Nike and Adidas are two of the biggest names in sportswear, known for their innovative products and global influence. With decades of experience, they dominate the market, constantly innovating to capture the attention of sports enthusiasts and casual shoppers alike.

This blog is an analysis of Adidas vs Nike, comparing their retail presence in key markets like the US and the UK. By examining POI data from ScrapeHero Datastore, we’ll explore how their financial state and merchandise strategy impact their physical store distribution.

Power Location Intelligence with Retail Store Location Datasets

Access thousands of global brands and millions of POI location data points ready for instant purchase and download.

Adidas vs Nike: Retail Presence and Geographical distribution

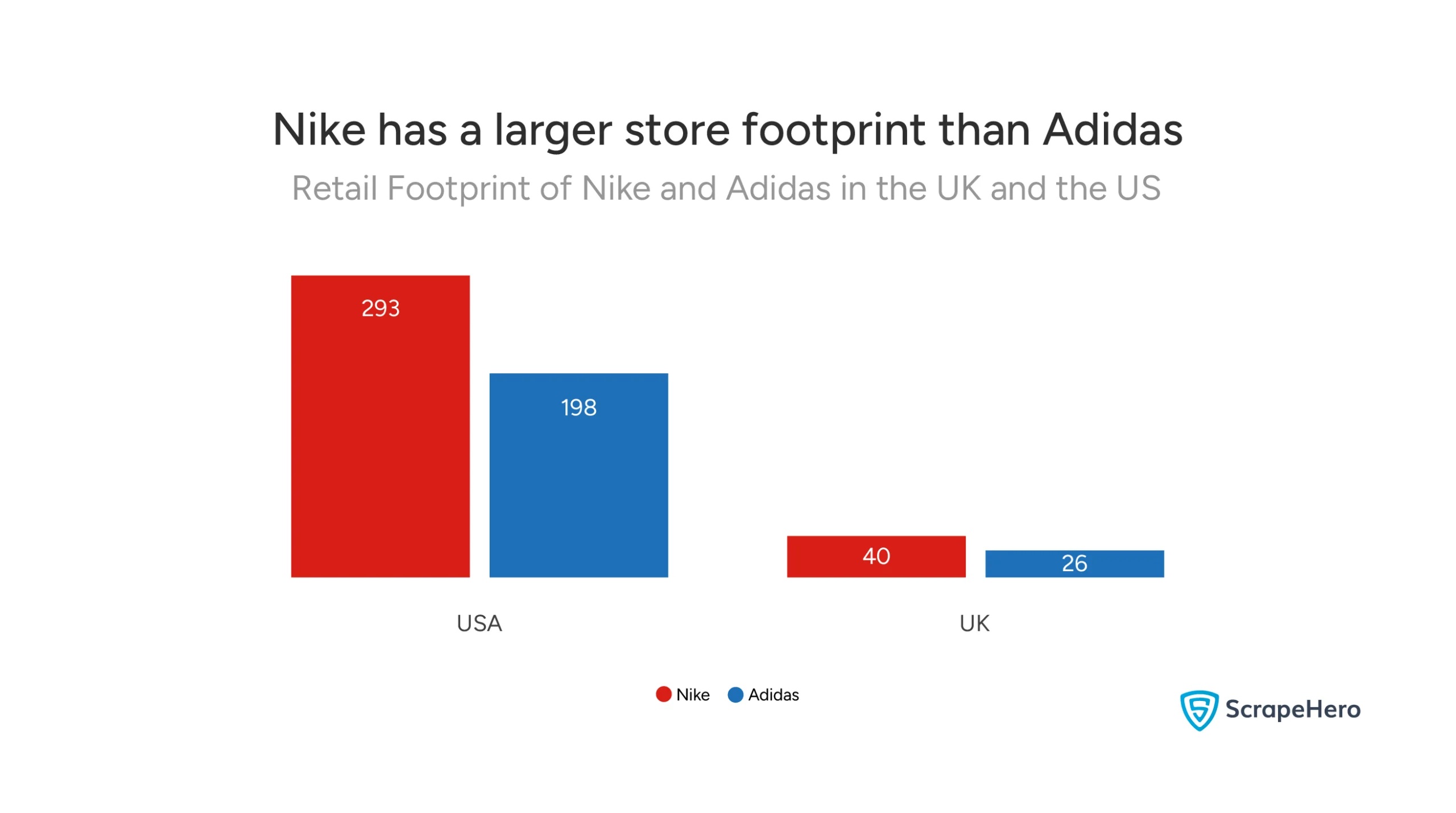

The retail presence of Nike and Adidas plays a crucial role in determining their visibility and accessibility to customers.

By analyzing the distribution of their physical stores in key markets like the US and the UK, we can better understand their market positioning and strategic choices.

This section explores the number of stores each brand has in these two major regions.

Retail Presence of Adidas and Nike in the US and UK

The graph below compares the retail presence of Adidas and Nike in the US and the UK.

- US: Nike leads with 293 stores, while Adidas has 198 stores. This difference indicates that Nike has a stronger retail presence in the US market.

- UK: Nike also maintains an advantage with 40 stores, compared to Adidas’s 26 stores.

In both markets, Nike’s larger number of stores suggests its broader reach and higher potential for customer engagement. The wider retail footprint allows Nike to capture more foot traffic and expand its brand presence. Adidas, with fewer stores, may rely on other strategies, such as online sales or targeted locations, to compete effectively.

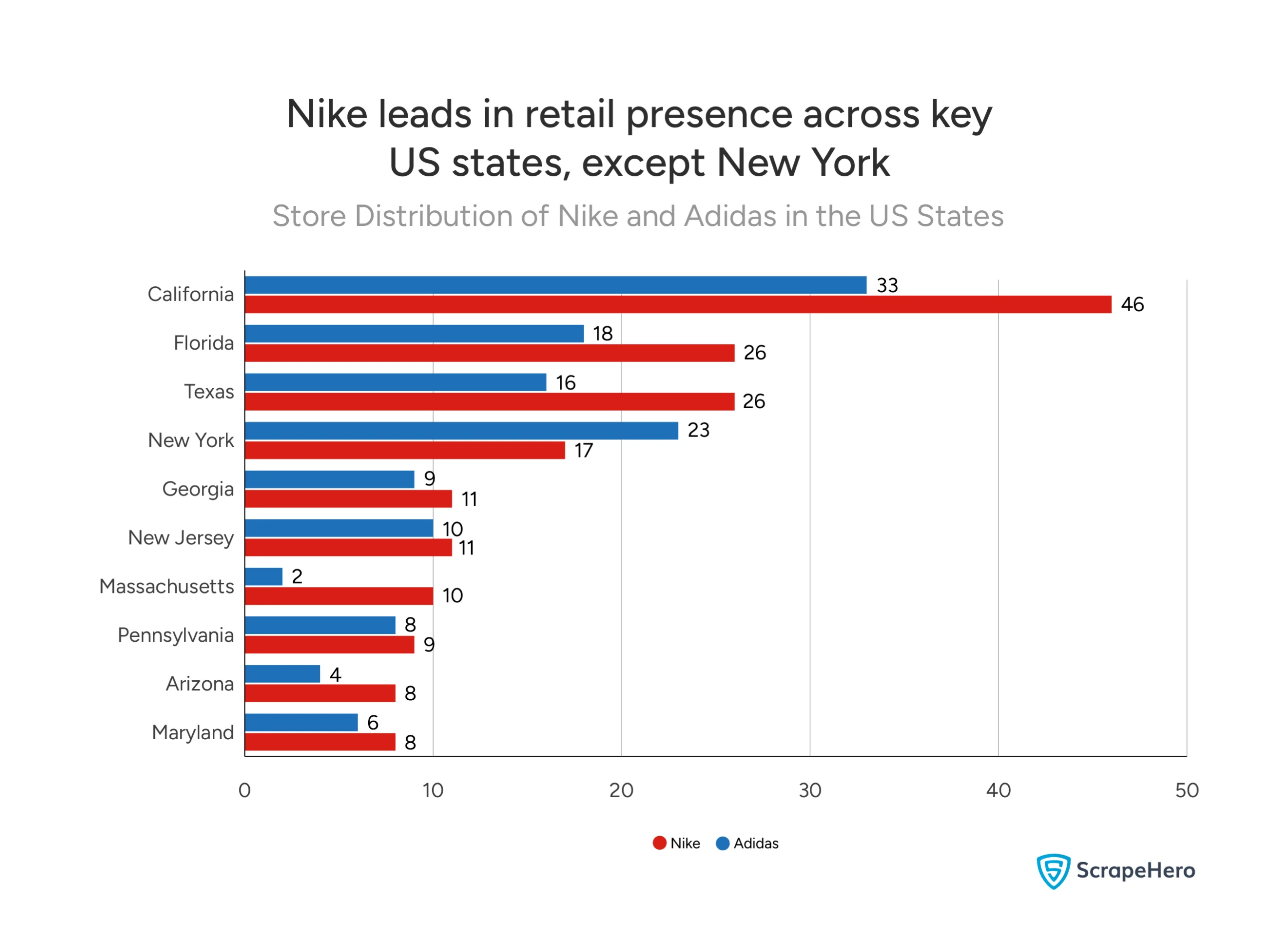

Adidas vs Nike in the US States

The map below is a detailed Adidas vs Nike store distribution across several key US states. As we can see, certain states show a marked difference in the retail presence of both brands.

- California stands out with Nike leading significantly, with 46 Nike stores compared to Adidas’s 33.

New York presents a different scenario, where Adidas slightly edges out Nike, with 23 Adidas stores and 17 Nike stores.

- Texas and Florida both show similar distributions, with Nike having an equal number of stores (26 stores each), and 18 and 16 Adidas stores, respectively.

- In states like Georgia, New Jersey, Pennsylvania, and Maryland, the difference is narrower, showing a more balanced presence.

This store distribution gives us a closer look at the competitive landscape of Nike and Adidas across the US.

Download the complete list of all Nike Stores in the US to compare it with the list of Adidas Stores in the US.

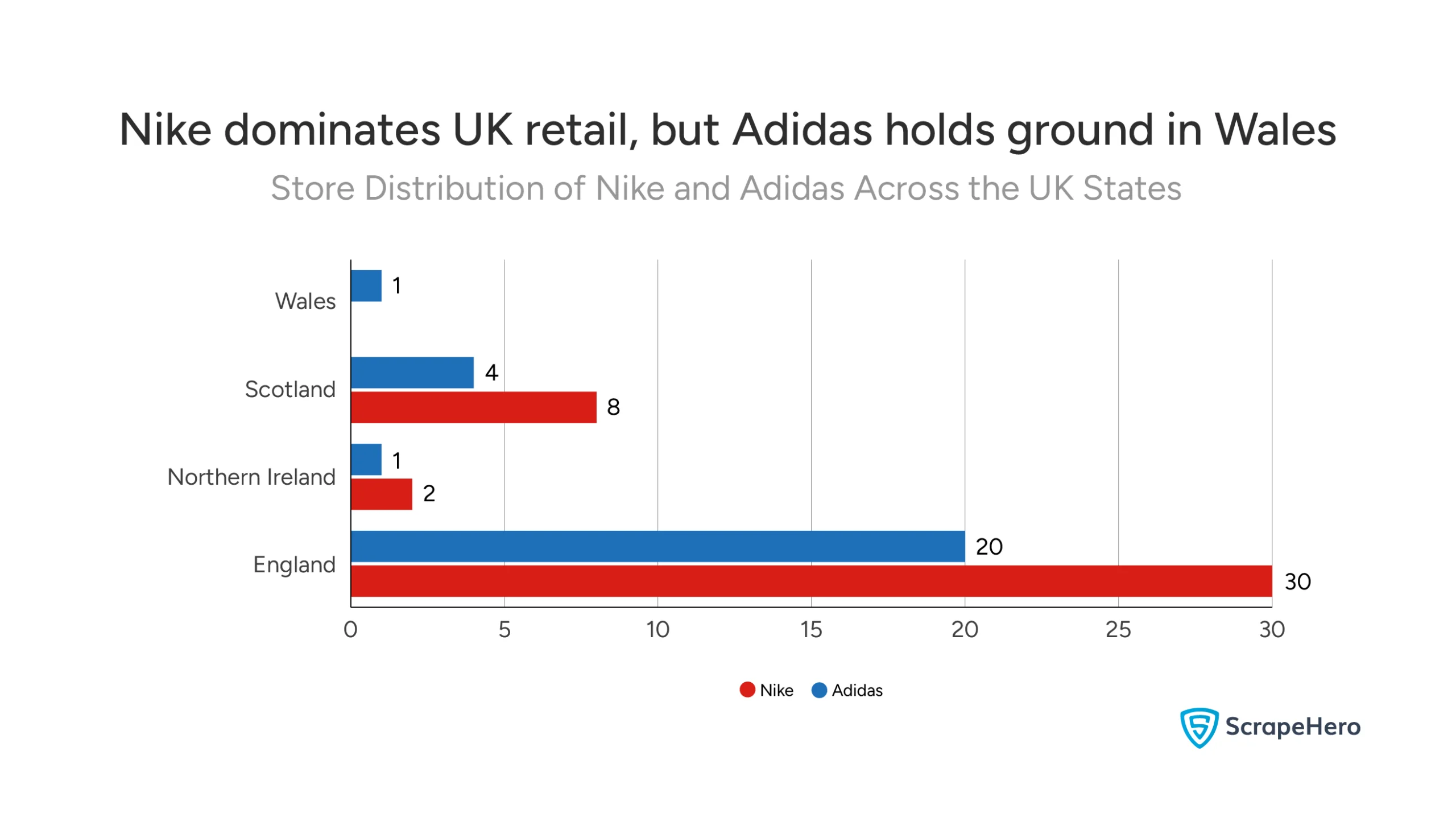

Adidas vs Nike in the States of UK

The graph below compares how Nike and Adidas are distributed across the different regions of the UK. While both brands have a presence across the country, the distribution varies by region.

- England: This is the primary market for both brands, with Nike leading at 30 stores compared to Adidas’s 20. Nike has a stronger presence in England.

- Scotland: Nike has more stores than Adidas here, too. Although the numbers are close, Nike still maintains a stronger retail presence in Scotland.

- Northern Ireland: Nike has 2 stores, while Adidas has 1. The difference is relatively small, but Nike holds a slight advantage.

- Wales: Adidas leads here with 1 store, while Nike has no significant presence. This is an interesting point as it suggests Adidas may have more localized strategies for certain regions within the UK.

This data emphasizes Nike’s stronger overall presence in the UK, particularly in England, but Adidas also has a foothold in regions like Wales, where Nike is less present.

Download the complete list of all Nike Stores in the UK to compare it with the list of Adidas Stores in the UK.

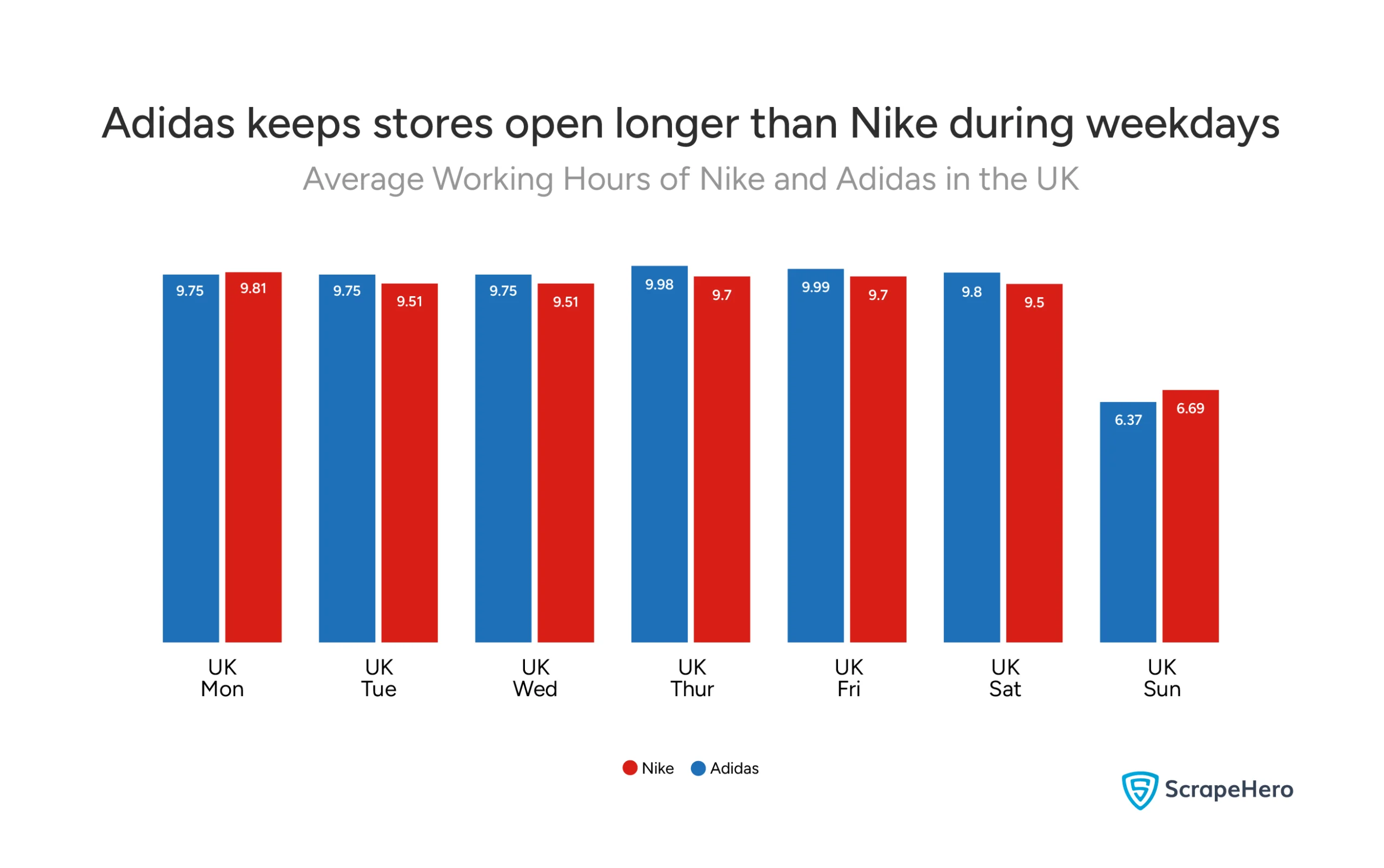

In addition to store distribution, examining the operational hours of Nike and Adidas stores can give insight into their retail strategies. The following graph compares the average working hours of Nike and Adidas stores in the UK, helping us understand how both brands manage customer access throughout the week.

- Weekdays (Monday to Friday): Both Nike and Adidas maintain similar working hours, with Nike slightly trailing behind Adidas on most days.

Adidas stores typically stay open for about 9.75 to 9.98 hours a day, while Nike stores operate for 9.51 to 9.7 hours.

Adidas tends to keep stores open a bit longer during the week, which could be a strategy to attract more foot traffic.

- Weekend (Saturday and Sunday): Nike stores stay open for about 9.5 hours on Saturdays, while Adidas stores remain open for 9.8 hours. On Sundays, Adidas stores have a significantly shorter Sunday working time (6.37 hours) compared to Nike’s 6.69 hours.

How Nike and Adidas’ Strategies Affect Their Store Locations

In this section, we’ll explore how Nike and Adidas’ business strategies influence where they open stores.

By looking at their financial performance and product strategies, we’ll explain how these factors impact their retail presence in different regions.

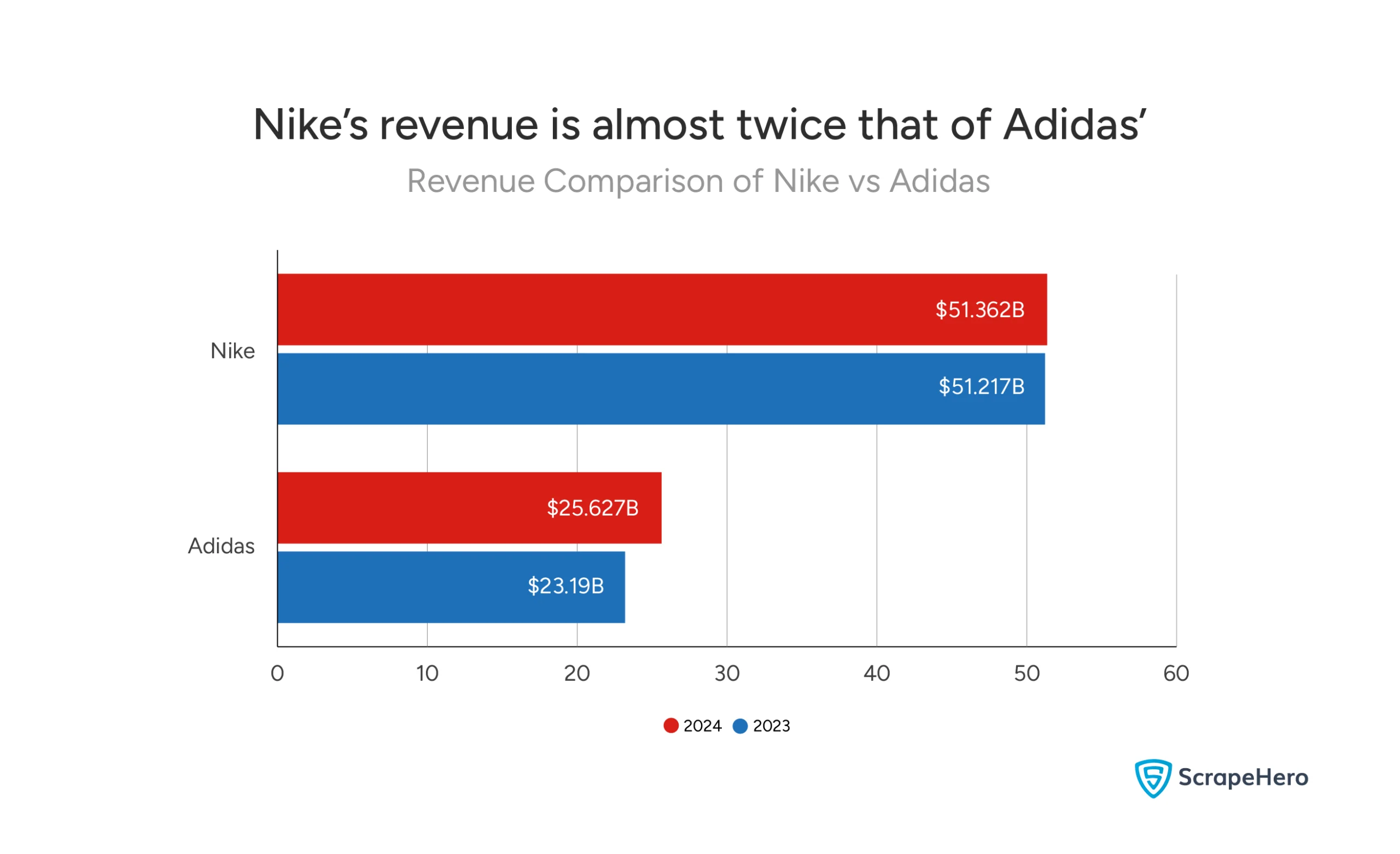

Financial Performance of Adidas vs Nike

Nike’s global revenue in 2023 was $51.217 billion, and it is projected to increase slightly in 2024 to $51.362 billion. Adidas, on the other hand, reported $23.19 billion in 2023, with a forecasted increase to $25.627 billion in 2024.

Nike’s higher revenue may provide the brand with more resources to expand its retail presence, potentially allowing it to open more stores in high-traffic areas, such as major cities.

This could explain why Nike has a larger retail footprint in regions like the US and the UK. The larger revenue might also support a more extensive global expansion strategy.

Adidas’s relatively smaller revenue, however, might suggest a more targeted approach to retail. With fewer financial resources, Adidas could focus on fewer locations, perhaps choosing regions or cities where it sees greater growth potential.

This might be why Adidas has fewer stores in some markets.

In this way, the financial performance of both brands might play a role in determining their approach to retail distribution and store presence.

Merchandise and Product Strategy

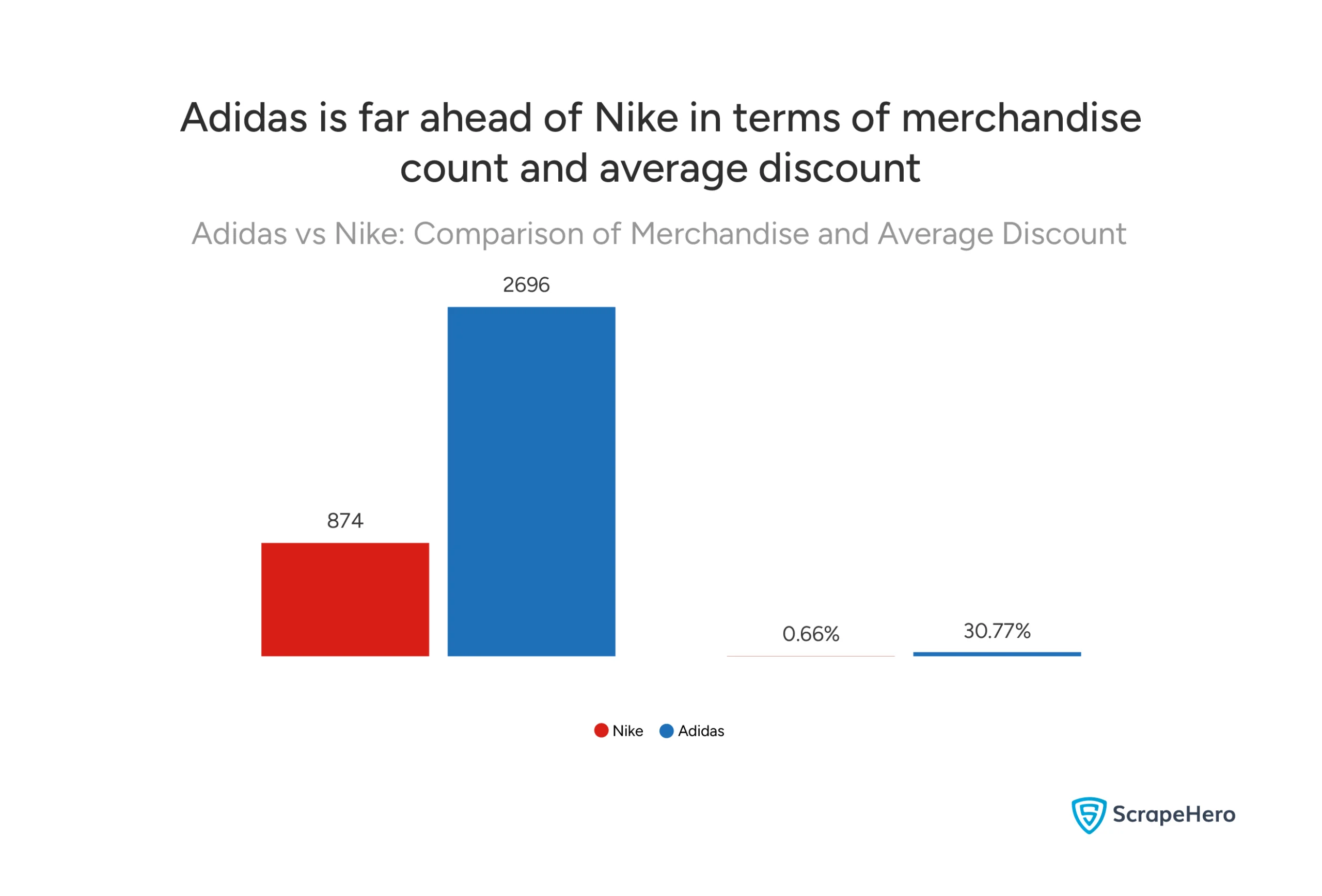

Below is a graph that compares Nike and Adidas based on product count and average discounts.

Adidas has far more products available (2,696 products) compared to Nike (874 products). Adidas also provides higher discounts, averaging around 30.77%, whereas Nike offers minimal discounts of just 0.66%.

Interestingly, despite Adidas offering a wider range of products and larger discounts, Nike still maintains a larger retail presence in the US and UK.

Final Thoughts on the Location Strategies of Adidas vs Nike

Nike and Adidas are both strong brands, but they have different ways of choosing store locations and managing their retail presence.

Nike’s larger revenue enables it to maintain more stores in key markets, such as the US and the UK.

Adidas, despite having fewer stores, utilizes its broader product range and higher discounts to target customer groups.

By looking at store distribution, financial performance, and product strategies, we see how each brand makes decisions to reach its customers effectively. Understanding these choices gives valuable insight into the competitive strategies behind two of the world’s biggest sportswear brands.

Want to Do a Similar Analysis?

ScrapeHero Data Store is the right place to go if you want retail store location data for instant download.

We monitor thousands of brands globally for store openings, closures, parking availability, in-store pickup options, services, subsidiaries, nearest competitor locations, and more.

However, partnering with ScrapeHero’s web scraping service is the smarter choice if you require custom data extraction, complex web navigation, or simply want to save time.

We handle everything, data collection, accuracy, and delivery, so you don’t need software, hardware, or scraping expertise. Instead, you can focus on using data for your business, not extracting it.

Connect with ScrapeHero today.

Report by ScrapeHero using publicly available data. This report is independent and not affiliated with Nike or Adidas.