the Coffee Chains in the UK

After examining the national landscape, the next logical step is to drill down into the city-level distribution of the leading coffee shop chains in the UK. This fine-grained focus helps us to discern patterns at a more local scale, offering a granular view of how Costa Coffee, Greggs, and Starbucks have established themselves in various urban centers. The accompanying map breaks down these details, making it easier to understand the geographical nuances at play.

London stands out as the epicenter for all three chains, boasting a total of 914 outlets for Costa Coffee, Greggs, and Starbucks combined. This data not only underlines London’s role as a vital market for coffee chains in the UK but also suggests that the level of competition in the capital is exceptionally high. Trailing behind London are Manchester and Birmingham, each with substantial numbers—230 and 228 outlets respectively—though significantly fewer than London.

London, the Epicenter of Leading Coffee Shop Chains in the UK

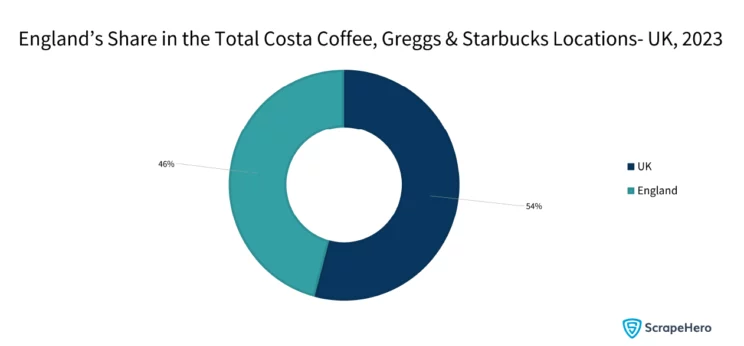

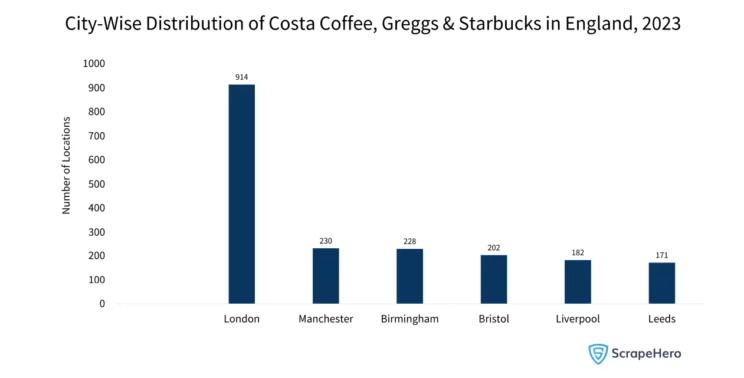

In any discussion about coffee chains in the UK, one cannot overlook the outsized role played by England and, more specifically, its capital city, London. This section focuses on the central importance of London in the distribution and market share of Costa Coffee, Greggs, and Starbucks. Remarkably, England is home to approximately 48% of the total locations of these three leading coffee shop chains in the UK, underscoring its dominance in the market.

City-Wise Distribution of the Three Coffee Chains in England

Within the scope of England’s significant contribution to the leading coffee shop chains in the UK, London emerges as a focal point of this dominance. Data indicates that the city is not merely a bustling capital but also a stronghold for Costa Coffee, Starbucks, and Greggs.

London alone accounts for an impressive proportion (914 outlets) of the total outlets of these three chains in England. This concentration reflects not just market penetration but also a heightened consumer demand.

Distribution of Costa Coffee, Greggs, and Starbucks in London

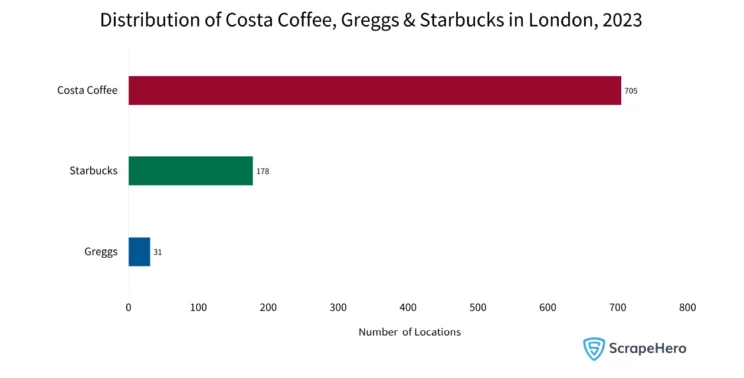

Among the leading coffee shop chains in the UK, Costa Coffee, Starbucks, and Greggs display varying degrees of presence in London’s market.

With a staggering 705 locations scattered across London, Costa Coffee has effectively saturated the local market. Starbucks, a brand with global recognition, maintains a relatively lower but still considerable footprint in London. The chain has established 178 locations, serving not just coffee but an array of beverages and snacks. Greggs has a modest presence with 31 outlets in London.

Closing Thoughts: Deciphering the UK Coffee Market Landscape

The analysis of the leading coffee shop chains in the UK presents a compelling picture of market dynamics, consumer preferences, and regional variations. Costa Coffee, Greggs, and Starbucks each offer a distinct yet valuable lens to interpret the intricacies of the coffee chains in England and beyond.

As stakeholders look to navigate this complex market, having an analytical edge is crucial. Grasping the distribution patterns of the leading coffee shops in the UK enables a more nuanced understanding of market saturation, consumer choice, and regional dynamics. This information is critical for shaping effective business strategies and making informed decisions.

For those seeking data-driven insights, the ScrapeHero Data Store offers an invaluable resource for comprehensive data on not just coffee shop locations, but a range of sectors, contributing a level of granularity and depth to market analyses. If you would like to monitor data on a large scale, ScrapeHero is a reliable web scraping service provider that can gather data on your own schedule.

Frequently Asked Questions (FAQ)

-

What is the biggest coffee chain in the UK?

The biggest coffee chain in the UK, in terms of the number of outlets, is Costa Coffee. With an overwhelming 14,321 locations spread across England, Scotland, and Wales, Costa Coffee stands as the dominant force in the market. It is an essential player among the leading coffee shop chains in the UK, displaying an expansive geographical footprint unparalleled by its competitors.

-

What is the most popular coffee shop chain in the UK?

The popularity of a coffee shop chain can be measured in various ways, including customer loyalty, brand recognition, and market share. However, if one were to consider the number of outlets as an indicator of popularity, then Costa Coffee would claim that title as well. Its ubiquitous presence across the leading coffee shop chains in the UK signifies a high level of consumer engagement and preference.

-

What is the leading coffee brand in the UK?

Based on the available data, Costa Coffee emerges as the leading coffee brand in the United Kingdom. With the highest number of outlets and a strong presence in all regions—England, Scotland, and Wales—Costa Coffee has effectively positioned itself as the market leader among coffee chains in the UK. Its comprehensive strategy and extensive reach make it a key reference point for understanding the dynamics of the coffee market in the United Kingdom.

-

Who are the largest coffee retailers in the UK?

The largest coffee retailers in the UK, based on the number of physical outlets, are Costa Coffee, Greggs, and Starbucks. According to our data, Costa Coffee leads with an imposing 14,321 locations, making it not just the largest but also one of the most influential among the leading coffee shop chains in the UK. Greggs follows in the second position with 2,153 outlets, offering a variety of coffee options in addition to its well-known baked goods. Starbucks rounds out the top three with 1,240 locations, maintaining a substantial though lesser footprint compared to its competitors.