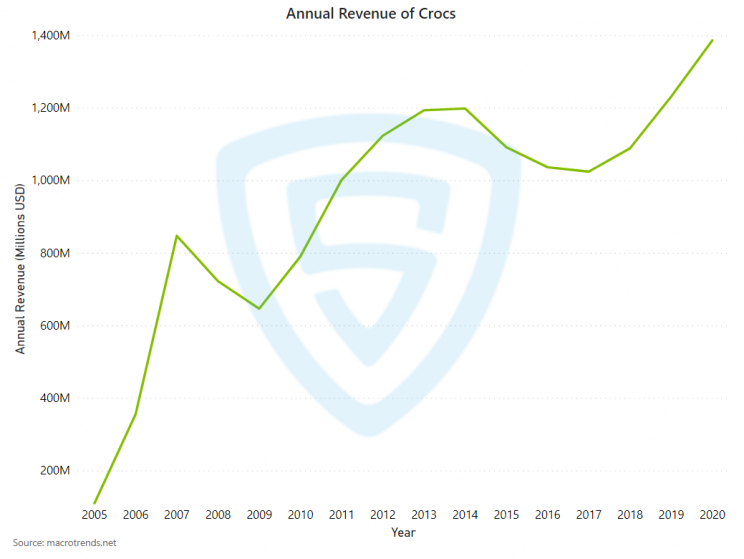

Did you know that Crocs CROX 106.7 (-0.4%) made their highest revenue during the pandemic?

Yes, the company reached the $1.4 Billion mark when many other brands across the world were facing huge losses. It was just in 2008 that Crocs announced a loss of $185MM that resulted in approximately 2000 job cuts and dozens of retail store location closings across the world.

As seen in the graph above, Crocs’ annual revenue started picking up gradually from 2017 before it peaked ($1400MM) in 2020. So, what changed during the pandemic? Here’s an analysis of the brand’s performance.

Instantly download Crocs’ retail store location data and more from our Data Store.Key Insights:

Demand for Crocs Is Now Higher Than Ever

Crocs, a world leader in innovative casual footwear, offers several distinct shoe collections. The collections include over 700 4-season casual footwear styles. Be it for comfort or customization, Crocs became the ‘go-to’ shoe choice for many people, especially in 2020. The brand’s sales soared in the fashion comeback, and it shows no signs of slowing down.

As part of this analysis, we have taken a closer look at Crocs’ revenue, locations, sales, and other crucial factors.

Revenue

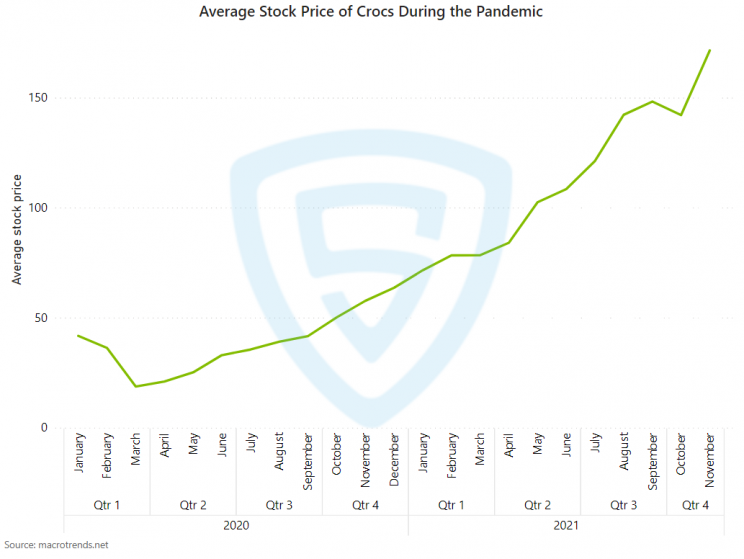

Crocs reported record sales of $640MM in the three months to 30 June 2021 – nearly double the same period last year. The company’s projected revenue for 2021 is expected to rise by as much as 65% due to the strong consumer demand. In the graph below, we can see a dramatic spike in Crocs’ quarterly revenue from about 280 million USD in Q1 2020 to about 630 million USD in Q2 2021.

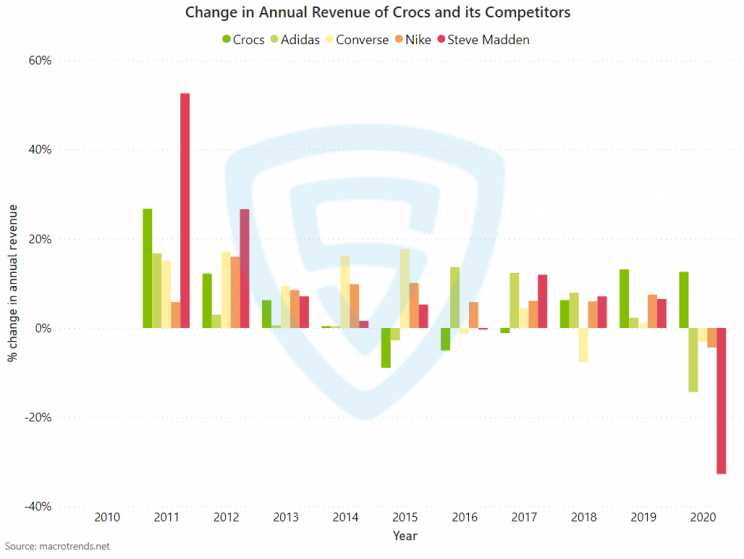

In terms of revenue earned, Crocs was way ahead of its competitors in 2020. You can see how its competitors faced a 5%-30% decline while Crocs enjoyed approximately 15% positive change in revenue.

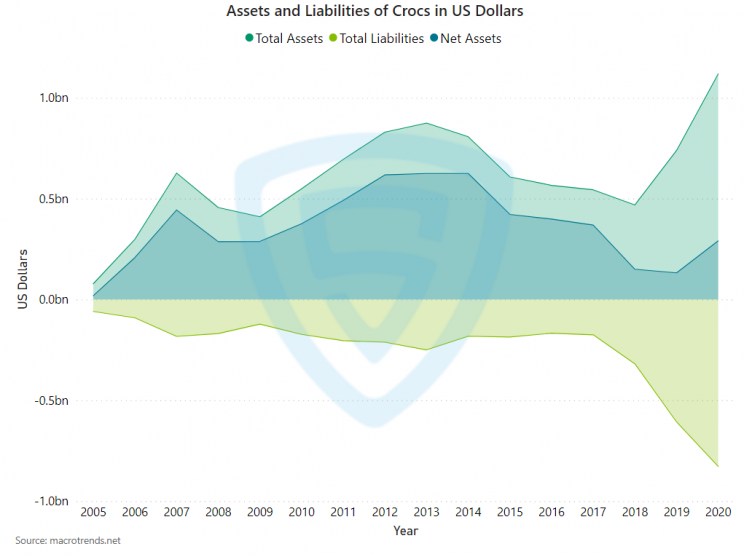

Assets

Although Crocs’ assets saw a steep downtrend from 2014-19, they returned with an increase of 120% in 2020. This, along with its quarterly earnings, positive business developments, and high consumer demand, has been crucial to enhancing its stock prospects.

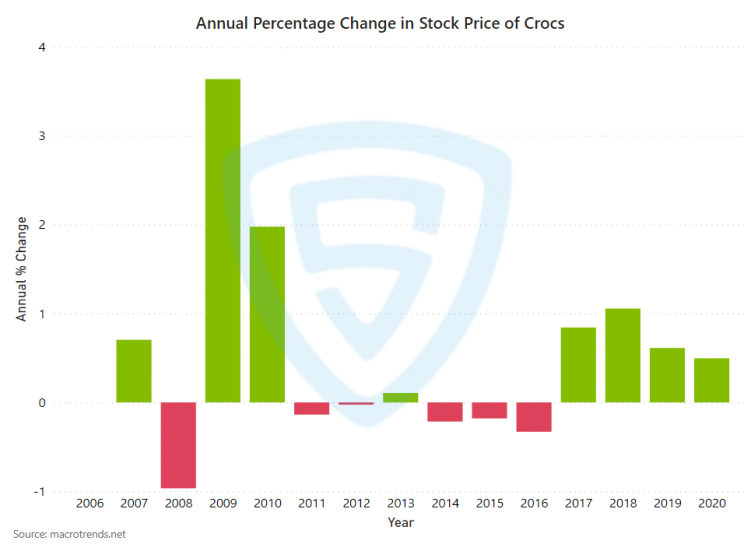

Stock prices

It is worth noting that the jump in assets has driven Crocs to achieve record-high sales and stock prices. A deeper look into the annual percentage change in Crocs’ stock prices reveals that the brand last witnessed a dip in the prices in 2016.

The prices have never come down since 2017, even amidst the pandemic, thanks to the exceptional consumer demand. In fact, the current stock price of Crocs is at 171.46, which is nearly 4 times the price at the beginning of 2020.

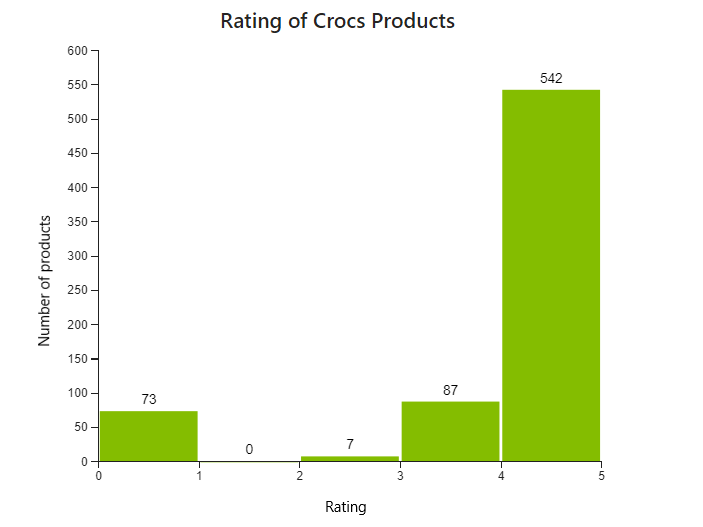

Wide Range of Products and Impressive Ratings

From athletic shoes to colorful and casual slip-ons, Crocs sells 709 products (including both Footwear and Jibbitz) on its website. But what’s more impressive is that 542 out of 709 products are rated 4/5.

How Did Crocs Make It Happen?

Crocs owes its remarkable success to three major factors:

- Enhanced focus on key product pillars

- Effective digital marketing strategies

- Efficient distribution network with an omnichannel presence

You may also find this interesting: Mapping Peloton’s Story: What Happened and Why?

Optimized Omnichannel Shopping Experience

Crocs ensured that it offered a consistent customer experience across e-commerce, retail and wholesale channels. The company used techniques like assortment localization, supply chain responsiveness, inventory distribution, in-store traffic counts, merchandise analytics, and much more to understand consumer preferences.

Crocs enforced the omnichannel experience by coupling the above with their loyalty programs, exclusive discounts, and other online programs. Naturally, these clever strategies bolstered their brand image, boosted revenue, and enhanced their reputation as a consumer-first brand.

Notably, Crocs’ e-commerce share rose to 25.9% in 2020 because of the lockdown. However, offline experience is said to be the king in the footwear industry. Footwear shoppers increasingly tend to prefer the touch-and-feel experience in an offline store compared to the click-and-buy online experience. Here’s how Crocs rightly capitalized on this:

Physical (Brick and Mortar) Locations and Sales

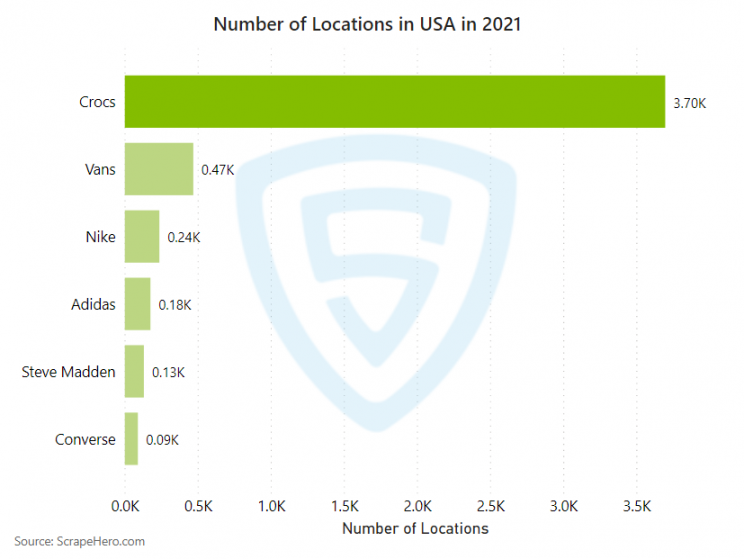

Compared to its competitors, Crocs has the highest number of physical retail store locations across the USA – a total of 3700. You can see from the graph that none of its competitors even come close to Crocs in terms of physical retail store locations and outlets. Vans comes second with a total of 0.47K stores in the United States.

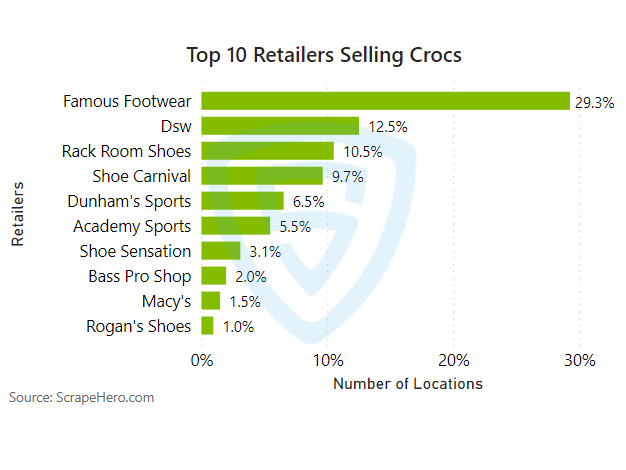

To establish and maintain its brand positioning, Crocs has tied up with several retail partners, including Famous Footwear (29.3%), DSW(12.5%), and others in the United States. Until 2020, nearly 96% of Crocs’ retail store locations were retail outlets.

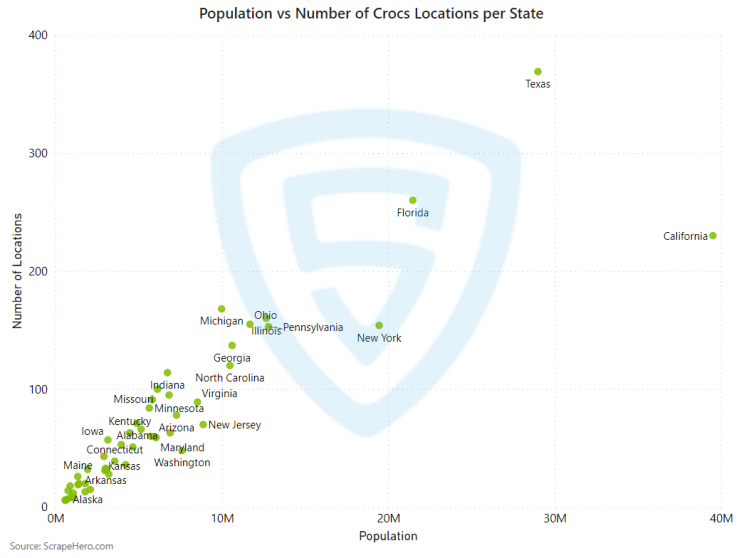

In addition, Crocs employed a clever offline store location strategy. We plotted the graph between the population of each state and the number of Crocs locations. Interestingly, we observed a linear relationship between them, i.e., the higher the population, the higher the number of Crocs locations.

With a nearly 30MM population, Texas has about 350 Crocs locations, while New York, with a 20MM population, only has 170 locations.

Strategic Pricing and Customized Product Offerings

Crocs acquired Jibbitz in 2006 and began offering customizable, decorative add-ons to footwear. The company paid utmost attention to the voice of their customers. This helped the company outranked its competitors as a customer-centric brand in no time!

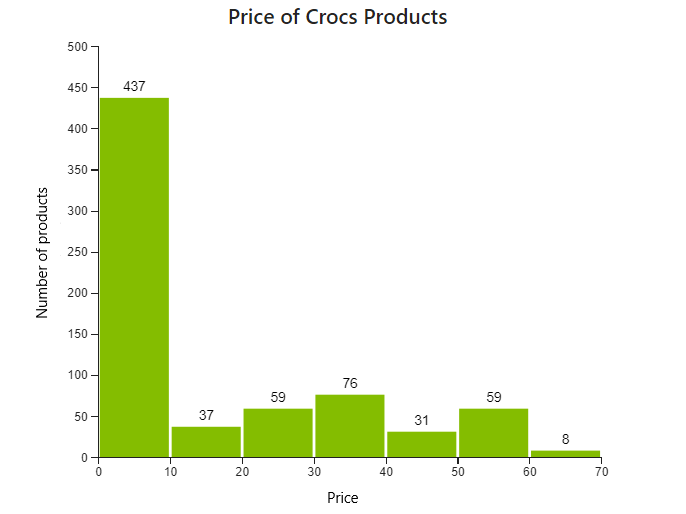

Moreover, Crocs stands true to its motto of offering everyone ‘Accessible, affordable and comfortable’ shoes. Sturdy quality, ease of customization, and unparalleled comfort have majorly contributed to the success of their footwear collection. What’s more? The prices of most of these footwear choices (437/709) are below $10.

Digital Presence

Crocs raced ahead of its competitors owing to multiple reasons. Their clever digital marketing strategy was one of them. Crocs appealed to Gen-Z via their social media channels. From capitalizing on trends to collaborating with celebrity influencers, the retail giant has done it all. The company’s digital savviness has consolidated its efforts in connecting with them.

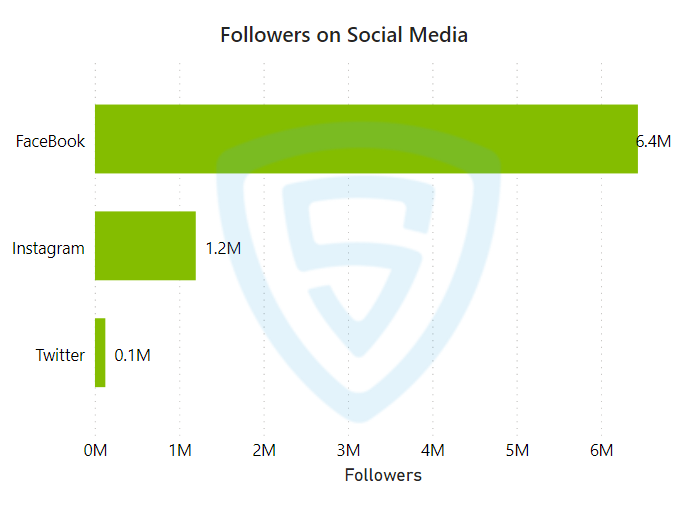

It garnered nearly 7.7M followers across social media platforms like Facebook, Twitter, and Instagram.

Entering a New Era of Retailing

The global footwear market is projected to reach $440 billion by 2026. The post-pandemic world is bracing up for offline markets again to enhance store shopping experiences. That said, retail store location data analysis can provide a strategic upper hand over competitors during this time. You can easily download ready-to-use retail store location datasets from the ScrapeHero Data Store. Our data store provides weekly updated data on millions of POIs across multiple countries and thousands of brands.

In case you need any custom datasets or data enrichments, fill out the form below, and our team will contact you at the earliest.

Turn the Internet into meaningful, structured and usable data

We can help with your data or automation needs