In the past, investment or market research would have meant sending people to stores to ask for any indications of sales numbers or handing out questionnaires to strangers about their preferences. As times and technology have changed, the industry too has changed and improved – significantly.

Data is now more of a strategy than a component. It could set the trajectory of an investment firm or make or break major decisions for it. Alternative data is being increasingly used to perform research, corroborate existing research or verify the results of traditional research and analysis.

What is Alternative data?

Data isn’t just scouring e-mails and twitter feeds anymore. Almost everything that a buyer does, leaves a digital footprint that can be scraped, categorized and used by some investor out there. Business performance information showing a public firm’s payment experience, private company decisions and the way they affect large companies and their markets, linkages providing risks and opportunities across the related business; all can be termed as alternative data.

We could categorize available alternative data into three major types –

Consumer transaction data – Transactional data can be information about exchanges, generally involving money between people and companies. This may include purchases, payments, debits and credits, hotel reservations, interest payments and more.

Web crawling data – Where bots retrieve public, legal information from sources as and when needed.

Social media data – This data segment contains social media sentiment analysis or crowd-sourced research that shape global public opinion and interests.

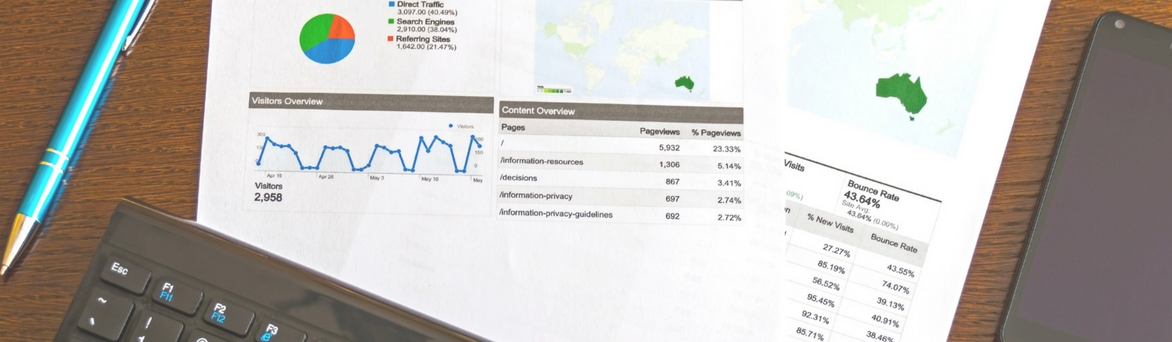

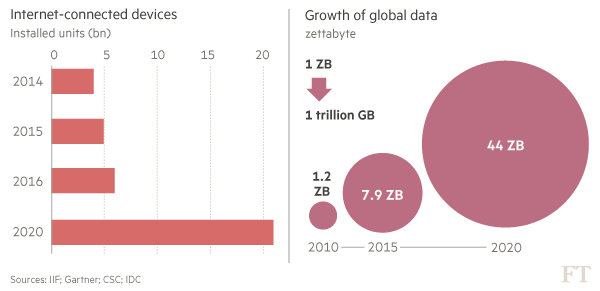

The graph above shows the growth of global data that has been predicted to reach a massive 44ZB by 2020. For every other field, this boom of big data is making considerable ripples with a problem of plenty. But for investment firms and hedge funds, this is opening up unseen possibilities. Going forth, online communities, communications metadata, satellite imagery, geospatial information and other data segments are going to be deciding factors when it comes to investment decisions.

Why is adoption important?

For an investor or a hedge fund manager, the biggest threat would be the fact that the rest of the world has come to understand the value of alternative data. According to a study conducted by Greenwich Associates, 63% of their sample group consisting asset and hedge fund managers said they would use alternative data for predictions of the future market or sector movements. 48% hedge fund managers said they would use alternative data for idea generation. This puts a lot of pressure on every other analyst out there. To dig out pieces of useful information from a myriad of publicly available data that could shape the future of their business.

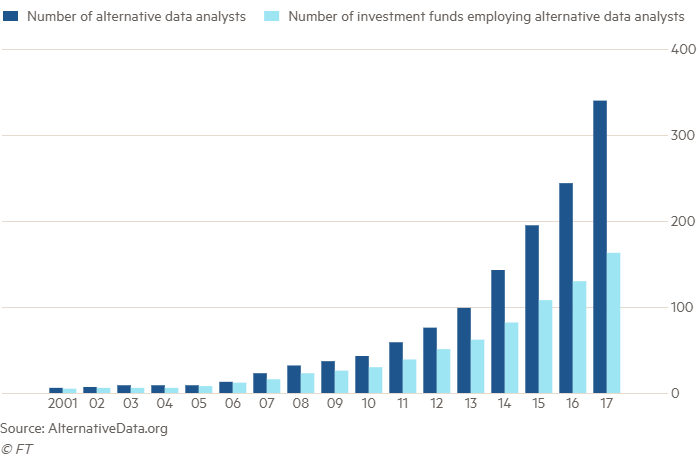

The above graph shows how the alarm has gone off in many investment firms across the globe about the need to accommodate alternative data. This graph is only going to go further up, as the amount of data and number of users online increases over the years.

Understanding the risks

Like with any other tool, adoption of alternative data comes with certain risks that may be overlooked by any firm. These are not unfathomable but needs careful understanding.

Risks with early adoption:

Data proliferation: While adopting alternative data into traditional line of analysis, there is a huge risk of placing workflow before active use of this information. In a traditional set-up, a market study would take months, the results carefully discussed and brainstormed before an action is taken. But with alternative data, each second wasted would mean a new development. In a very dynamic environment, proliferation is a major risk.

Talent risk: As the graph above shows, the number of alternative data analysts have quadrupled over the years. While accommodating such a need for manpower in your system, the blending of traditional talent with the new one is going to be a bumpy ride.

Data risk: One issue that investment firms using alternative data deals with is the credibility and safety of information they procure. Organisations like SEC gets involved with the mining of data and the question of alternative data being illegal is still a fresh one. While web scraping extracts only legal, public data, ensuring the safety of segments you procure is a task.

Risks with late adoption:

Market position risk: When the rest of the market is actively digging into alternative data, the ‘wait and see’ approach is going to place traditional firms in an ugly mid-place The information disadvantage is going to affect both their market position as well as client requirements.

Adoption risk: Being the last one to set-up an alternative data adoption strategy would mean a harder time finding the right talent and prepping up your company towards what needs to be done.

Reputation risk: When your clients are very up to date about what is best and most easily available out there, being a laggard could place you at the risk of losing your reputation. After all, time is money.

Choosing the right resource

As more and more companies understand the need to adapt to alternative data, there is a question of how that comes with it. There are a few ways of doing it, you could have an in-house team that does your alternative data research for you, or you could hire a specialized firm like ours to handle your data needs or you could buy alternative data from an online marketplace.

The risks of setting up an in-house team are in-line with the risks we spoke of earlier. Getting the right talent, setting up a whole department and providing them with long-term resources could be a huge liability for a mid-level firm. Furthermore, trusting all of your data, insights or decisions on one or two analysts could be a lot of pressure.

The risks of using an online commodity marketplace for your alternative data is that you are getting the same data as everyone else. The alpha that you can achieve with this commodity data cannot be much. Only custom alternative data can provide you the edge in the alternative data space.

Having a custom alternative data provider such as ScrapeHero take care of all your needs makes it a lot easier for you. Our resources are already in place to help you direct your next step. Furthermore, you need less investment, we could help tailor your requirements and also help you catch up on the many possibilities and opportunities with alternative data.

If you are an investor and could benefit from the service we have to offer, contact us on the form below.

Need Custom Alternative Data?

Turn the Internet into meaningful, structured and usable data