Walk down any drugstore aisle, and you’ll see Dove. It’s a staple, a household name you recognize in an instant.

But have you ever stopped to wonder what that brand looks like in the world’s biggest store?

On Amazon, a brand isn’t just a logo on a box. It’s a living, breathing entity made of data—thousands of products, millions of opinions, and countless strategic decisions visible in every price tag.

This blog is a deep dive into that digital reality.

We’re conducting a full Dove brand analysis on Amazon, tearing apart the numbers from a single week to see how this giant actually operates online.

NB: The data for the analysis was downloaded using the ScrapeHero Cloud Amazon Search Results Scraper.

With ScrapeHero Cloud, you can download data in just two clicks!Don’t want to code? ScrapeHero Cloud is exactly what you need.

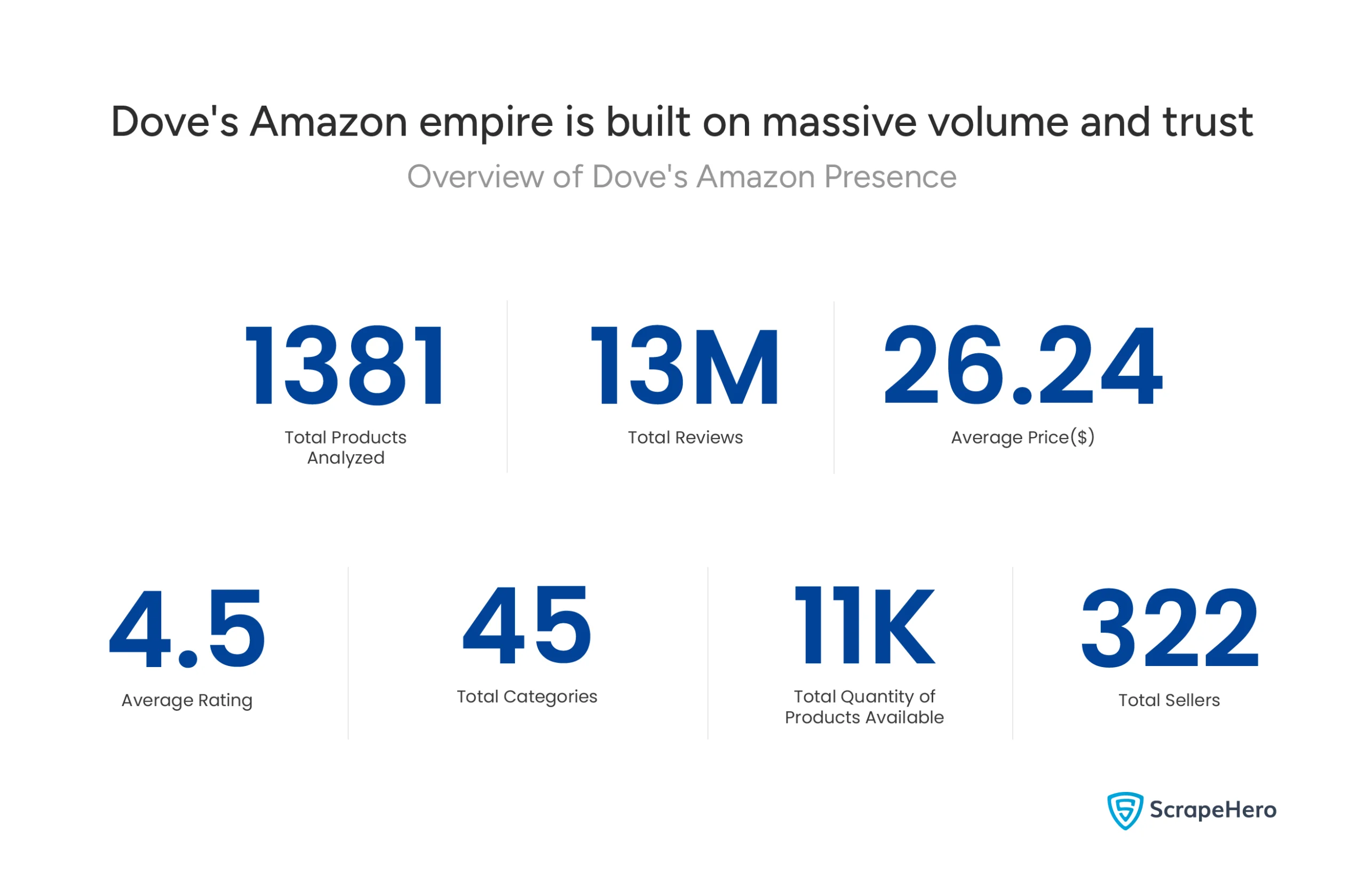

An Overview of Dove’s Digital Shelf Space

Everyone knows Dove is big. But the real question is: how big, and what are they doing with that scale?

Before we get into the clever tricks of bundling and category wars, let’s first understand the size of the battlefield.

This snapshot gives us the hard numbers.

1,381 products across 45 categories means Dove maintains a vast and varied catalog.

But volume alone doesn’t drive sales. Engagement does.

The 13 million reviews and a 4.5-star average rating are critical metrics. They represent a massive reservoir of social proof. For a potential buyer, this level of validated feedback significantly lowers perceived risk.

The average listing price of $26.24 and the presence of 322 sellers complete the landscape. This indicates a mature, liquid marketplace for Dove products.

It’s not a curated brand store; it’s an open, competitive arena with multiple players influencing price and availability.

The Core Insight: It’s All About the Bundle

So, Dove has thousands of products and millions of reviews. The next logical question is: what are people actually buying at the high end? If you search for the most expensive Dove items, you might expect to find luxury creams or advanced serums.

You won’t.

The Dove products market analysis on Amazon reveals something much more straightforward.

The top of the price list isn’t dominated by fancy new products. It’s owned by the classics—soap, deodorant, body wash—but in massive quantities.

This is the first major insight into their strategy.

Look at the list. A case of 24 deodorants for $218. A case of 48 soap bars for $150. Body wash by the case.

This isn’t about selling a single “expensive” product. It’s a volume strategy:

- Targeting specific buyers: Large families, resellers, or long-term users who value a lower cost per unit over time.

- Increasing cart value: A single purchase of a case locks in significant revenue.

- Securing loyalty: A customer with a 24-pack of body wash is a customer who won’t shop a competitor for months.

When you perform a Dove product market trends analysis, this bundling tactic stands out.

It shows how a mass-market brand leverages its core strength—everyday reliability—into a high-volume online sales model.

They aren’t creating premium items; they are packaging trust and routine into bulk SKUs.

The takeaway is crucial for any brand selling essentials online. The “most expensive” listing can be a strategic tool, not just a price point. It’s a way to serve your most dedicated customers and build predictable revenue.

But what about the other side of the coin? If the high end is about stockpiling, how does Dove bring new customers into the fold? The answer is on the opposite end of the price spectrum.

The Entry Point: Low-Cost Trials and Singles

A brand can’t survive on bulk buyers alone. You need a steady stream of new customers. So, how does a giant like Dove lower the barrier to entry? The strategy is a perfect counterbalance to their bulk offerings.

If the high end is about commitment, the low end is about removing risk. A first-time buyer isn’t going to purchase a case of 24 body washes. They want to try it. They need a low-stakes way in.

Our Dove products market analysis on Amazon shows exactly how Dove solves this. While the highest prices are for bulk, the lowest prices are for singles, travel sizes, and trial versions.

Look at the prices. A travel-sized deodorant for $1.20. A small beauty bar for $2.00.

This part of the Dove brand analysis reveals a classic funnel strategy:

- Minimize friction: A sub-$5 price point makes the decision easy. It feels low-risk.

- Facilitate trial: Small sizes let customers test the product’s feel and scent before committing.

- Cross-sell potential: Once a customer likes the shampoo, the algorithm can recommend the matching conditioner or the full-size version.

This creates a complete ecosystem. The bulk packs serve the established, loyal customer. The small singles attract the curious newcomer. One funds predictable volume; the other fuels future growth.

Together, these two pricing extremes paint a clear picture.

Dove’s Amazon market analysis shows they aren’t just putting products online. They are architecting a customer journey. They meet users at both ends of the commitment spectrum with the right product format.

But this raises another question.

With hundreds of products across dozens of categories, where does Dove actually focus its efforts? Which categories drive their volume, and which command higher prices? To understand that, we need to look at the category landscape.

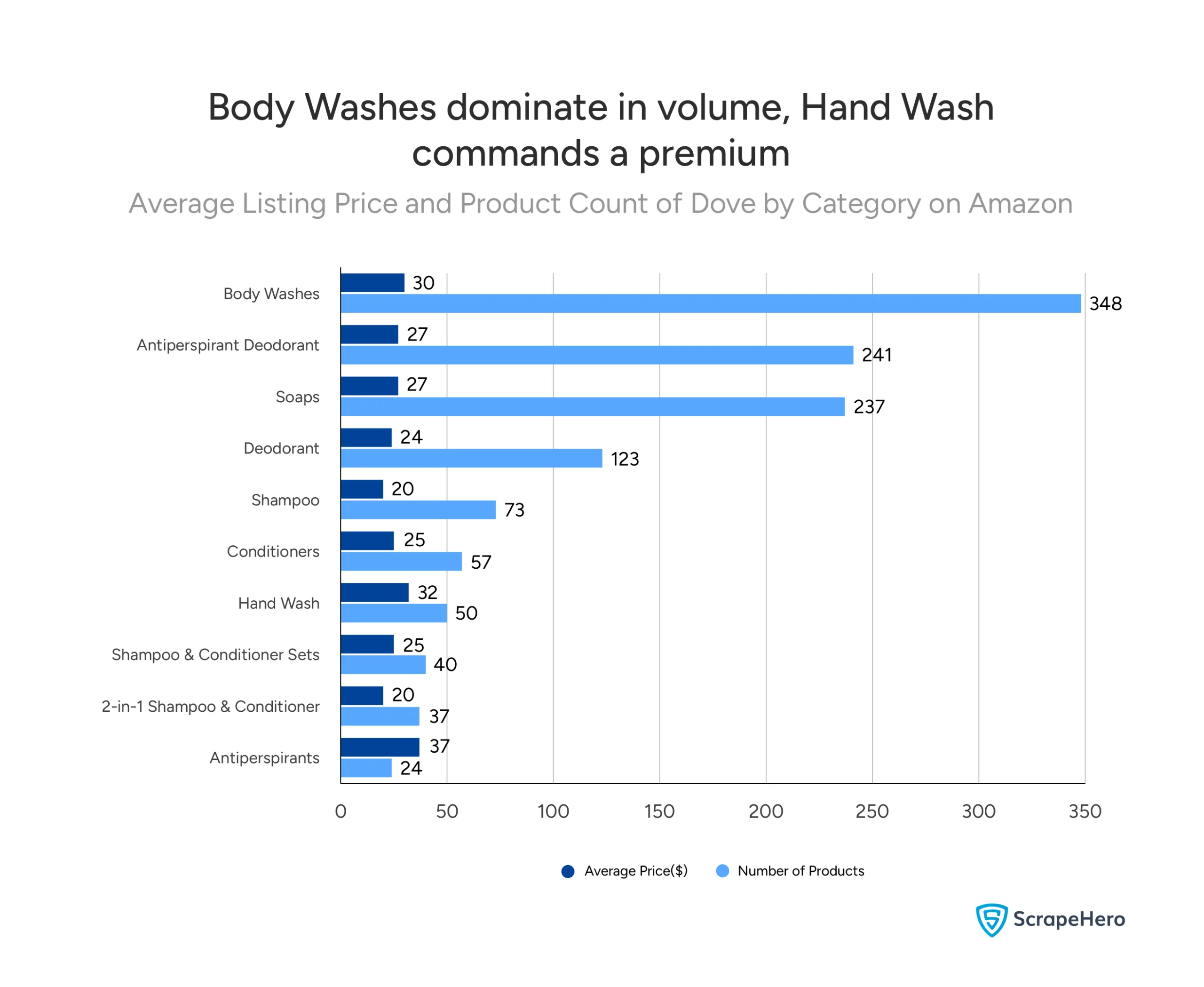

Category & Pricing Landscape: Where Dove Plays (and Profits)

We’ve seen Dove’s Amazon strategy at the price extremes. But to understand their core business, we need to look at the middle.

Where does Dove concentrate its firepower? And which categories actually bring in higher revenue per item?

A Dove brand analysis on Amazon must go beyond individual products. It has to examine the categories. This is where we see the brand’s true priorities and pricing power.

The data shows Dove isn’t trying to win everywhere equally. They dominate a few key battlegrounds.

The chart makes two things immediately clear.

First, volume is concentrated. Three categories hold over half of Dove’s product listings on Amazon:

- Body Washes (348 products)

- Antiperspirant/Deodorant (241 products)

- Soaps (237 products)

This is the heart of Dove’s Amazon presence. They flood these categories with options—different scents, formulas, and pack sizes.

Second, average prices tell a different story. While Body Washes lead in volume, Hand Wash has the highest average listing price at $32.

Meanwhile, Shampoo and 2-in-1 Shampoo & Conditioner sit at the bottom with a $20 average price.

So, what’s the takeaway from this Dove product market trends snapshot?

- Dove’s strength on Amazon is in core cleansing and deodorizing. They compete on width and depth in these areas.

- Average price is shaped by pack strategy. A high category average often means more bulk or bundled listings, not necessarily a premium product.

But volume and price are only part of the equation. On Amazon, social proof is currency. So, which of these many products are people actually talking about?

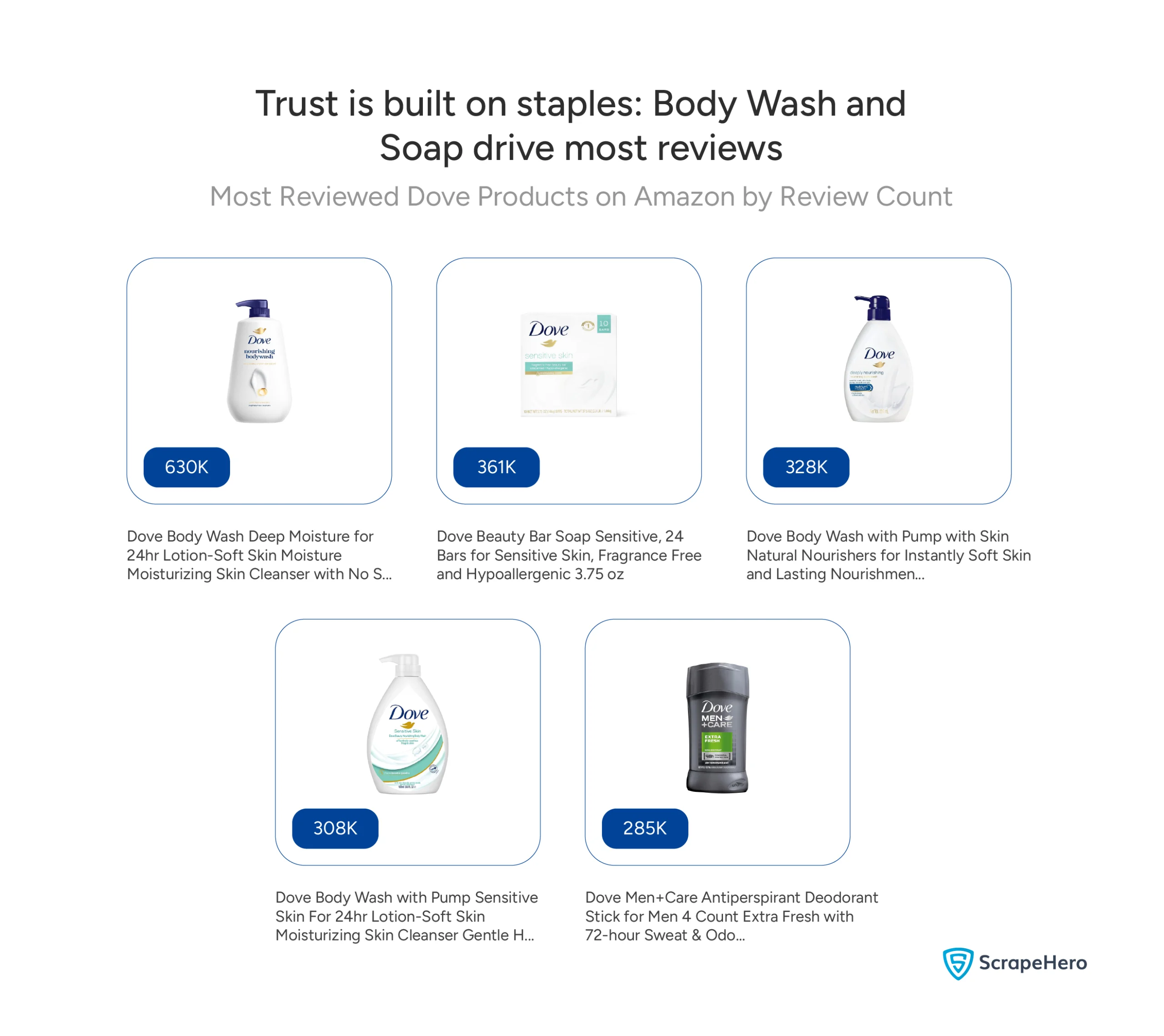

The Power of Reviews: Social Proof Drivers

You can have the best pricing strategy in the world, but on Amazon, you need trust. How does a customer choose one body wash over another when there are hundreds? They look at the reviews.

Review volume is more than a number. It’s a signal. It screams “popular,” “trusted,” and “safe bet.”

For our Dove brand analysis, the most-reviewed products tell us what’s actually working in the market, not just what’s listed.

So, what are people reviewing? Are they raving about limited editions or fancy innovations? The data points to something more fundamental.

The list is a masterclass in consistency. The top spots aren’t for flashy new launches. They’re held by the workhorses.

A single Dove Body Wash variant has over 630,000 reviews. Several other body washes and the classic Beauty Bar Soap follow closely, each with hundreds of thousands of testimonials.

What does this mean for Dove product market trends?

- Core products are review engines. Everyday essentials like body wash and soap generate massive, ongoing feedback loops.

- Bundles drive review volume. Notice the listings? Many are for multi-packs (e.g., “24 Bars,” “4 Count”). A customer buying a bulk pack often leaves one review for the entire purchase, funneling immense feedback into a single product page.

This creates a powerful flywheel. High sales of core items lead to massive review counts. Those reviews reduce hesitation for new buyers, leading to more sales. It’s a self-reinforcing cycle that solidifies Dove’s dominance in its key categories.

Conclusion: What Did This Amazon Dove Market Analysis Reveal?

So, what’s the final verdict? This deep dive into Dove’s data shows a brand that has fully adapted to the Amazon playbook. They aren’t just translating their retail strategy online. They are optimizing for it.

Our Amazon Dove market analysis revealed a strategy built on three clear pillars:

- 1. A Two-Tiered Pricing Architecture. Dove doesn’t have one price point; they have an entire pricing ladder.

At the top, bulk packs secure loyalty and high cart value from dedicated users. At the bottom, trial-sized singles eliminate risk for newcomers. It’s a calculated method to capture customers at every stage of their journey.

- Dominance Through Concentration, Not Diffusion. Dove wins by owning specific grounds. They pour their resources into a few core categories—Body Wash, Deodorant, and Soap. They flood these segments with options, making it harder for competitors to get a foothold.

- Leveraging Social Proof. The staggering review counts are a defensible asset. By focusing massive review volume on flagship products (often through bulk pack listings), Dove creates a barrier to entry. For a new customer, a product with 600,000 reviews feels like a guaranteed safe choice.

Ultimately, this Dove brand analysis on Amazon shows a brand playing the long game. Their strategy isn’t about flashy discounts or viral moments. It’s about building a resilient, data-driven ecosystem on the platform:

- Stability over spikes (seen in the steady average prices).

- Volume over vanity (seen in the focus on core categories).

- Trust over tricks (seen in the monumental review counts).

For any brand looking at Amazon, the lesson is clear. Success isn’t just about listing your products. It’s about architecting your presence. It’s about understanding how price formats, category focus, and social proof work together to build a durable, dominant position in a crowded digital aisle.

Dove’s playbook offers a masterclass in doing exactly that.

How to Get the Data for an Analysis Effortlessly?

The most effortless way to get data for an analysis is to outsource to a web scraping service like ScrapeHero.

ScrapeHero Cloud’s scrapers are a go-to for small data requirements because of their ease of use.

However, outsourcing with ScrapeHero’s web scraping service is the smarter choice if you require custom data extraction, complex web navigation, or simply want to save time.

We are among the top 3 web scraping service providers globally. And since we are a full-service data provider that handles everything, including data collection, accuracy, and delivery, you don’t need software, hardware, or scraping expertise. Instead, you can focus on using data for your business, not extracting it.

Connect with ScrapeHero today.

Report by ScrapeHero using publicly available data. This report is independent and not affiliated with Dove.