This US Pizza Chain Analysis looks at the presence, key players, and trends of major pizza chains in the US. It covers service trends, market sales, and online visibility.

We will explore statistics to provide an overview of the current pizza chain landscape.

NB: The POI data for this analysis was downloaded from the ScrapeHero DataStore.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

How Extensive is the Pizza Chain Presence Across the US?

The US is home to a significant number of pizza chain locations.

We have identified a total of 33,711 locations of major pizza chains for this analysis. It includes prominent names like Hunt Brothers Pizza, Domino’s, Pizza Hut, and Little Caesars.

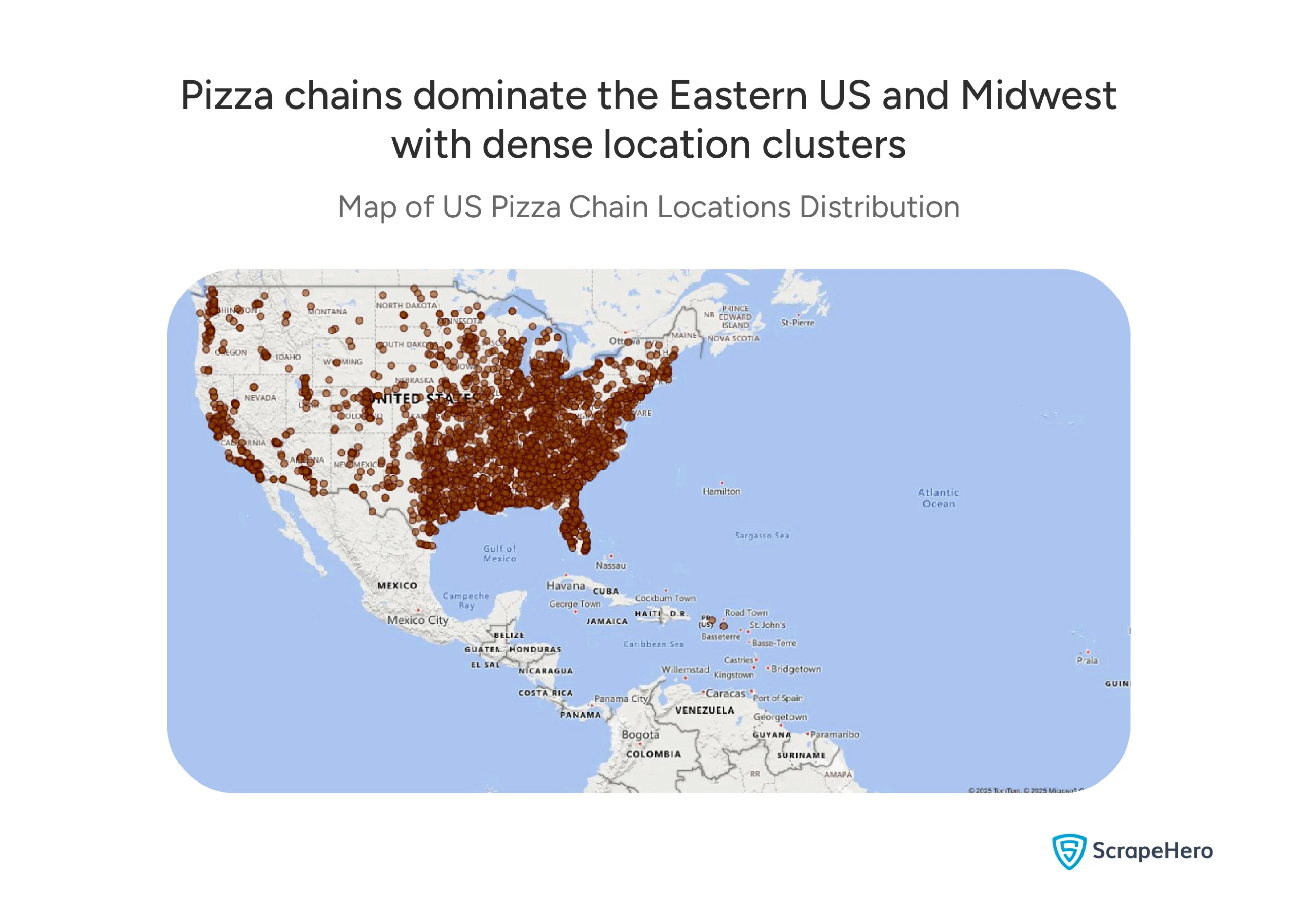

The visual representation of these locations on a map demonstrates a dense concentration of pizza chains, particularly in the eastern half of the country, the Midwest, and along the West Coast.

Notable gaps appear in the mountain states and northern plains.

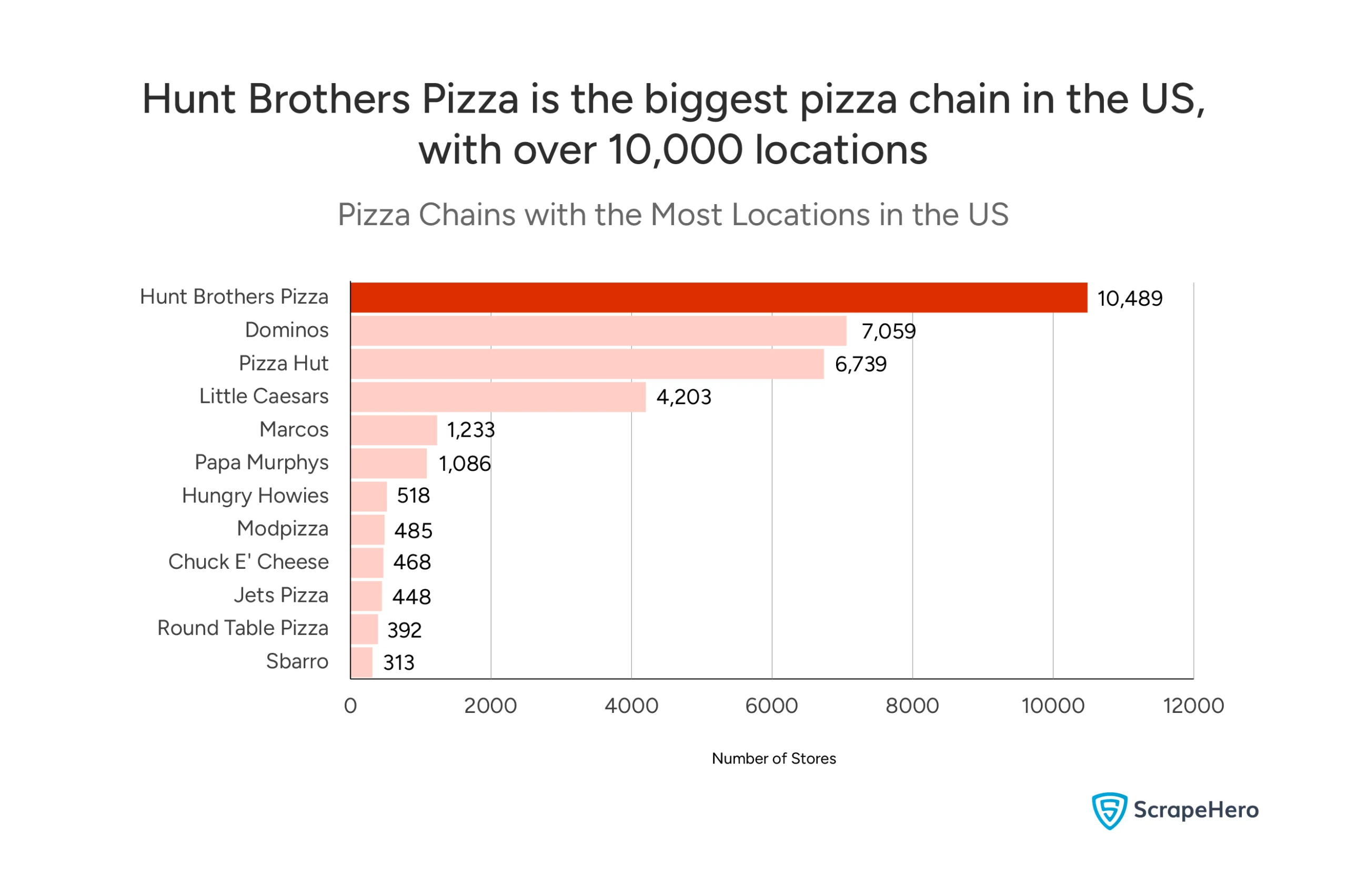

What are the Largest Pizza Chains in the US by Number of Locations?

When examining the physical footprint of pizza chains, it’s clear that some brands have significantly more stores than others, shaping the overall Pizza chain landscape in the US.

The data reveals that Hunt Brothers Pizza leads with 10,489 locations.

This makes Hunt Brothers Pizza, the chain with the largest physical presence, despite its somewhat regional distribution, as we will see later.

Want to see for yourself where all the Hunt Brothers Pizza stores in the US are located?

Following Hunt Brothers Pizza are globally recognized names: Domino’s with 7,059 locations and Pizza Hut with 6,739 locations.

Easily download and compare the list of Domino’s locations with the locations of Pizza Hut!

Little Caesars also holds a substantial share with 4,203 locations.

Other chains like Marcos (1,233), Papa Murphy’s (1,086), Hungry Howies (518), Modpizza (485), Chuck E’ Cheese (468), Jets Pizza (448), Round Table Pizza (392), and Sbarro (313) contribute to the extensive network, though with fewer individual outlets.

So, the top 10 pizza companies in the US by location are:

- Hunt Brothers Pizza- 10,489

- Dominos- 7,059

- Pizza Hut- 6,739

- Little Caesars- 4,203

- Marcos- 1,233

- Papa Murphys- 1,086

- Hungry Howies- 518

- Modpizza- 485

- Chuck E’ Cheese- 468

- Jets Pizza- 448

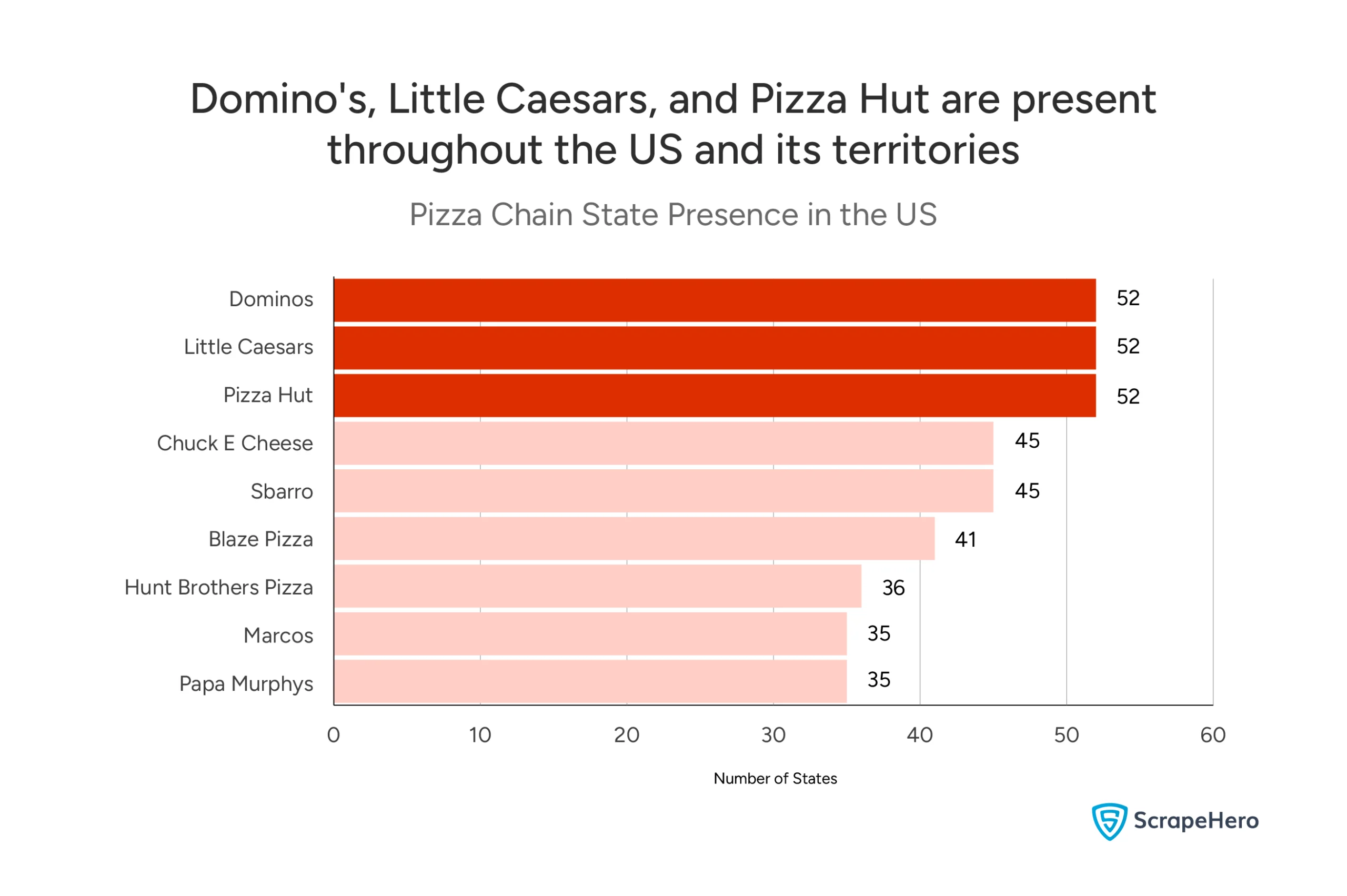

Which Chains Boast the Widest National Reach, and Where are Pizza Chains Most Concentrated?

Understanding the Pizza chain landscape in the US also involves looking at national penetration and geographical hotspots. While some chains have a high number of locations, their spread across states can vary, as can the density of pizza chains within specific states.

When it comes to national distribution, Domino’s, Little Caesars, and Pizza Hut stand out by operating throughout the US and its territories.

Chuck E’ Cheese and Sbarro also have a broad reach, present in 45 states each.

Interestingly, Hunt Brothers Pizza, despite having the most overall locations, operates in only 36 states. This indicates that its extensive number of stores is concentrated in specific regions rather than spread thinly nationwide.

So, pizza chains in the US, in order of their national presence, are:

- Dominos- 52

- Little Caesars- 52

- Pizza Hut- 52

- Chuck E’ Cheese- 45

- Sbarro- 45

- Blaze Pizza- 41

- Hunt Brothers Pizza- 36

- Marcos- 35

- Papa Murphys- 35

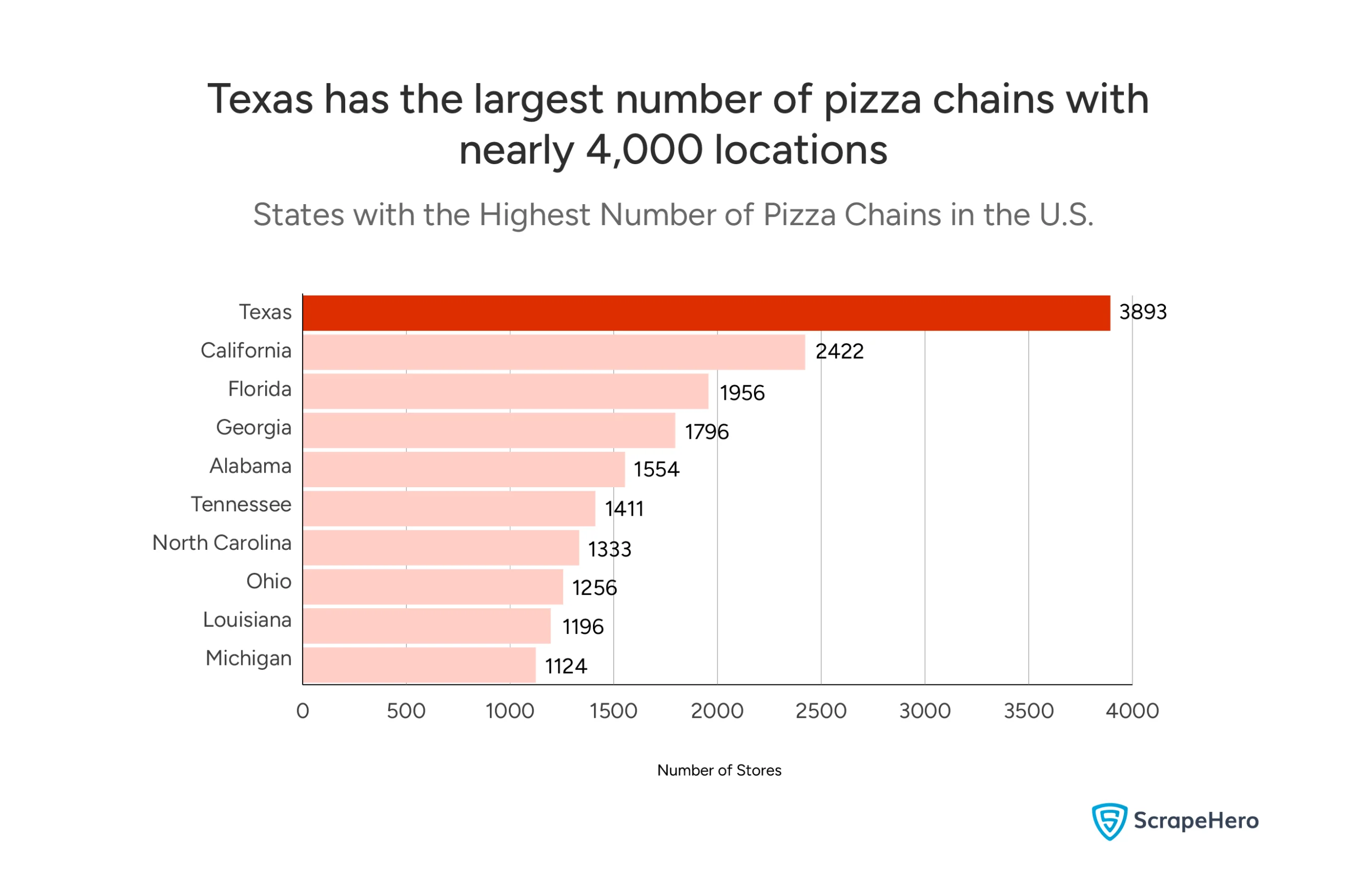

However, geographically, certain states emerge as major hubs for pizza chains.

Texas leads in the nation with 3,893 pizza chain locations, making it the largest pizza market by store count.

California follows with 2,422 locations, while Florida holds third place with 1,956 stores.

Georgia ranks fourth with 1,796 locations, and Alabama rounds out the top five with 1,554 pizza chains.

So, the major hubs for the Pizza chains in the US are:

- Texas- 3,893 locations

- California- 2,422

- Florida- 1,956

- Georgia- 1,796

- Alabama- 1,554

- Tennessee- 1,411

- North Carolina- 1,333

- Ohio- 1,256

- Louisiana- 1,196

- Michigan- 1,124

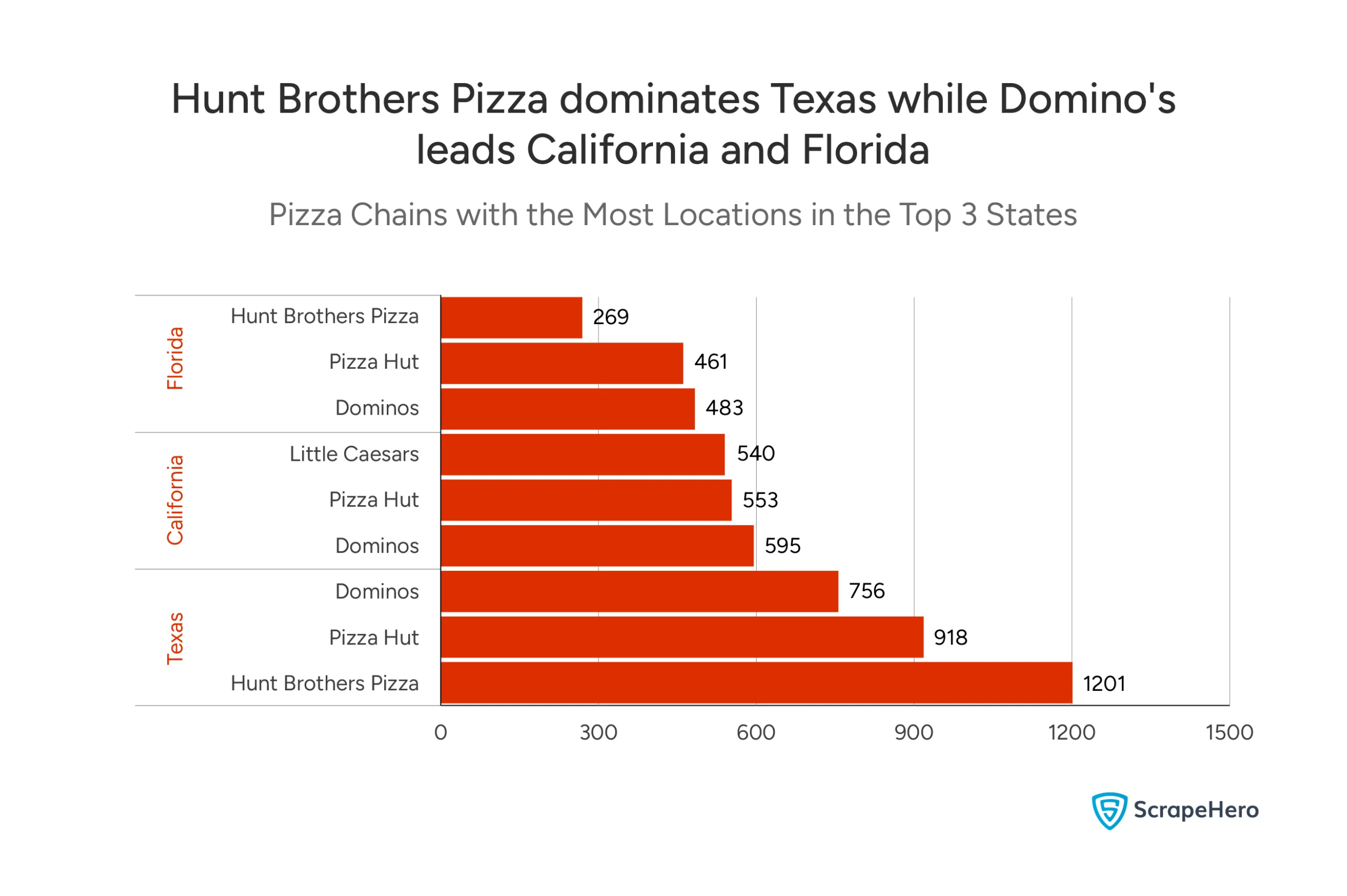

Which Pizza Chains Dominate the Top 3 State Markets?

A deeper dive into the largest pizza chains in the three major markets provides a granular view of regional dominance.

In Texas, which has the highest number of pizza locations overall, Hunt Brothers Pizza takes the lead with 1,201 locations.

It is followed by Pizza Hut with 918 and Domino’s with 756.

In California, Domino’s leads with 595 locations, closely followed by Pizza Hut (553) and Little Caesars (540).

For Florida, Domino’s again emerges as the top chain with 483 locations, with Pizza Hut (461) and Hunt Brothers Pizza (269) also showing strong presence.

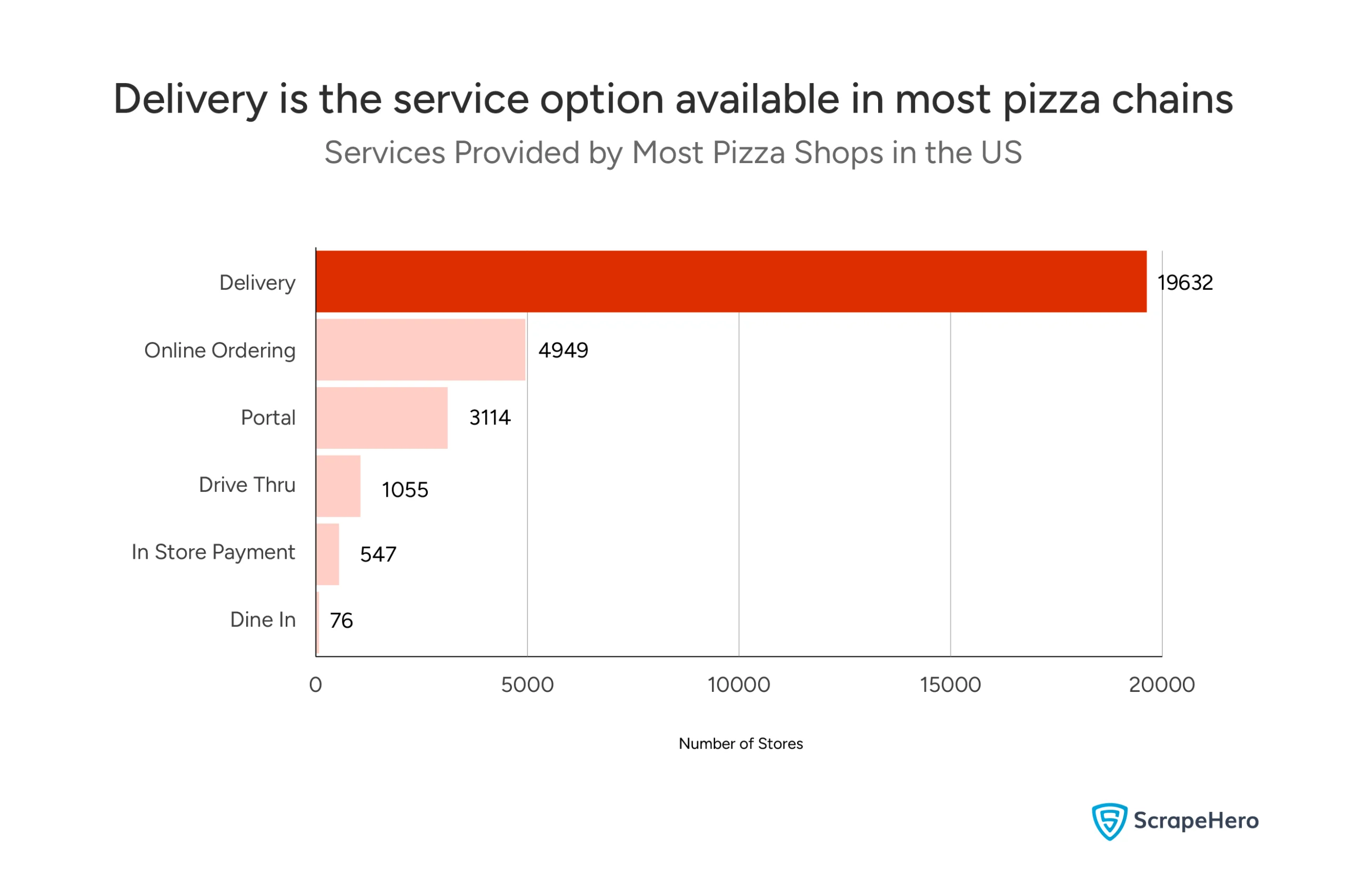

What Services Do Most Pizza Chains Offer to Customers?

The data on services provided by pizza shops suggests a trend towards convenience.

Delivery is the most prevalent service, offered by 19,632 locations. Online ordering is a popular option at 4,949 locations.

“Portal” services are available at 3,114 locations, while Drive Thru options are present at 1,055 locations.

In-Store Payment is offered at 547 locations, but traditional Dine-In options are significantly less common, available at only 76 locations.

This points towards the industry’s shift away from dine-in experiences towards off-premise consumption, driven by delivery and digital ordering platforms.

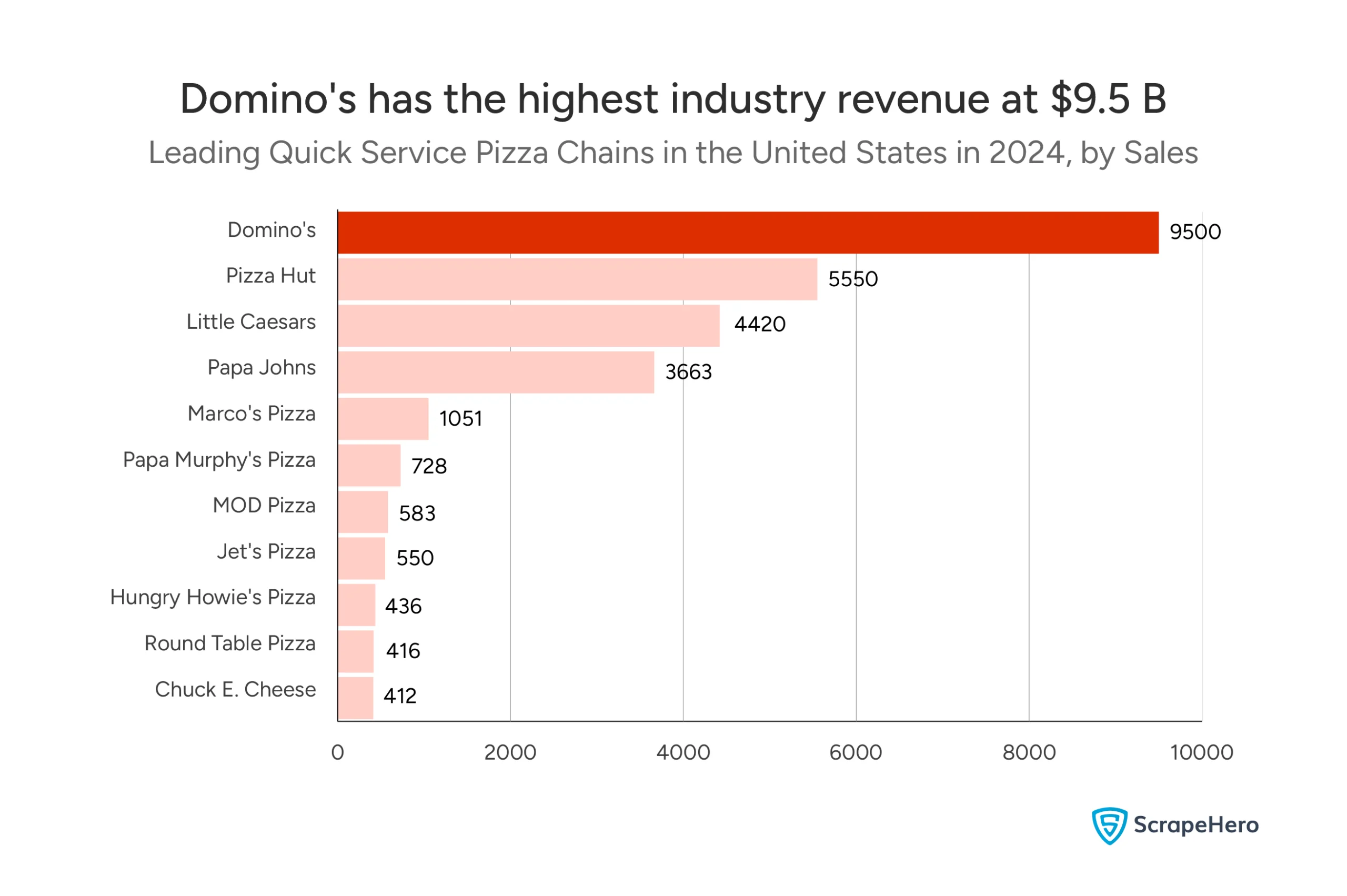

How Big is the Pizza Industry in the US, and Which Chains Lead in Sales?

Domino’s holds the top position with $9,500 million in sales, making it the leading pizza chain in the US by revenue. Pizza Hut is second with $5,550 million, and Little Caesars ranks third with $4,420 million.

Papa John’s also has significant sales at $3,663 million.

Smaller chains like Marco’s Pizza ($1,051 million), Papa Murphy’s Pizza ($728 million), MOD Pizza ($583 million), Jet’s Pizza ($550 million), Hungry Howie’s Pizza ($436 million), Round Table Pizza ($416 million), and Chuck E. Cheese ($412 million) also contribute to the market, but with more limited sales figures.

So, the largest pizza chains in the US in terms of revenue are:

- Domino’s- $9,500 million

- Pizza Hut- $5,550 million

- Little Caesars- $4,420 million

- Papa John’s- $3,663 million

- Marco’s Pizza- $1,051 million

- Papa Murphy’s Pizza- $728 million

- MOD Pizza- $583 million

- Jet’s Pizza- $550 million

- Hungry Howie’s Pizza- $436 million

- Round Table Pizza- $416 million

- Chuck E’ Cheese- $412 million

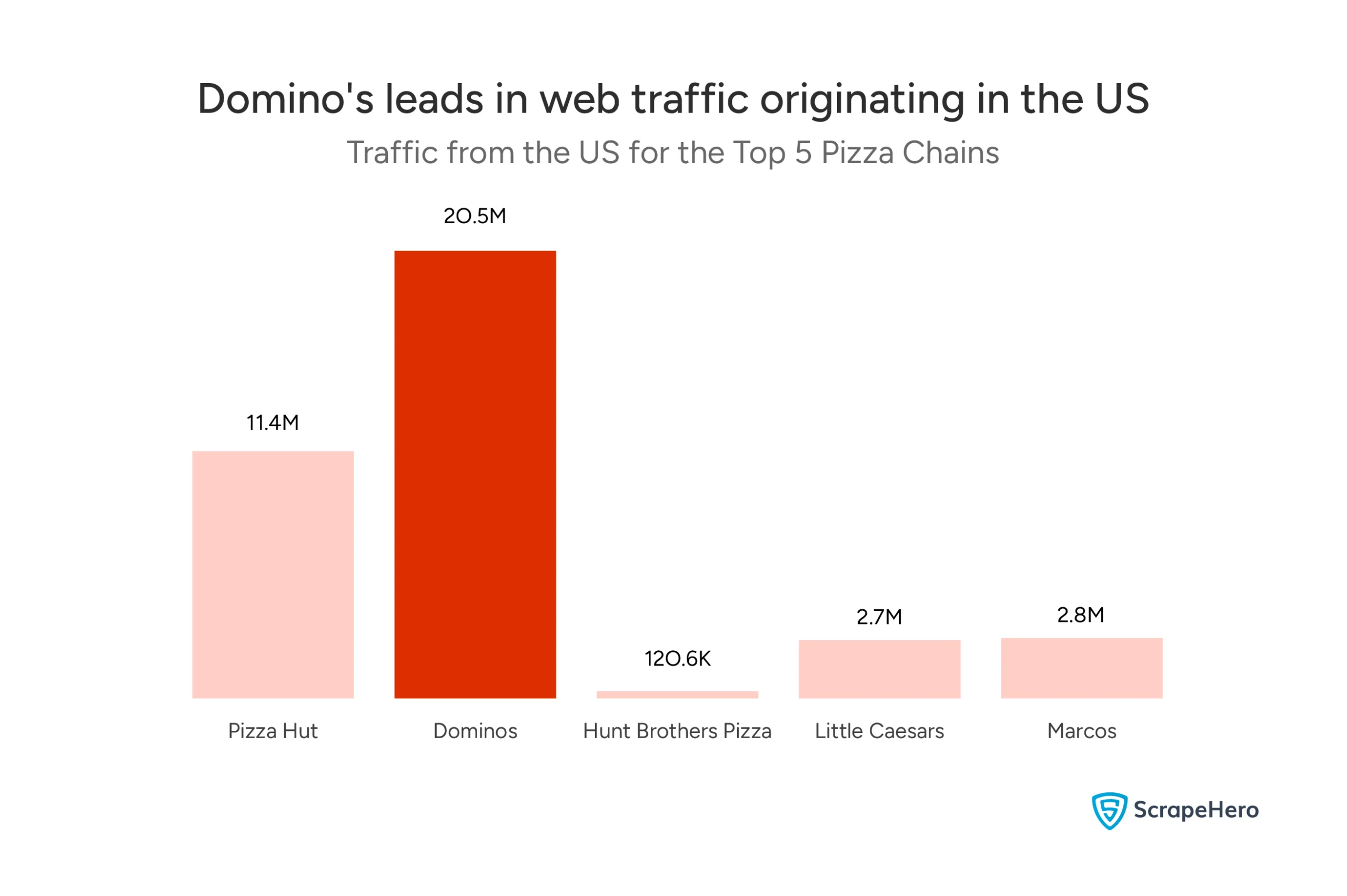

What is America’s Contribution to the Web Traffic of Top Pizza Chains?

Focusing specifically on traffic originating from the US, Domino’s leads with 20.5 million website visits. Pizza Hut follows with a substantial 11.4 million US visits.

Marco’s Pizza and Little Caesars show comparable traffic figures, with 2.8 million and 2.7 million visits, respectively.

Hunt Brothers Pizza, despite its high number of physical locations, has the lowest US web traffic among the top chains, with only 120.6K visits.

Summarizing Our US Pizza Chain Analysis

This analysis of the US pizza chain landscape reveals a market dominated by established players across 33,711 locations nationwide.

The data shows clear geographic patterns, with pizza chains heavily concentrated in the Eastern US, Midwest, and West Coast, while mountain states and northern plains remain underserved.

Key Findings:

Market Leadership: Hunt Brothers Pizza leads in location count with 10,489 stores, followed by Domino’s (7,059) and Pizza Hut (6,739).

However, revenue tells a different story: Domino’s dominates with $9.5 billion in sales, significantly outpacing Pizza Hut’s $5.5 billion and Little Caesars’ $4.4 billion.

Geographic Distribution: Texas emerges as the largest pizza market with 3,893 locations, followed by California (2,422) and Florida (1,956).

Domino’s, Little Caesars, and Pizza Hut achieve the widest national reach, operating in all 52 states and territories.

Service Evolution: The industry has clearly shifted toward convenience, with delivery available at 19,632 locations and online ordering at 4,949 locations.

Traditional dine-in service is now available at only 76 locations, highlighting the transformation toward off-premise consumption.

Digital Performance: Domino’s leads in US web traffic with 20.5 million visits, followed by Pizza Hut at 11.4 million.

Notably, Hunt Brothers Pizza generates only 120.6K web visits despite having the most physical locations.

How to Get the Data for an Analysis Effortlessly?

The most effortless way to get data for an analysis is to outsource to a web scraping service like ScrapeHero.

ScrapeHero Data Store monitors thousands of brands globally for store openings, store closures, parking availability, in-store pickup options, services, subsidiaries, nearest competitor stores and much more.

However, outsourcing with ScrapeHero’s web scraping service is the smarter choice if you require custom data extraction, complex web navigation, or simply want to save time.

As one of the top 3 web scraping service providers globally, ScrapeHero offers:

- Cost-effective solutions that deliver maximum value for your investment

- Real experts with decades of experience in data extraction and web scraping

- Full-service data provision that handles everything, including data collection, accuracy, and delivery

- No obligation to sign up – explore our services risk-free

Since we are a complete data provider, you don’t need software, hardware, or scraping expertise. Instead, you can focus on using data for your business, not extracting it.

Connect with ScrapeHero today.

Report by ScrapeHero using publicly available data. This report is independent and not affiliated with any pizza chain brands.