If you sell, invest in, or compete with skincare brands, you need to know about CeraVe and Cetaphil. Both are major players. But one is pulling far ahead.

This is a look at the real numbers behind the CeraVe vs Cetaphil’s market performance on Amazon. We are not talking about which product feels better. We are talking about sales, traffic, and customer behavior.

We looked at data from Amazon and other sources. This CeraVe vs Cetaphil comparison will show you which brand has the stronger position today.

Thesis: This data-driven analysis, focusing on Amazon performance, web traffic, and consumer engagement, will demonstrate that CeraVe has secured a dominant market position, outperforming Cetaphil in revenue, brand visibility, and customer loyalty, despite Cetaphil’s wider product assortment.

Data Sources: Amazon listings gathered using ScrapeHero Cloud Amazon Search Results Scraper, Momentum Commerce, YouGov, and Semrush.

With ScrapeHero Cloud, you can download data in just two clicks!Don’t want to code? ScrapeHero Cloud is exactly what you need.

CeraVe’s Market Dominance in Revenue and Reach

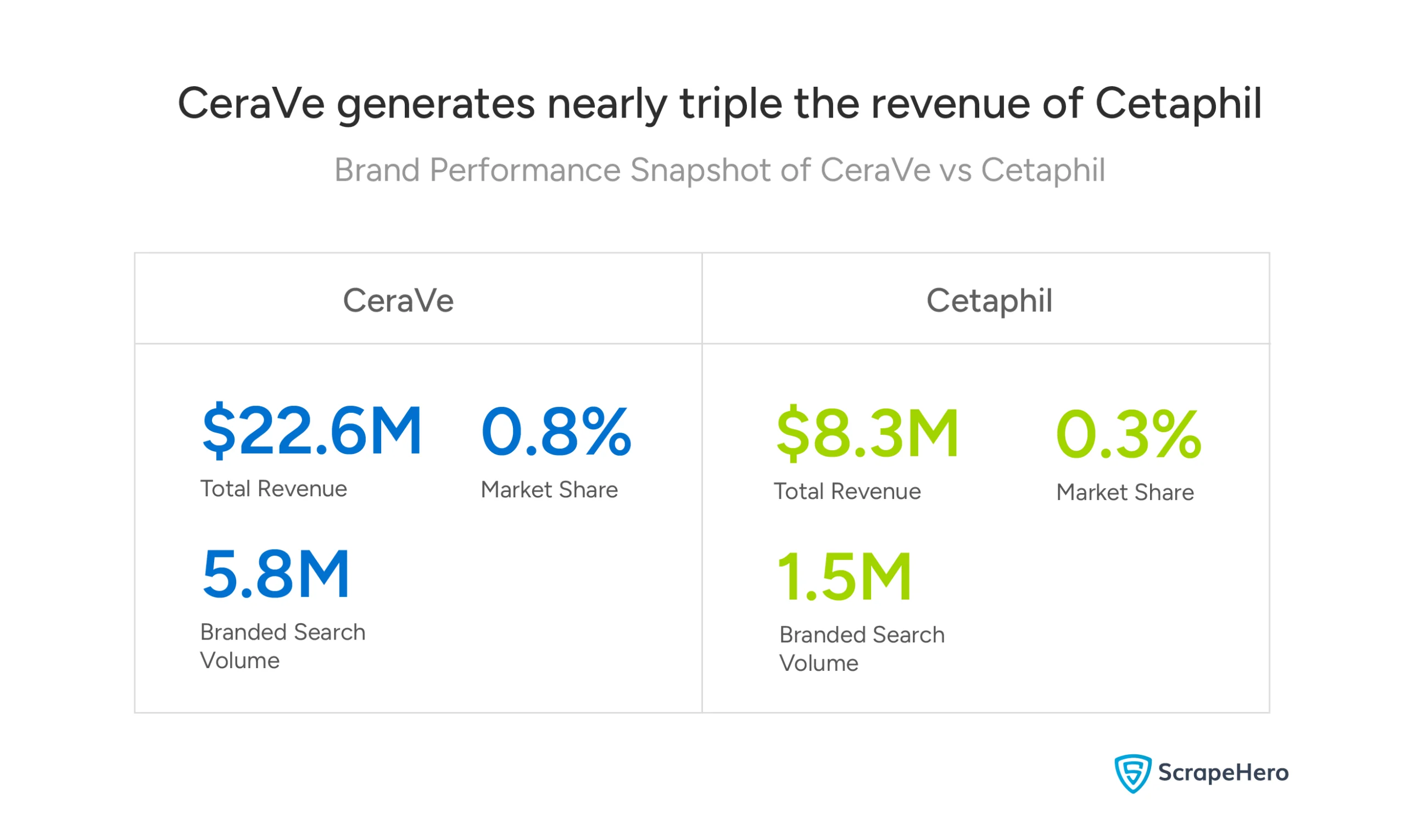

When we look at the core business metrics, CeraVe isn’t just competing with Cetaphil—it’s operating on a completely different level.

The data from Momentum Commerce shows a gap in their market positions.

CeraVe’s ability to drive revenue and capture customer interest is significantly stronger. This sets the stage for everything else we’ll uncover.

Let’s break down what this means:

- Massive Revenue Lead: CeraVe brought in a huge $22.6 million. Cetaphil earned a much smaller $8.3 million. This means CeraVe makes almost three times more money.

- Huge Search Advantage: People are actively looking for CeraVe. It had 5.8 million brand searches, dwarfing Cetaphil’s 1.5 million. This shows much stronger customer desire and brand awareness.

- Larger Market Share: All of this adds up to CeraVe controlling more than double the market share (0.8% vs. 0.3%). It’s simply a bigger player in the skincare world.

This clear lead in the CeraVe vs Cetaphil market performance battle is the foundation of our analysis.

It shows us that CeraVe has won the first and most important battle: winning the customer’s wallet and their initial search.

CeraVe Crushes Cetaphil in Online Visibility

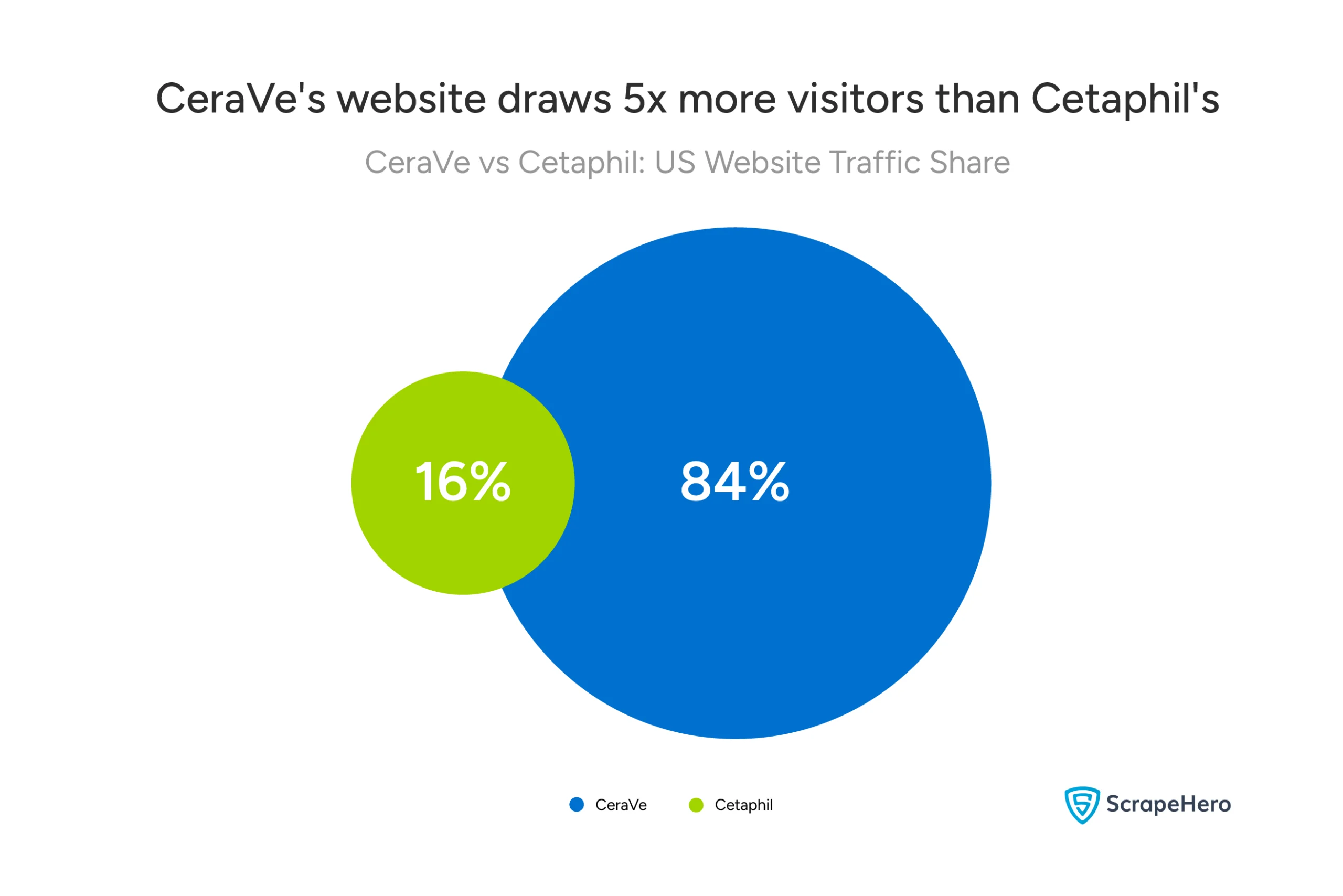

A brand’s website is its front door online. And when it comes to attracting visitors, CeraVe’s door is seeing a massive crowd, while Cetaphil’s is much quieter, according to Semrush.

- CeraVe’s website gets a huge 84% of all the traffic between the two brands.

- Cetaphil’s website only gets 16%.

Think about what this means for CeraVe vs Cetaphil on Amazon.

More website visitors means more people are learning about CeraVe’s products, reading its ingredient stories, and building trust in the brand. This trust then flows directly to Amazon when they’re ready to buy.

This overwhelming traffic lead proves that CeraVe has won the battle for online attention. It’s the brand people are actively seeking out, which is a huge driver for its overall market success.

CeraVe’s Amazon Domination: Sales Rank and Social Proof

A brand’s real test is on the shelf; let’s explore Amazon’s digital shelf.

Here, we see two things: what’s selling best, and what customers are talking about. In both areas, CeraVe’s lead is overwhelming.

Let’s look at the sales rankings first. The “Amazon Best Sellers Rank” is like a live leaderboard of what’s hot.

The data is striking:

- CeraVe products dominate the Amazon Best Seller list in skincare, securing 13 out of the top 100 ranks

- CeraVe’s top product—a daily moisturizing lotion—holds the #13 rank with over 130K reviews.

- Several other CeraVe moisturizers, cleansers, and sunscreens are also placed within the top 50.

- Cetaphil appears only twice, at ranks 65 and 97, with significantly lower review counts.

This means when people browse for skincare on Amazon, they are far more likely to see and buy a CeraVe product.

But sales are only part of the story. The other part is what happens after the purchase.

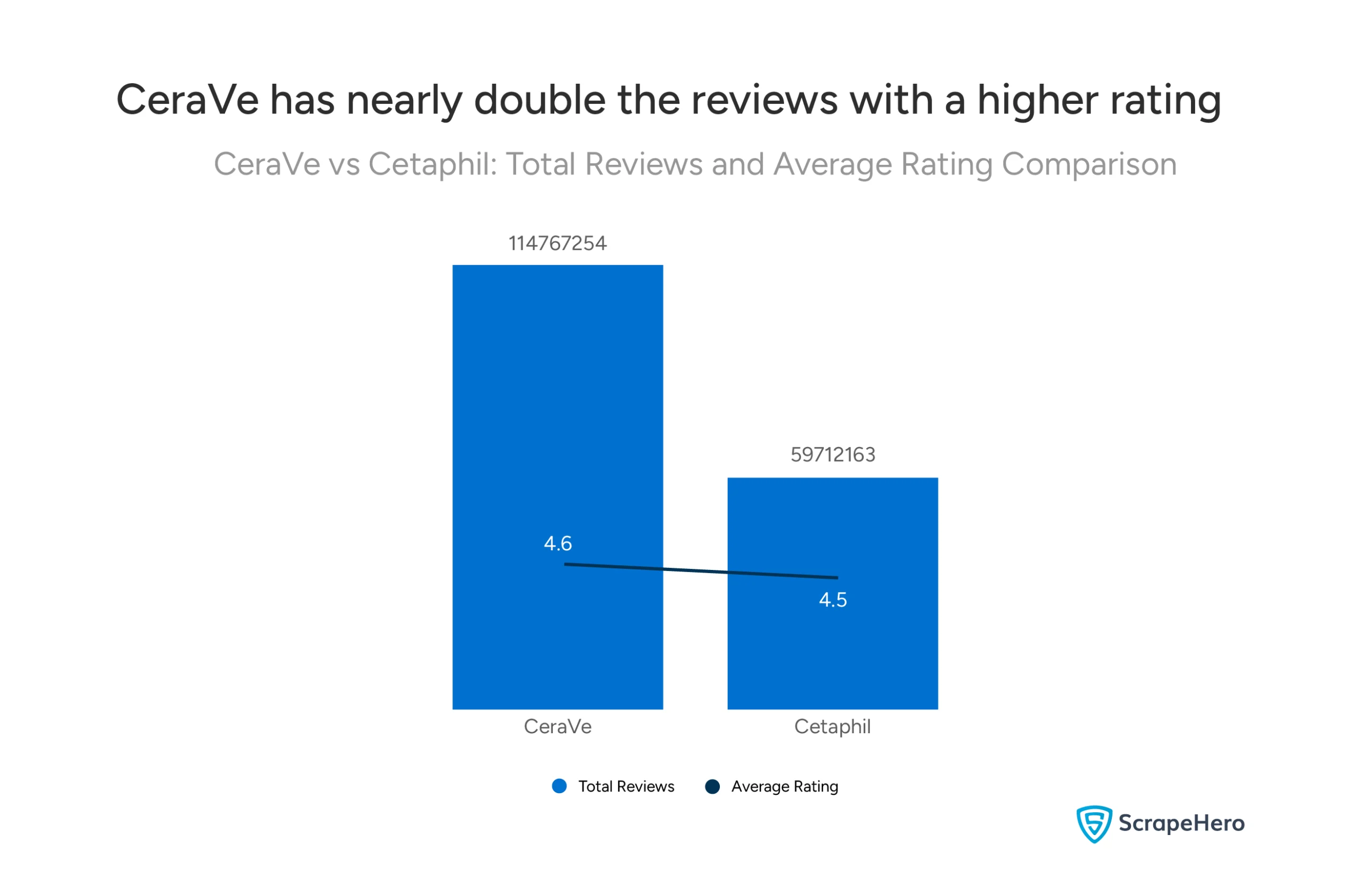

Points to note about customer engagement and satisfaction:

- Massive Engagement: CeraVe has over 114 million reviews on Amazon. Cetaphil has about 59 million. This means almost twice as many people are buying and reviewing CeraVe products.

- Slightly Better Perception: Not only do more people buy CeraVe, but they also rate it slightly higher (4.6 stars vs. 4.5 stars). This shows stronger customer satisfaction.

When you combine these two visuals, the conclusion for the CeraVe vs Cetaphil brand performance is clear.

CeraVe is winning on sales as well as on customer trust and satisfaction, which fuels its continued dominance.

The Product Paradox: More Listings Don’t Mean More Wins

Here is one of the most interesting findings from our CeraVe vs Cetaphil comparison.

At first glance, it seems like Cetaphil should be winning. They have many more products for sale. But as we’ve seen, CeraVe makes more money and gets more love from customers.

Let’s look at the number of products each brand has on Amazon.

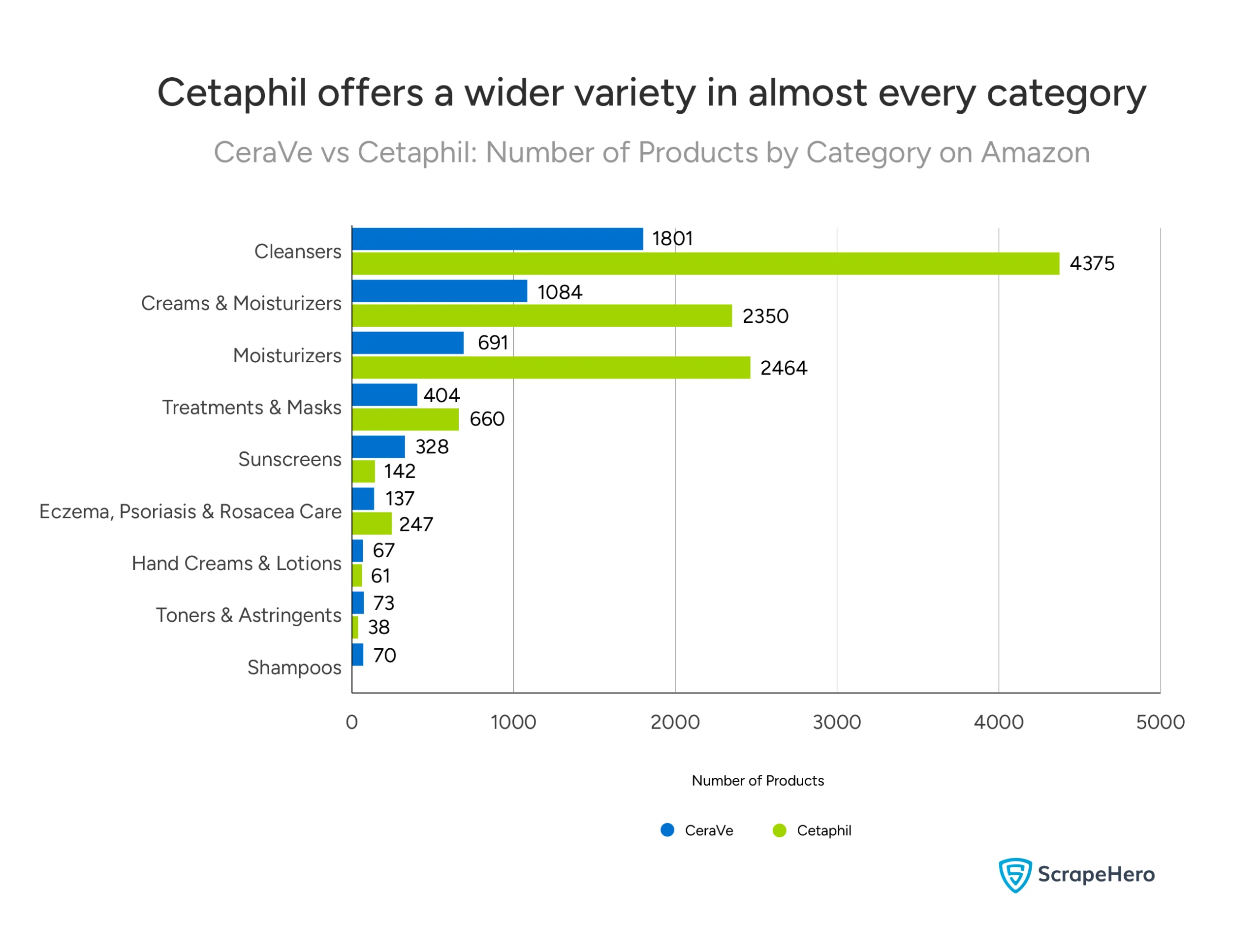

The chart shows a clear story every single day:

- Cetaphil’s product listings are much higher, often doubling CeraVe’s numbers.

- CeraVe’s listings are steady and lower.

This isn’t just a fluke. Cetaphil’s wider variety is a core part of its strategy.

The data shows Cetaphil’s depth:

- In Cleansers, Cetaphil has over 4,300 products vs. CeraVe’s 1,801.

- In Cream & Moisturizers, Cetaphil has 2350 products, while CeraVe has 1084 products.

- In Moisturizers, Cetaphil has 2464 products, while CeraVe has only 691 products.

So, what does this mean for the CeraVe vs Cetaphil on Amazon battle?

It creates a powerful paradox. Cetaphil has more choices, but CeraVe has more demand.

CeraVe’s strategy on Amazon seems to be about building a few hero products that everyone wants. Cetaphil’s strategy is about offering a wider range for every possible need.

Organic Trust vs Paid Ads: CeraVe vs Cetaphil

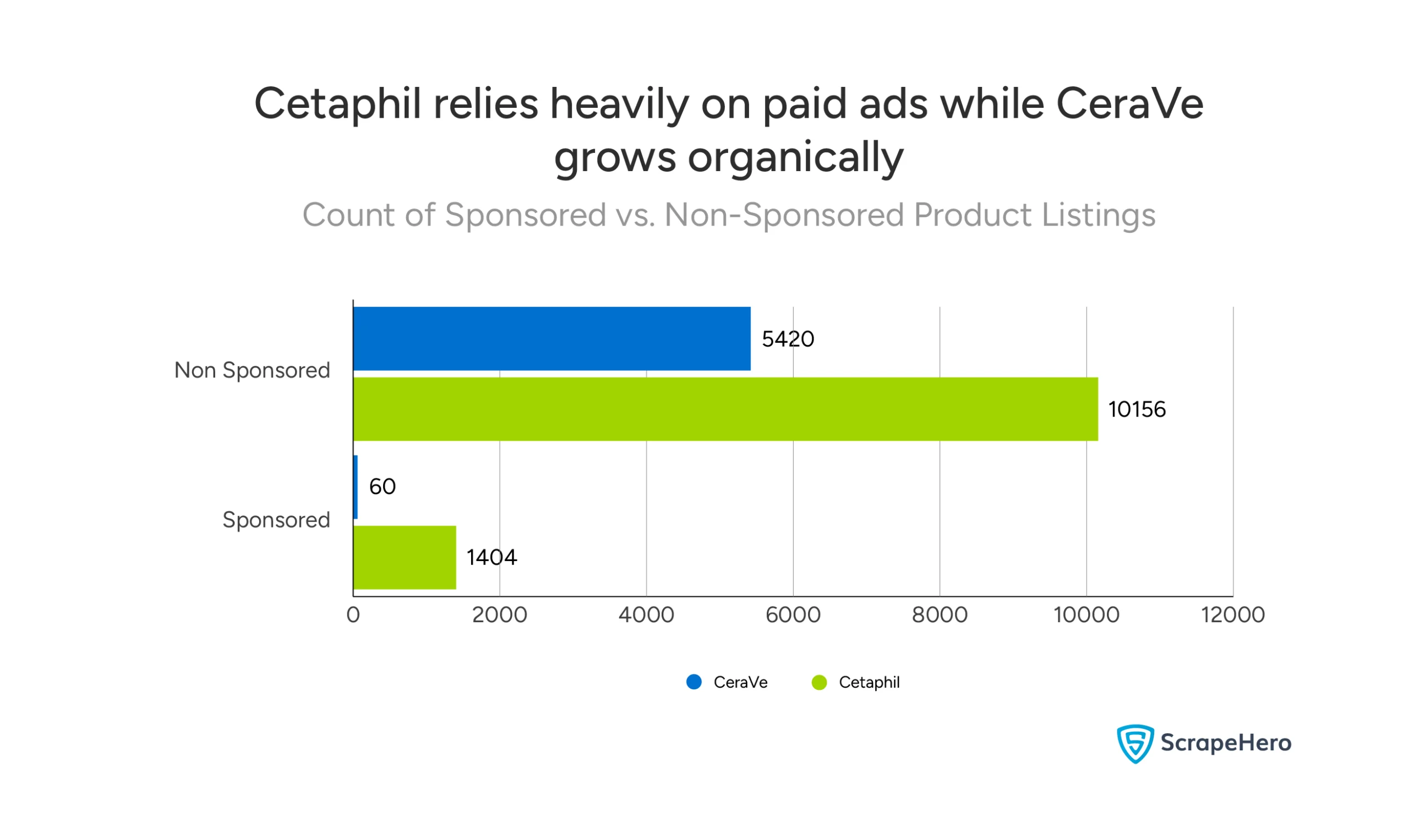

How does a brand get seen on a crowded platform like Amazon?

The data shows that CeraVe and Cetaphil use two completely different strategies. One builds on organic strength, while the other pays more for visibility.

This difference is a huge clue about the overall CeraVe vs Cetaphil brand performance.

The numbers in this chart reveal the following:

- Cetaphil’s Paid Push: Cetaphil has over 1,400 sponsored products. This means it is actively paying Amazon to show these products at the top of search results.

- CeraVe’s Organic Strength: CeraVe has only 60 sponsored products. It isn’t paying for much visibility.

For anyone analyzing the CeraVe vs Cetaphil market performance, this is a key insight.

So, CeraVe or Cetaphil?

So, who is winning the CeraVe vs Cetaphil battle on Amazon? The data leaves no room for doubt.

Our CeraVe vs Cetaphil skincare market analysis on Amazon proves that CeraVe has secured a dominant market position. It isn’t just a slight lead; it’s a comprehensive victory across every key metric that matters for business.

Let’s recap the evidence:

- Financial Dominance: CeraVe generates nearly triple the revenue and has more than double the market share.

- Digital Command: It captures 84% of the combined web traffic, showing vastly stronger brand pull.

- Amazon Supremacy: CeraVe crowds the best-seller lists and earns almost twice as many customer reviews.

- Efficient Growth: It achieves this with a smaller product range and minimal advertising, proving its growth is driven by powerful organic demand.

How to Get Data for an Analysis Effortlessly?

The most effortless way to get data for an analysis is to outsource to a web scraping service like ScrapeHero.

ScrapeHero Cloud’s scrapers are a go-to for small data requirements because of their ease of use.

However, outsourcing with ScrapeHero’s web scraping service is the smarter choice if you require custom data extraction, complex web navigation, or simply want to save time.

We are among the top 3 web scraping service providers globally. And since we are a full-service data provider that handles everything, including data collection, accuracy, and delivery, you don’t need software, hardware, or scraping expertise. Instead, you can focus on using data for your business, not extracting it.

Connect with ScrapeHero today.

Report by ScrapeHero using publicly available data. This report is independent and not affiliated with CeraVe or Cetaphil.