Walmart Private Labels is hardly a new area for Walmart. The retail giant launched it’s own dog food brand Ol’ Roy, in 1983 and has since taken an interminable approach. From dog food to clothing, it has long offered its customers alternatives to well-known brands in diverse categories. Walmart is now trying to tap into a new consumer segment — higher-income customers and bolster its online presence. The acquisition of digitally native brands such as Jet.com, Bonobos, Modcloth, and Moosejaw is a part of this attempt.

Here, we have analyzed the private label brands on Walmart.com and their products.

Insights in brief

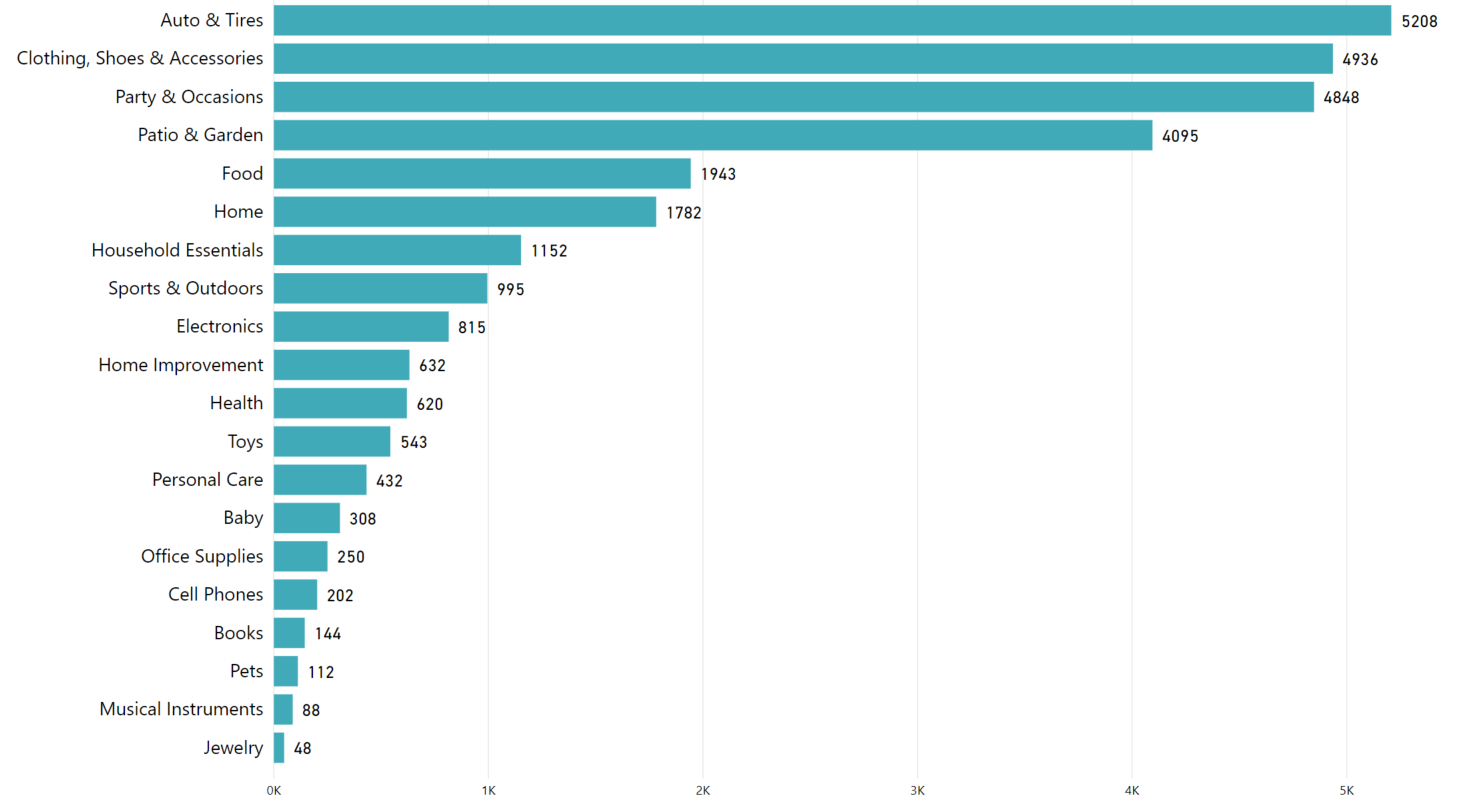

- Walmart’s private label has 29,153 products listed for sale on their website.

- The largest private label category in Walmart is Auto & Tires (5,208).

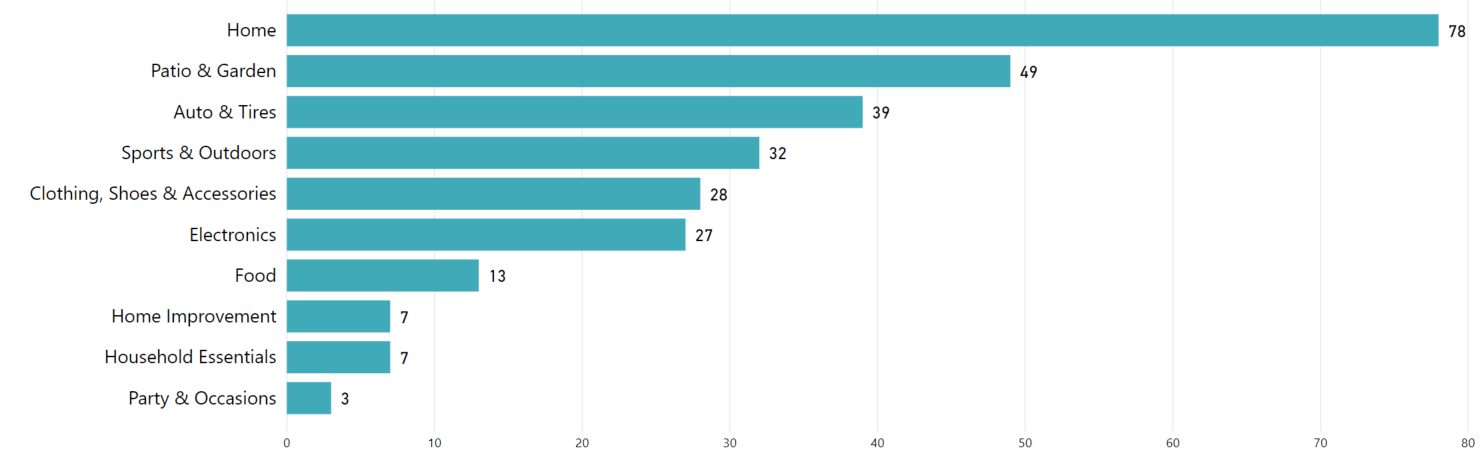

- The category with the highest number of private label brands is Home (78).

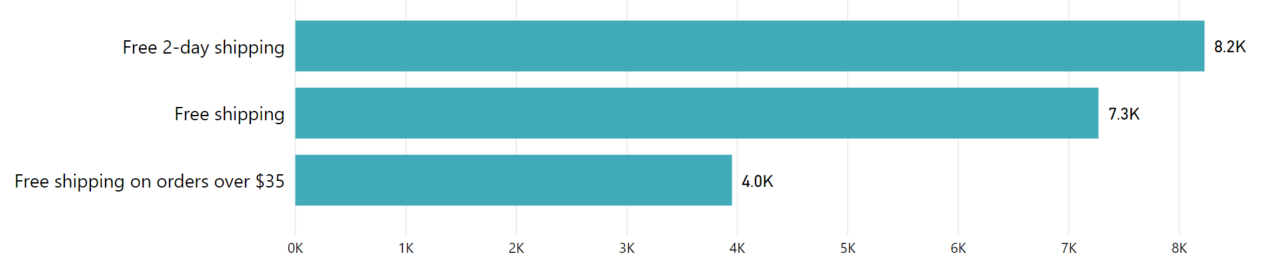

- Walmart offers free 2-day shipping for 8.2K private label products.

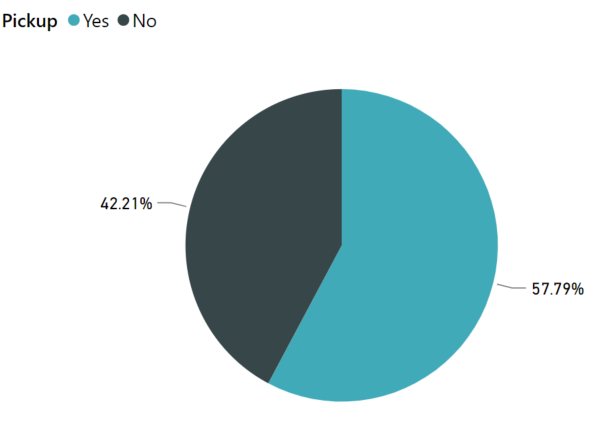

- 57.79% of private label products on Walmart have a free pickup option.

- Walmart sells more private label products compared to Amazon and Kroger.

How many Walmart Private Label products are there?

Walmart has 29,153 products across 319 private label brands in 20 categories. The Auto & Tires category has most number of Walmart private label products with 5,208 products. Douglas tires alone account for 92.34% of products in this category. Two other categories that Walmart has been stocking up its shelves are ‘Clothing, Shoes & Accessories’ (4,936) and ‘Party & Occasions’ (4,848). Walmart even launched four new private-label clothing brands last year, namely Time and Tru, Terra & Sky, Wonder Nation, and George.

The following chart shows the top ten categories that have the most number of private label brands. ‘Home’ category has the highest number of private labels (78). This is followed by ‘Patio & Garden’ and ‘Auto & Tires’ that has 49 and 39 private labels respectively. Even though ‘Party & Occasions’ has only 3 brands, it comes under the top 3 categories with 4848 products.

How does Walmart price its private labels

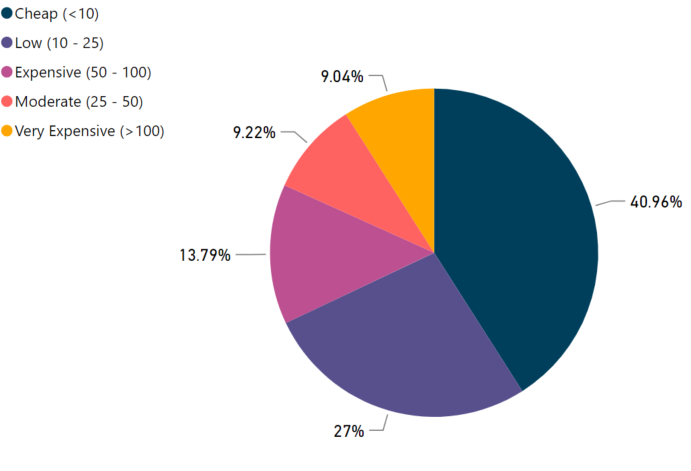

- 40.96% of products sold are priced below $10 and almost half of them belong to ‘Party & Occasions’ and ‘Clothing, Shoes & Accessories’.

- 27% of products are priced between $10 and $25. 95% of products in the Clothing, Shoes & Accessories category are priced below $25.

- A majority of the products under the Auto & Tires category (70%) are expensive and are priced above $50.

Walmart private label ratings

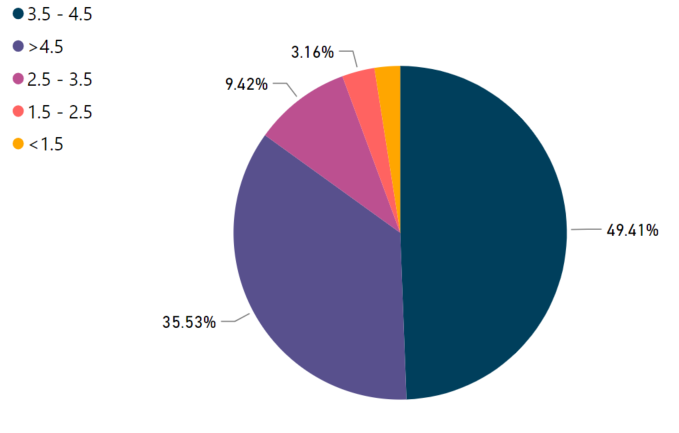

- Walmart private label brands score higher in terms of customer satisfaction with 49.41% of the private label products having an average rating between 3.5 and 4.5.

- 35.53% of products have an average rating above 4.5.

- Auto & Tires have the highest average rating (4.6). This shows that customers trust private labels as much as name brands.

- Cell Phone is the lowest rated category with a 2.9 average rating.

Free shipping and Pick-up

In order to enhance delivery efficiency, Walmart is offering competitive shipping and pick-up options. Free 2-day shipping is provided for 8.2K products and free shipping for 7.3K products. It has also acquired logistics startup ‘Parcel’ to support its delivery initiatives.

Walmart’s biggest advantage is that its 4657 stores are located within 90% of the U.S. population and its products are available for either free pickup or next-day delivery. This also gives Walmart a competitive edge over Amazon’s Whole Foods that has only 479 stores. More than half of the private label products on its website (57.79%) are available for free pickup now.

The Private Label Influence

Walmart private labels focus is on Auto & Tires while Amazon and Kroger‘s focus is on apparel and grocery respectively. 84% of Walmart shoppers prefer buying their private label brands, while 83% of Kroger shoppers buy theirs. Whereas only 27% of Amazon shoppers buy their private label brands.

Walmart Private label brand sales accounted for $128.6 billion in the U.S. in 2018, compared to only 1.1% sales growth of national brands across all retail channels. Retailers are increasingly investing in more innovative private labels in a wide variety of categories, without compromising on quality. According to the 2019 PLMA survey, 40% of consumers said they “always/frequently” buy store brands and 25% said they plan on buying more private label brands in the year ahead. Store brands are no longer seen as generic products with lower quality. 70% of consumers believe that private labels are “just as good in quality” as those from national brands. In-house brands are now part and parcel of the retailer’s brand strategy, as these allow stores to offer their customers lower priced, quality products and also a way to ensure customer loyalty.

Do you want data regarding store brands?

You can download all Walmart locations and more from our data store.