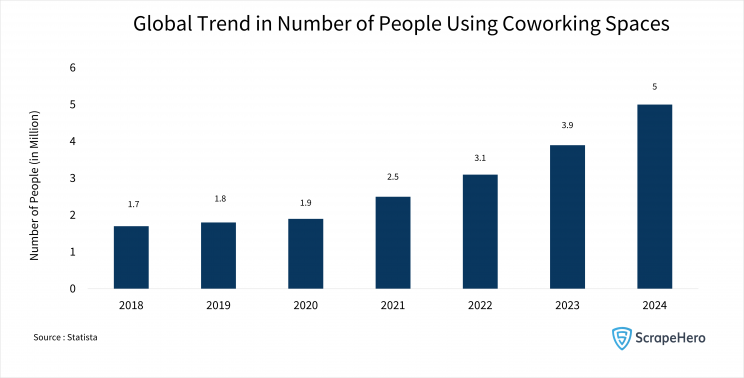

Coworking spaces are no longer a trend, they are now mainstream. It is estimated that nearly 5 million people will be working from these spaces by 2024, almost doubling between 2021 and 2024. As more and more companies turn to remote working, the boom of coworking spaces is a natural consequence.

This blog is a glimpse into the coworking space business worldwide, its growth, expansion, major players in the field, and where the industry is headed. But before that,

What is a Coworking Space?

A coworking space is an arrangement where people who work for different companies and enterprises share an office space. This workspace is typically hired from a third party on a short-term, monthly basis, with the third party providing most of the office infrastructure.

Coworking spaces are particularly popular among work-from-home people who might not have an actual office space to go to but would like to enjoy the benefits of being in one. It is also preferred by smaller companies that cannot afford the cost of setting up a private office.

Are Coworking Spaces Profitable?

Flexibility with regard to location and cost-effectiveness makes remote work spaces a popular option among employers, employees, and other working populations.

From the graph above, it can be seen that there has been a significant increase in the number of people relying on coworking spaces from 2018 to 2023. This growth trend predicts an estimated 5 million relying on remote work spaces by 2024.

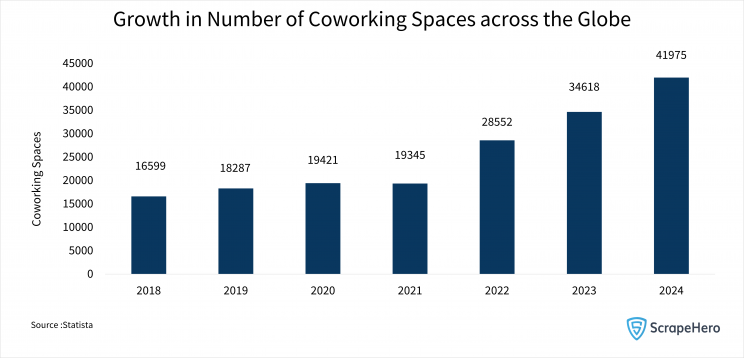

The increased demand and growth prediction have only pushed the coworking space business to expand further. The demand for remote work spaces comes mainly from large organizations and enterprises looking to decentralize their workforce. The graph below shows the growth of coworking spaces across the globe. By 2024, the number of coworking spaces globally is predicted to reach 42,000.

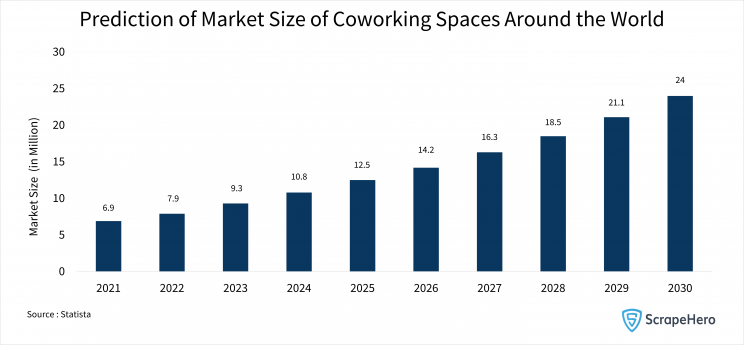

In the long run, all offices will potentially turn into flexible, on-demand spaces. The potential for coworking space business to grow and evolve has never been higher. The graph below shows that the market size is expected to reach 24 million by 2030.

The future seems to belong to coworking spaces. Coworking has grown steadily and attracted much attention since its inception. It is now a multibillion-dollar worldwide market that can support both large chains and independent, single locations.

The ability to adapt, foresee market needs, and align strategies with coworking evolution also leads to promising growth avenues for related businesses. Using point-of-interest (POI) datasets, and location intelligence, businesses draw insights into factors like consumer behavior, catchment area, locality patterns, etc., and make informed decisions to increase their profits. This most often leads to the overall development of the area.

Who Uses Remote Work Spaces the Most?

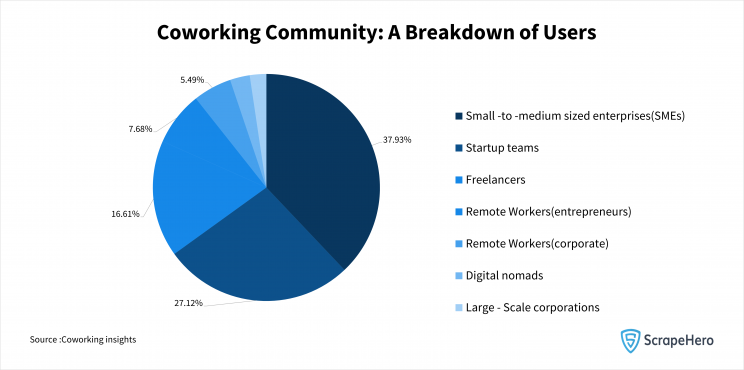

Though coworking spaces were popularized by location-independent freelancers, it is now a preferred choice for a larger and more diverse group of people, including small-scale businesses and start-ups. Digital nomads and remote workers, who once made up the lion’s share of the people using coworking spaces, now hold only a small percentage.

The graph reveals that the most common demographics of people who use coworking spaces are members of small companies and start-up teams. This indicates a newer shift in the coworking space business to accommodate the needs of organizations with 50-100 members.

Coworking spaces not only benefit their users: but the respective nearby areas also benefit from the presence of a remote work space, as it brings vitality to the neighborhood and increases spending at local businesses.

How Does the US Perform in the Coworking Space Business?

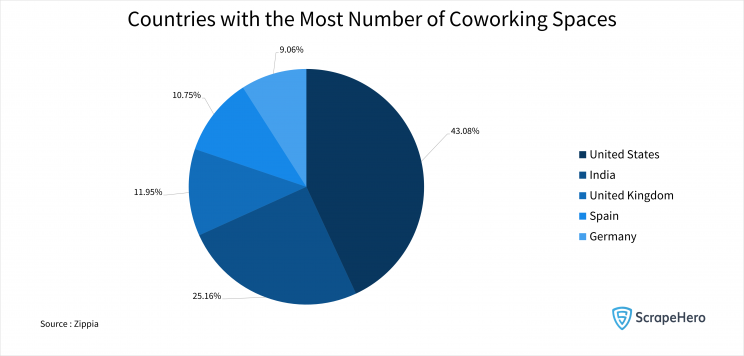

The US leads the coworking space business market regarding real estate (square feet). The country also has the most number of coworking spaces, making up 43%. It is then followed by India and the United Kingdom.

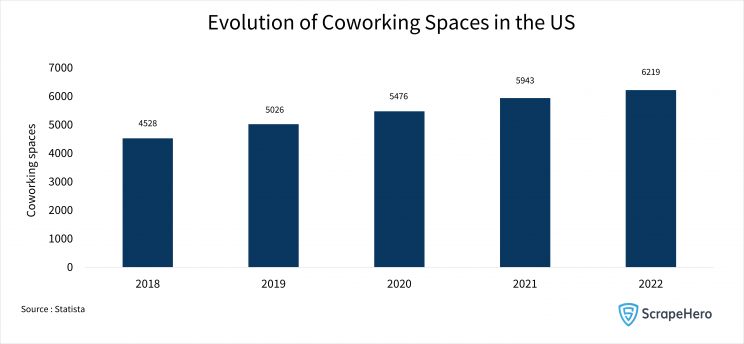

The US currently ranks as a hotspot of remote work spaces and is leading this workplace evolution with some of the best coworking spaces. The graph below shows the growth in shared office spaces in the country from 2018 to 2022.

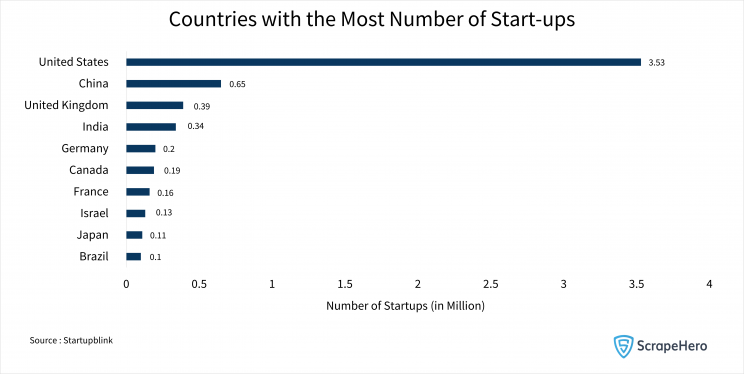

As seen from a graph above, the coworking space business is majorly determined by the increase in the number of start-ups globally. The US leads globally regarding the number of start-ups, with approximately 3.53 million. Undoubtedly, it translates to an increased demand for coworking spaces in the country.

Top Coworking Spaces in the US

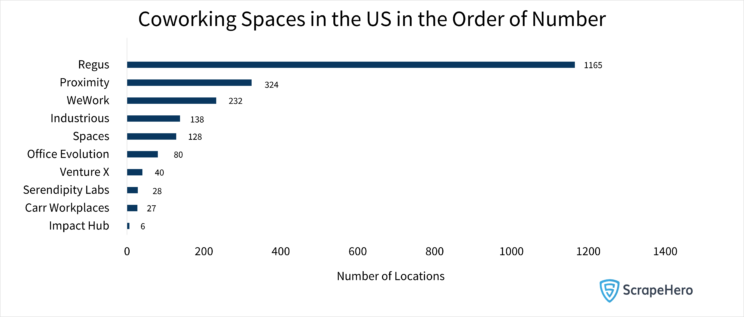

The US is home to some of the best coworking spaces in the world. Based on the number of locations, the following are the top coworking spaces in the US:

Coworking space business players use POI data to better understand the market and growth perspectives to stay relevant in the market. This helps them make better decisions, connect with customers, and plan expansion strategies. This trend is generally followed by other businesses that also benefit from coworking space business.

A Comparative Analysis of Two of the Best Coworking Spaces in the US: Regus vs. WeWork

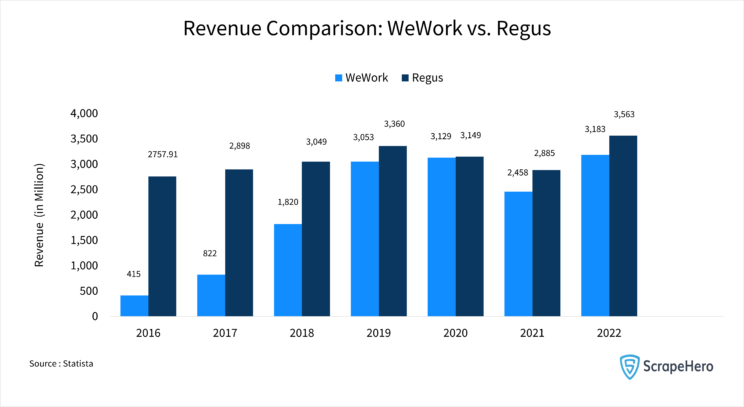

Regus was started in 1989 by Mark Dixon to provide business owners with affordable office spaces. On the other hand, WeWork emerged 24 years later in 2010. Though Regus had a headstart of over two decades, both hold a respectable position in the coworking space business in the US with respect to the revenue they yield.

Annual Revenue

Even though Regus was launched way earlier than WeWork and has the highest number of locations in the US, WeWork offers good competition to Regus in terms of its revenue. Till 2018, the gap in revenue between these two coworking space business players was significant, but from 2019 to 2022, the gap has become negligible.

Both Regus and WeWork saw a dip in their revenue in 2021. But both picked up momentum the year after.

Location

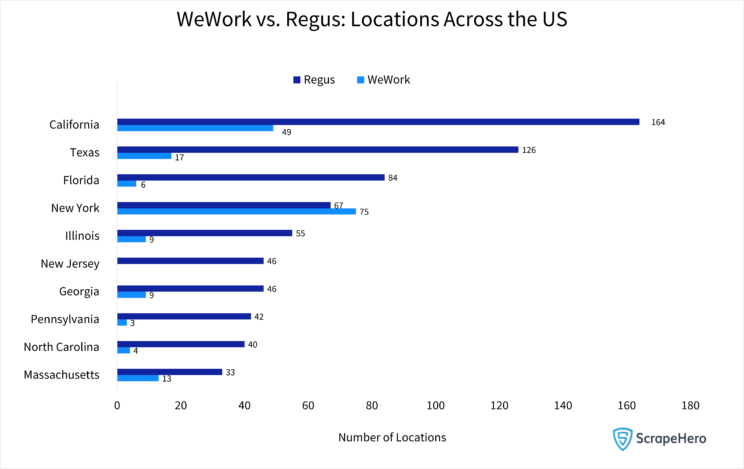

Regus and WeWork have a presence across different locations. They buy and lease out properties at different prime locations. Over the past three decades, Regus has expanded to about 3,500 locations in 120 countries. Even though WeWork is less than a decade old, it has remote work spaces in more than 650 locations in 37 countries.

It can be understood from the graph that Regus has more coworking locations than WeWork, in the US. Location-wise, it is more popular than WeWork in most states of the US.

Compare WeWork coworking space locations with Regus dealer locations in the US for a better picture.

Social Branding

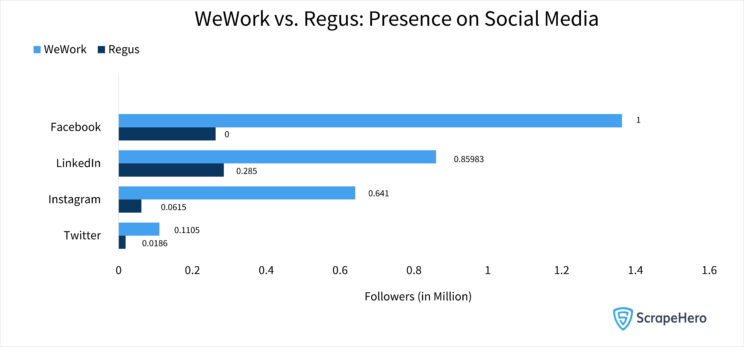

WeWork is more prevalent among its audience than its competitors, despite fewer locations. Of all the platforms, WeWork has more followers on Facebook. The company actively uses social media marketing strategies to engage with its target consumer base.

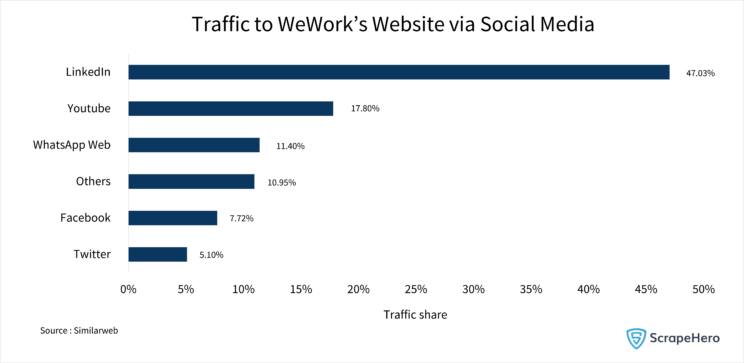

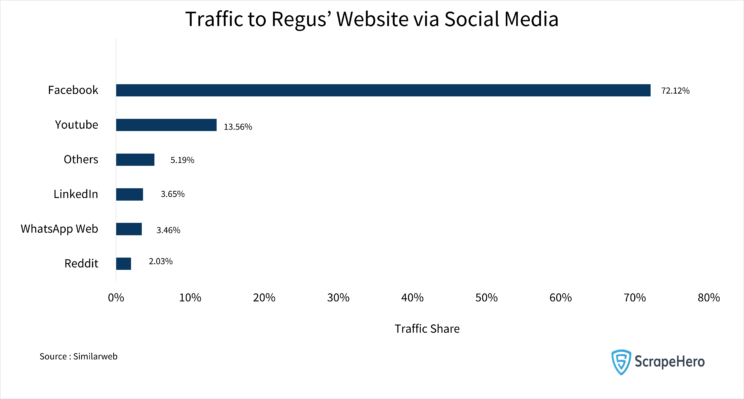

Regus and WeWork use social media branding to drive website traffic. Amongst the social media channels, LinkedIn drives the majority (47.03%) of WeWork’s website traffic. Whereas Facebook accounts for most visitors (72.12%) on Regus’ official website.

Regus vs. WeWork

From its humble beginnings in 2010, WeWork rose to become one of the biggest coworking companies today. It caters to over half a million members, a huge contrast to the numbers in 2010. The company crossed the half-million mark in 2019 before the pandemic hit.

WeWork looks at coworking spaces differently. While Regus follows a utilitarian approach in its business, WeWork aims to build a community-based ecosystem that functions as a collective.

WeWork’s coworking spaces are not restricted to including the tools of the trade. The company also aims to create experiences that bring its tenants together. They offer collaborative programs like lunch-and-learns and community-building perks like yoga, coffee bars, etc. These efforts have significantly contributed to the spike in the company’s user base.

The Future of Coworking Spaces

The dramatic rise of WeWork and other coworking spaces can be attributed to the confluence of two trends in the workplace: remote work possibilities and a rise in small businesses that prefer not to spend on office infrastructure. Studies show that just under half of all coworking spaces are profitable. As the world adapts to the new work standards, the numbers are set to rise in the years to come.

As more number of people and employers are choosing coworking spaces to get their work done, the profit-making potential of related businesses is now greater than ever. Download the strategic location dataset of coworking spaces in the US to stay ahead of the curve.

We can help with your data or automation needs

Turn the Internet into meaningful, structured and usable data