In this Gap vs American Eagle Outfitters US Analysis, we are peeling back the layers to see who really rules the market.

Are you betting on the brand with the most cash, or the one with the most fans?

This Gap versus American Eagle market comparison covers:

- Physical Footprint: Who has more stores and where are they located?

- Financial Muscle: Revenue and market value battles.

- Digital Dominance: Who is winning on Amazon and Walmart?

- Customer Loyalty: Who do shoppers actually like more?

To get you the most accurate Gap and American Eagle US performance metrics, we went straight to the source:

- Store Locations: We used POI data downloaded from the ScrapeHero Data Store.

- Online Presence: All E-commerce details were scraped using the ScrapeHero Cloud Amazon Search Results Scraper and the ScrapeHero Cloud Walmart Search Results Scraper.

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.Power Location Intelligence with Retail Store Location Datasets

If you don’t have time to read the whole thing right now, here is the spoiler. Our Gap vs American Eagle analysis reveals a massive split in strategy:

- Gap is the “Financial Giant”: They are generating nearly three times the revenue of American Eagle and dominating digital sales channels like Amazon and Walmart.

- American Eagle is the “Physical Leader”: They have nearly double the number of physical stores in the US and crushing Gap when it comes to customer loyalty and brand love.

💡 Quick Backstory Did you know both brands are retail veterans? Gap Inc. actually has a bit of a head start—it was founded back in 1969 as a single store in San Francisco. American Eagle Outfitters joined the party a few years later, launching in 1977. Both have survived decades of fashion changes to end up where they are today.

The Financial Heavyweight: Gap’s Undeniable Scale

When we look at the retail landscape, it is easy to get distracted by who has the most “Now Open” signs in the mall window.

But if we look at the bank accounts, the story changes completely.

In this section of our Gap vs American Eagle Outfitters US Analysis, we are following the money to see who holds the real power.

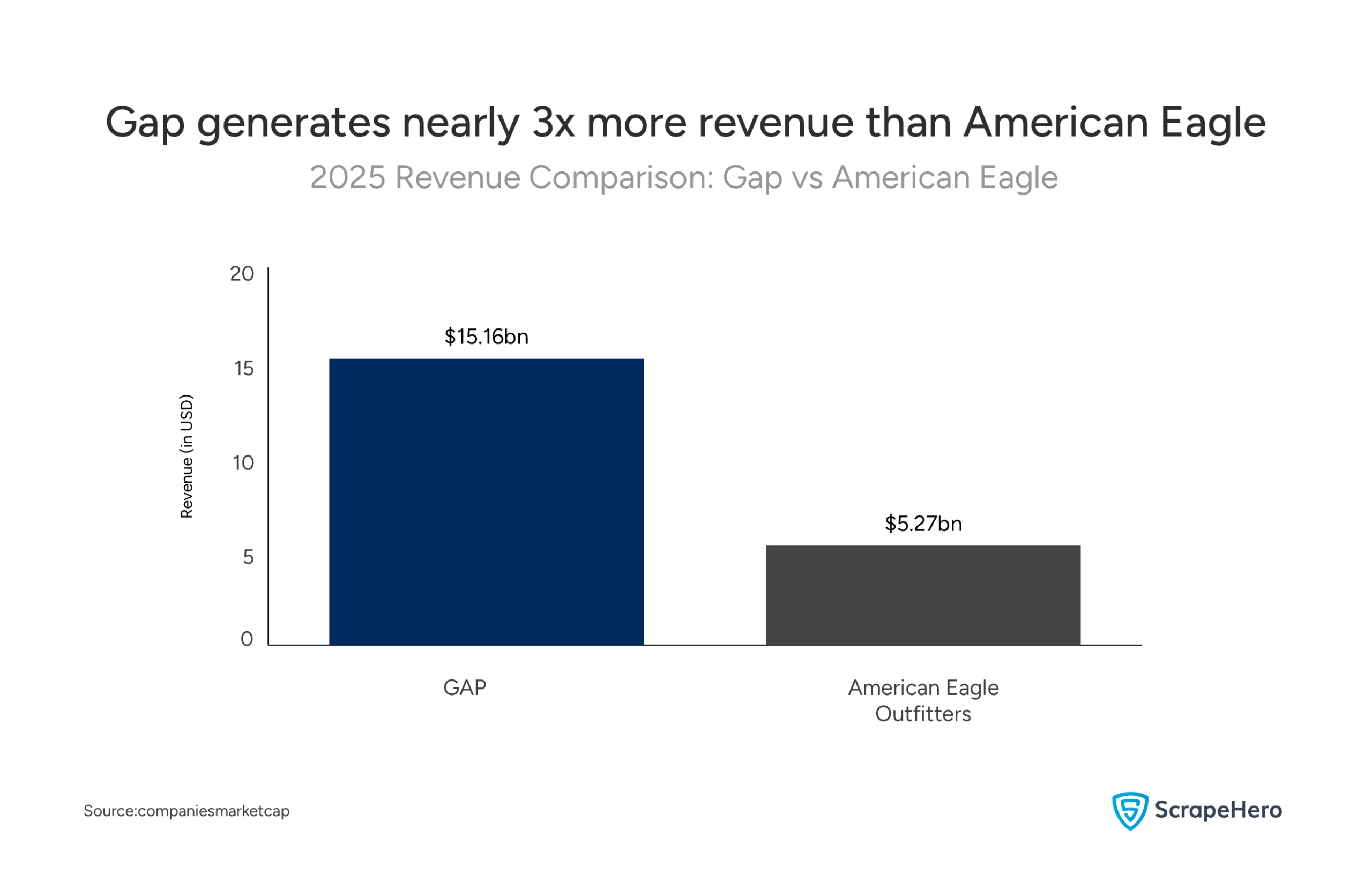

The Revenue Gap Between Gap and American Eagle

We often assume that the brand we see more often is the one making more money, right? Well, in this case, that assumption is dead wrong.

So, just how big is the difference?

If you look at the revenue numbers for 2025, the gap (pun intended) is huge.

- Gap brought in a massive $15.16 billion.

- American Eagle Outfitters generated $5.27 billion.

That means Gap is generating nearly three times the revenue of American Eagle.

Therefore, while AE is popular, Gap remains the undisputed giant in terms of pure financial scale.

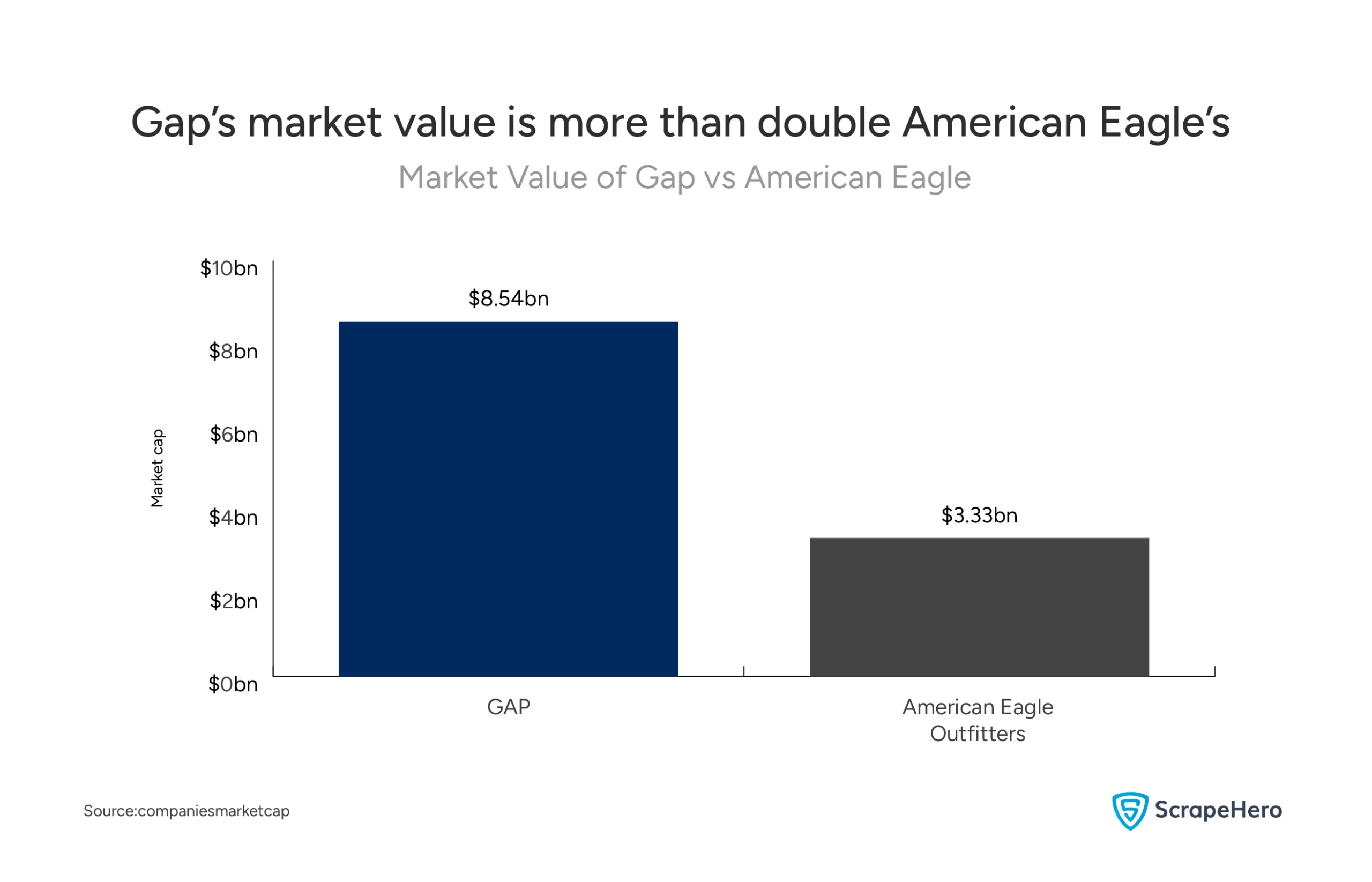

The Market Valuation: What Investors Think

We established that Gap is bringing in more revenue, but does that actually make it a more valuable company?

When you look at the market capitalization (the total value of the company’s outstanding shares), the answer is a resounding yes. Investors are clearly putting their money on the legacy giant.

According to the data from Companies Market Cap, the difference in valuation is just as stark as the revenue numbers:

- Gap Inc. holds a market value of $8.54 billion.

- American Eagle Outfitters trails significantly at $3.33 billion.

So, what does this mean for our Gap vs American Eagle analysis?

It means Gap is worth more than double what American Eagle is worth.

This part of the Gap vs American Eagle Outfitters US Analysis confirms that, when it comes to financial stability and investor confidence, Gap’s scale is hard to beat.

The Ground Game: American Eagle’s Physical Takeover

We just saw that Gap is the financial heavyweight. But here is where our Gap vs American Eagle Outfitters US Analysis takes a sharp turn.

If Gap makes three times the money, you would expect them to have three times the stores, right?

Actually, the exact opposite is true. When it comes to pure physical presence, American Eagle is absolutely crushing it.

Why does this matter? Because visibility is everything. While Gap might be winning on the balance sheet, American Eagle is winning on the street.

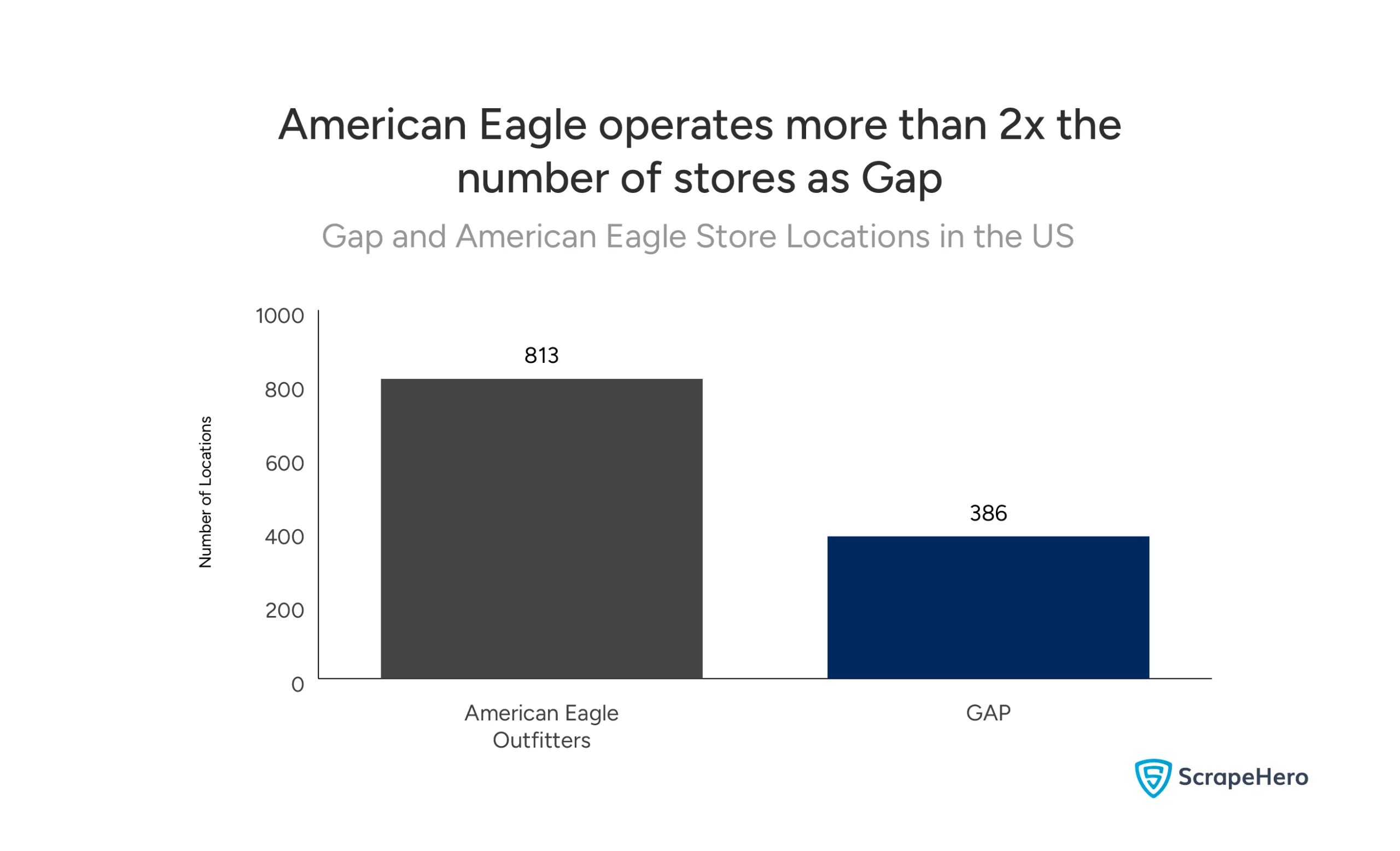

Let’s look at the raw numbers from our Gap versus American Eagle market comparison:

- American Eagle Outfitters operates a massive network of 813 stores across the US.

- Despite its higher revenue, Gap operates only 386 stores.

Think about that for a second. American Eagle has more than double the physical footprint of Gap.

Does Fewer Stores Mean Less Business?

You might be asking, “How does Gap make more money with half the stores?” It suggests that Gap’s revenue isn’t coming from foot traffic in the same way AE’s is.

Gap is likely relying on digital sales or third-party distribution (which we will get to next). Meanwhile, American Eagle is betting big on being physically accessible to you.

The Online Battleground: Where Gap Flexes Its Muscles

We just left off wondering how Gap makes so much more money with so few stores.

The answer? They have quietly turned into an e-commerce juggernaut on third-party platforms.

In this section of our Gap vs American Eagle Outfitters US Analysis, we are looking at the digital shelf—specifically Amazon and Walmart.

The Inventory Flood: Gap is Everywhere You Click

Have you ever tried searching for American Eagle on Amazon? You might struggle to find much. Search for Gap, however, and you will be scrolling for days.

Why is the difference so huge? It comes down to strategy. Gap seems to be using these platforms as a massive distribution hose, while American Eagle keeps its inventory closer to home.

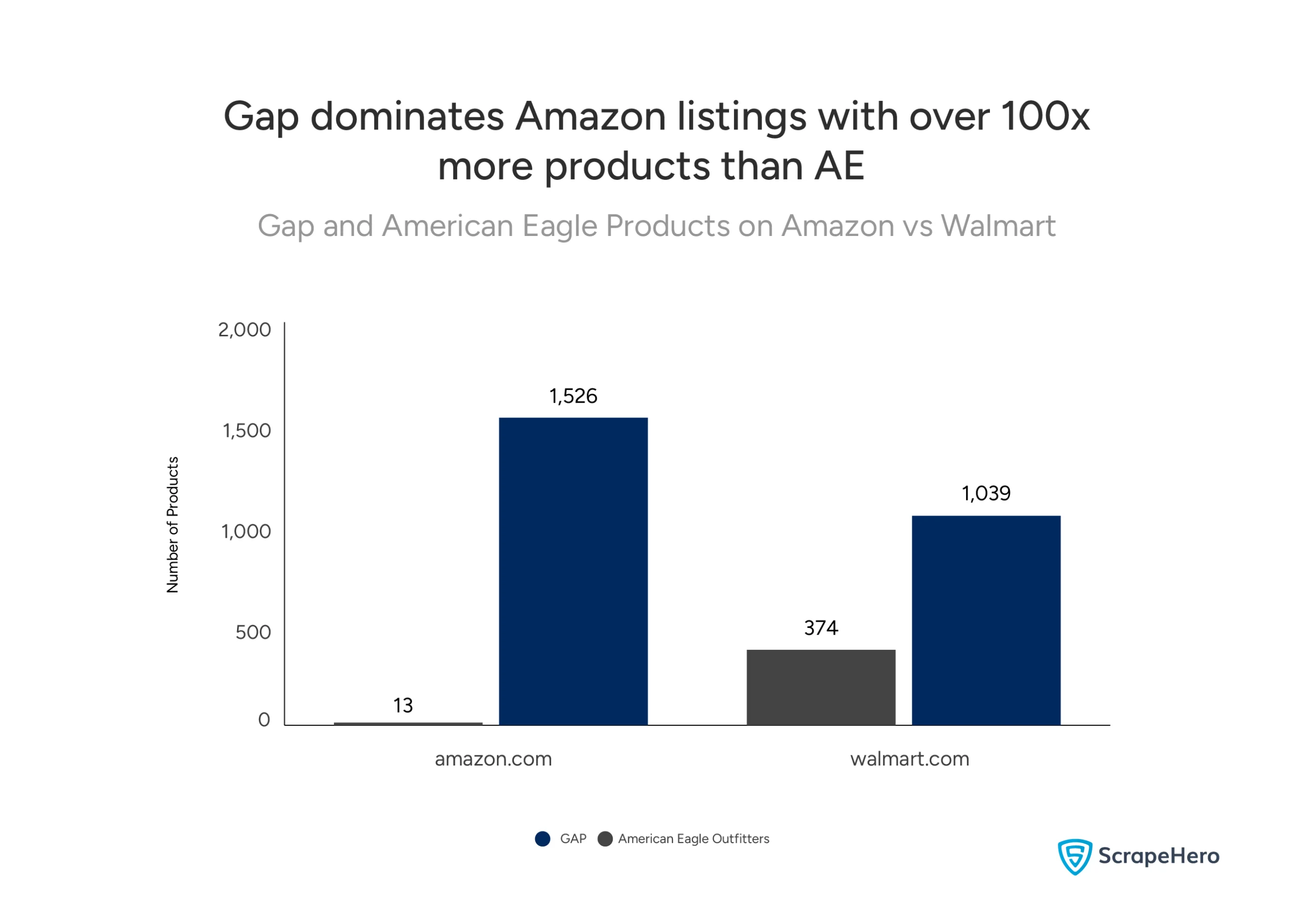

Let’s look at the numbers from our Gap versus American Eagle market comparison:

- On Amazon: Gap lists a staggering 1,526 products. American Eagle? A tiny 13 products.

- On Walmart: Gap maintains the lead with 1,039 products compared to AE’s 374.

This Gap vs American Eagle analysis shows two completely different approaches.

Gap is flooding the zone, making sure their logo pops up whether you are buying at Walmart or on Amazon.

American Eagle, on the other hand, is virtually non-existent on Amazon, likely forcing fans to visit their own website or physical stores to buy.

The Feedback Loop: Who are People Actually Buying From?

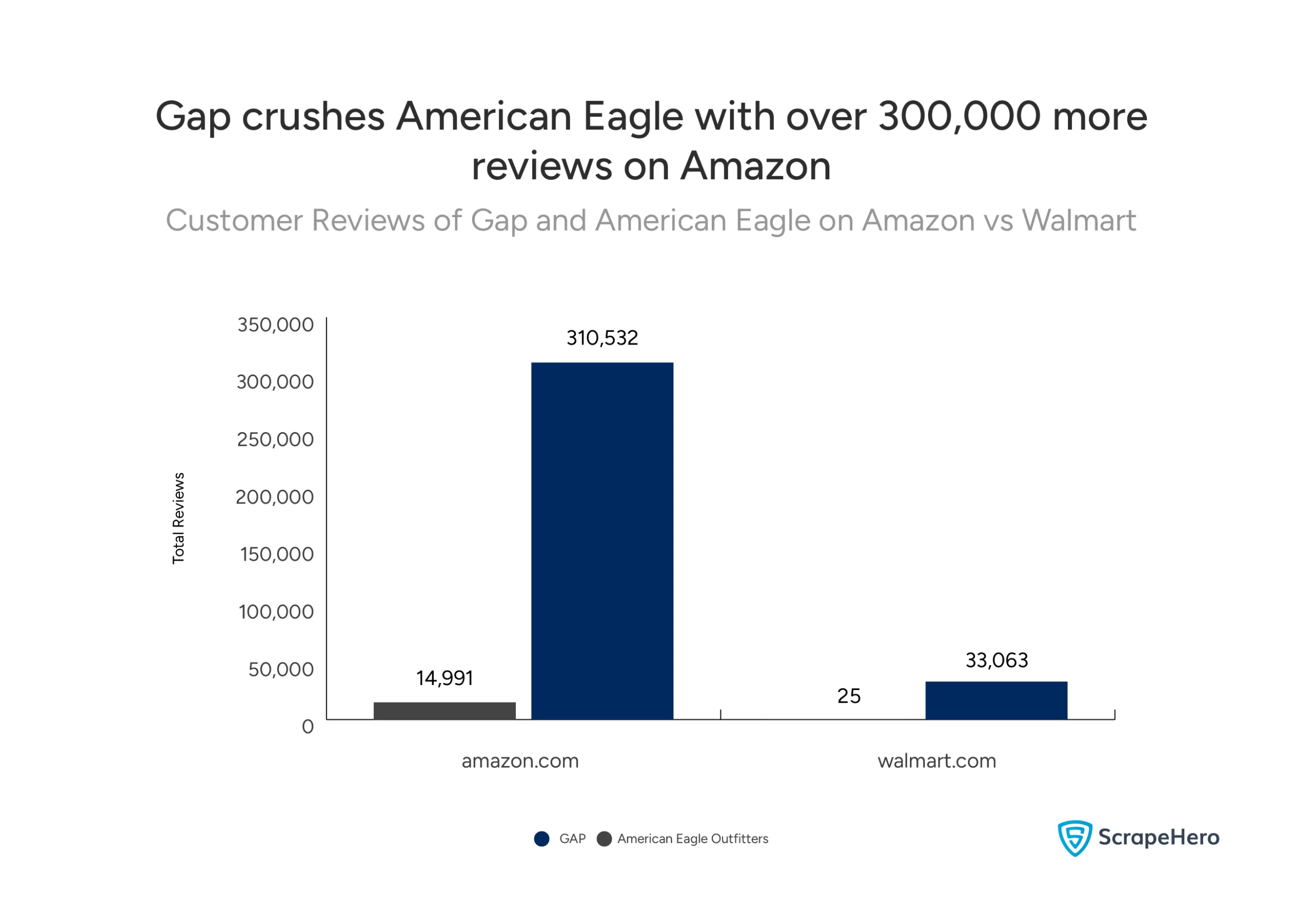

It is one thing to list a thousand t-shirts online; it is another thing to actually sell them. So, does Gap’s massive inventory lead to actual engagement?

The short answer is yes.

The review counts tell us exactly how long and how strong Gap has been playing this game.

- On Amazon: Gap has racked up over 310,000 customer reviews. American Eagle sits at roughly 15,000.

- On Walmart: Gap has 33,063 reviews, while American Eagle has a barely-there 25 reviews.

You might be wondering, “Does this mean nobody likes American Eagle?” Not at all.

The data reveals a strategic choice and its consequence: American Eagle maintains a minimal presence on Amazon, which naturally results in far fewer sales and reviews on that platform.

The Customer Heartbeat: American Eagle’s Loyalty Advantage

Up until now, Gap has dominated the financial metrics (revenue, market value) and the digital sphere (products, reviews). But let’s look at the one thing that money can’t buy: customer love.

We have saved the most important metric for last, because this is where American Eagle completely steals the show and shifts the entire Gap vs American Eagle Outfitters US Analysis.

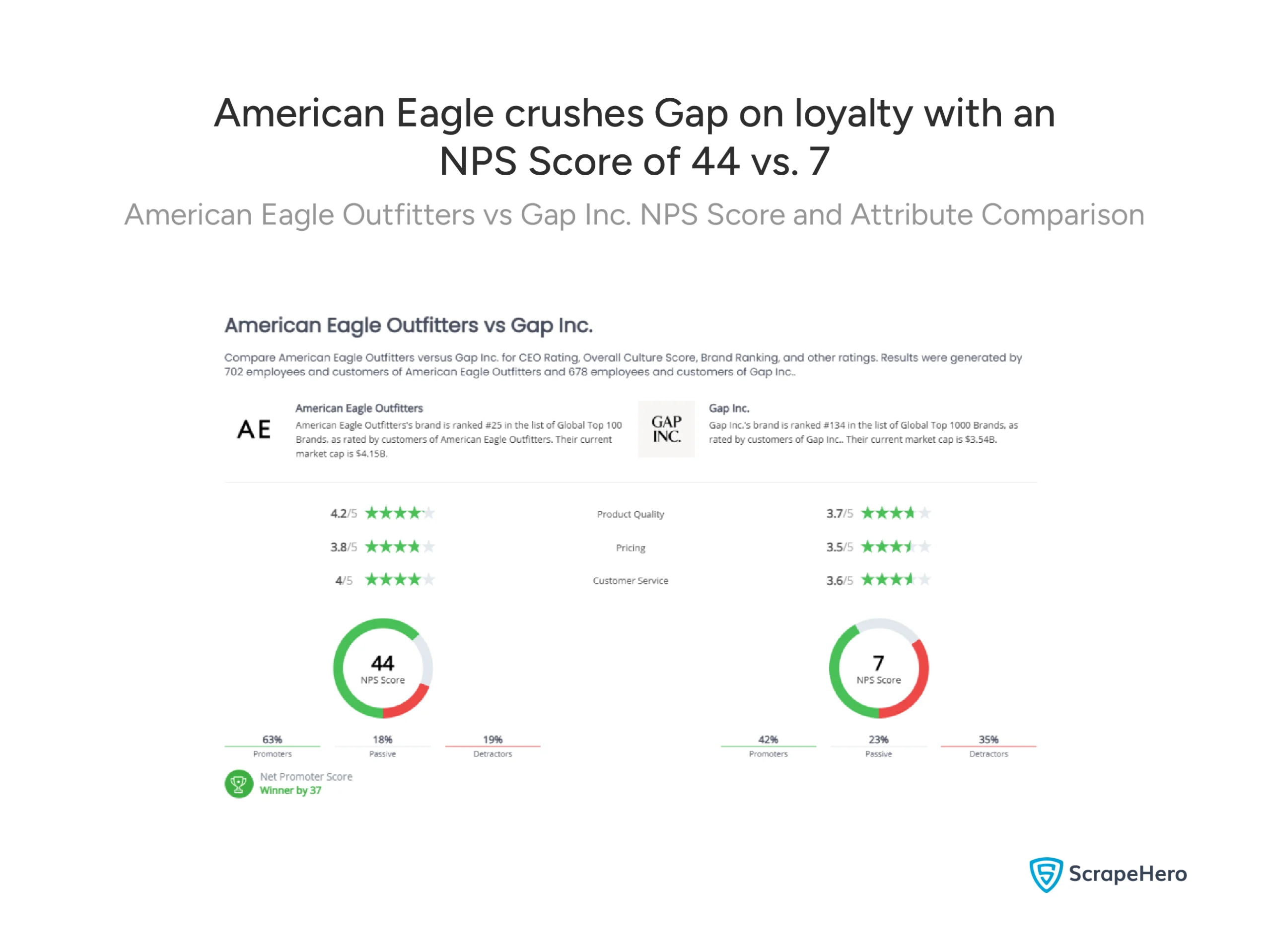

The Net Promoter Score (NPS) is a key metric in customer experience. It measures customer loyalty and enthusiasm for a company. It works by asking one simple question: “How likely are you to recommend [Brand] to a friend or colleague?” Scores range from -100 to +100. A score above 0 is considered good, and a score over 30 is excellent.

How do you measure brand loyalty? You look at the Net Promoter Score (NPS). This score basically tells you how likely a customer is to recommend the brand to a friend. It’s the ultimate sign of customer advocacy.

So, what are the scores?

- American Eagle Outfitters boasts an outstanding NPS score of 44.

Gap Inc.’s score lags significantly behind at 7.

American Eagle is the “Winner by 37” points. This means AE has far more customers who are actively recommending the brand (Promoters) than Gap does.

This loyalty advantage is reinforced by other key factors:

- Product Quality: AE scores better (4.2 vs. 3.7).

- Customer Service: AE scores better (4.0 vs. 3.6).

- Pricing: AE scores better (3.8 vs. 3.5).

This final piece of the Gap and American Eagle US performance puzzle shows that while Gap is winning today’s market share with scale, American Eagle has a stronger, more resilient brand foundation.

The Final Score: Gap’s Scale vs American Eagle’s Loyalty

So, after this deep dive into our Gap vs American Eagle Outfitters US Analysis, where does the final score stand?

We have seen a tale of two very different retail strategies playing out in the American market.

Gap is the Financial Machine: They are the giants of scale. The data confirms Gap’s undisputed authority in purely financial terms.

- Revenue: Gap pulls in nearly three times the revenue of American Eagle ($15.16B vs. $5.27B).

- Digital Reach: They dominate the mass-market digital shelf, crushing American Eagle in product listings and reviews on Amazon and Walmart.

American Eagle is the Physical and Emotional Leader: AE’s strategy is all about physical accessibility and deep brand connection. They win the ground game and the heart of the customer.

- Physical Footprint: American Eagle has nearly double the stores in the US (813 vs. Gap’s 386).

- Customer Loyalty: This is the most crucial metric. In this Gap versus American Eagle market comparison, American Eagle won the loyalty contest with an NPS of 44, compared to Gap’s low score of 7.

Scale vs. Sentiment – Who Wins the Future?

This Gap vs American Eagle analysis gives us a clear trade-off. Gap’s enormous financial scale and digital momentum ensure stability and current market dominance. They are too big to fail anytime soon.

However, superior customer loyalty is the foundation of long-term, organic growth. American Eagle’s massive lead in NPS, combined with a strong physical presence, suggests a brand that is building resilient customer advocacy.

Ultimately, while Gap holds the money and the distribution today, American Eagle has the dedication and the physical reach.

In the retail landscape, a 37-point NPS advantage is a powerful tool. It is the kind of loyalty that ensures a brand can survive the next trend cycle.

This Gap and American Eagle US performance battle is far from over, but here’s the question!

Are You Wondering How to Do a Similar Analysis?

How did we get all these numbers to create this detailed Gap vs American Eagle Outfitters US Analysis in the first place?

We just compared:

- The exact count of every American Eagle and Gap store in the country.

- The inventory levels and customer reviews on massive platforms like Amazon and Walmart.

- Complex brand health scores like NPS.

Trying to collect all of this market intelligence manually would take you weeks—maybe even months. You would be clicking through hundreds of store locator pages and copying thousands of review scores into a spreadsheet. That is not strategic work; that is just tiring work.

The Smarter Way to Get Market Data

The reality is, a comprehensive Gap versus American Eagle market comparison like this needs data at scale. You need real-time, accurate information about:

- Physical Footprint: Where every single competitor store is located (POI data).

- Digital Shelf: Product counts and competitor pricing from multiple e-commerce sites.

- Customer Sentiment: Reviews and loyalty scores.

This is exactly where specialized web scraping services, like ScrapeHero, become invaluable.

Instead of manually checking prices or trying to find product URLs, the data arrives clean, structured, and ready for you to analyze. You don’t need to install any software. You don’t need to hire a team of developers.

Our service handles all the difficult parts—navigating complex websites, extracting the data, and making sure it stays current.

Focus on Strategy, Not Spreadsheets

Think about it: building your own in-house data collection operation, or doing it manually, means diverting money and time away from what matters most.

Your job is to analyze the market and make winning strategic decisions.

When you need effortless data to execute a massive performance study (or any competitive analysis), outsourcing to a web scraping service specialist is the smarter choice. You get all the data you need without the infrastructure headache.

Connect with ScrapeHero today.

Report by ScrapeHero using publicly available data. This report is independent and not affiliated with Gap or American Eagle Outfitters.